Tron (TRX) has reached a five-month high as the price rises have increased. However, recent bullish momentum seems to have lost steam and indicate the possibility of price correction.

The assets are working well, but