With Bitcoin over $120,000 and Ethereum still steady at nearly $3,000, bullish momentum spilled on Chinese coins.

The “Made in China” Crypto Index has grown nearly 1% over the last 24 hours, with top performers like Vechain, Conflux and QTUM flashing powerful weekly gains and key indicator shifts. Check out the trending setup that will take place in the third week of July.

Vechain

Vechain, a blockchain platform known for supply chain traceability and enterprise use cases, shows signs of a trend reversal after strong weekly profits.

Currently, just above $0.025, Vet’s Vet is made with Chinese coins, down nearly 91% from its all-time high of $0.282, but it appears that buyers are stepping in.

Veterinarians surged 21.5% last week, and are currently facing immediate resistance at $0.02629. If you have a successful breakout beyond this level, your pass will be $0.02769. This is the level that previous rally attempts have struggled.

However, a more interesting setup is in the divergence that forms in the chart.

The RSI (Relative Strength Index) has achieved highs, but the prices still produce low heights. This is a pattern known as bullish divergence. This indicates that although prices have not yet been caught up in the way, momentum is gradually changing in favor of the bull.

On the downside, $0.02311 is the first important support. However, the true invalidation of this bullish structure is below $0.02171, the breakout candle that launched the current uptrend. If the vet slides down it, the bullish hypothesis is largely ineffective and the seller can regain control.

As long as veterinarians continue to build higher RSI strengths above $0.023, this trend remains constructive.

Conflux (CFX)

Conflux is one of China’s most prominent public blockchains designed to support fast decentralized apps and regulatory compliance.

China’s CFX coin has grown by 40.2% over the past week, and is now just above $0.103, indicating strong short-term momentum. However, it remains 94% below its all-time high of $1.70, leaving plenty of room for recovery or risk.

On the chart, $0.1042 is the closest resistance. A clean breakout on top of this could push the CFX to $0.1233, with little technical resistance in between. That price disparity could act as a driver if market momentum hits it.

On the downside, multiple support is around $0.1008, $0.0913 and $0.0827. But the real bullish nullification is under $0.0827. It is at a level where structure collapses and can change trends even in strong Altcoin cycles.

One bullish technical signal stands out. The 20-day EMA (exponential moving average) has recently expanded beyond the 50-day EMA.

This is not the usual 50-200-day golden cross, but it shows a short-term trend acceleration, especially when such divergence angles increase. With a closer time frame, this is a more responsive indicator, highlighting how quickly and bullish short-term emotions have become.

As long as CFX is above $0.1008 and this EMA gap continues to expand, the Bulls may continue to take charge.

qtum (qtum)

QTUM is one of the earliest hybrid blockchains developed from China, mixing the account-based Ethereum system with the UTXO model of Bitcoin. QTUM, a “Made in China” blockchain coin, once reached an all-time high of $106.88, but today it trades at around $2.31, down nearly 98% from its historic peak. That said, QTUM has scored 16.8% over the past week, suggesting fresh momentum.

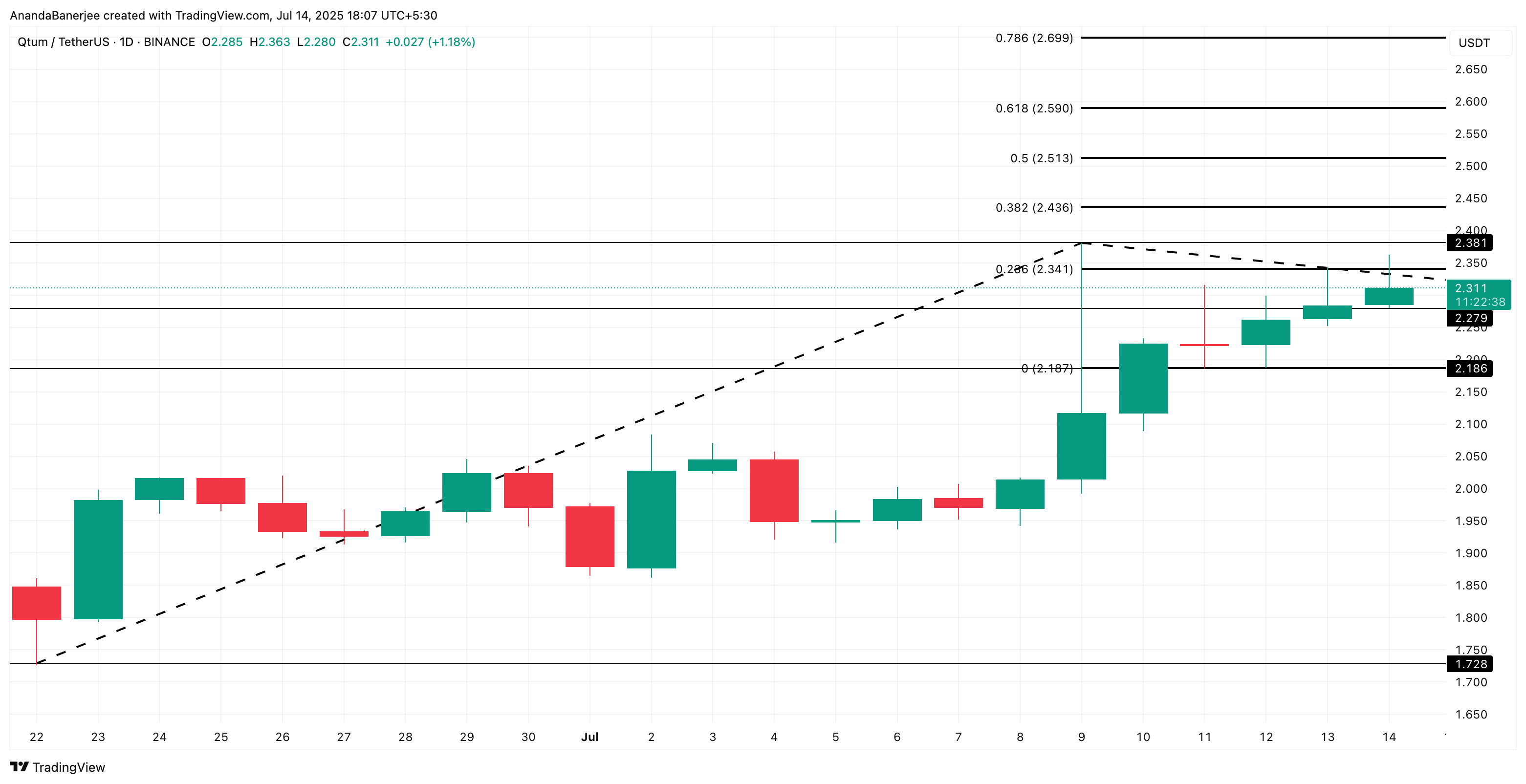

It was drawn from a trend-based Fibonacci expansion, with multiple upside targets appearing from a low of $1.73 on June 22nd to a high of $2.382 on July 9th, followed by a $2.187 revision.

QTUM violated immediate resistance before $2.341, but quickly faced rejection, and is now just above $2.279. This is the main level of horizontal support.

As long as QTUM is above $2.187, this trend remains the case. If the Bulls were able to push the $2.341 resistance again in volume, their next target would be $2.436, which would be $2.513, following the Fibonacci expansion.

If the price is below $2.187, the breakout structure will be invalid. Breakdown of under $1.728. The original impulse start could invalidate the broader bullish paper.

In short, QTUM is trying to regain its strength after years of inadequacy. The technical setup offers hope, but the $2.341 barrier remains the key to unlocking higher targets.

Disclaimer

In line with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. Although Beincrypto is committed to accurate and unbiased reporting, market conditions are subject to change without notice. Always carry out your research and consult with an expert before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.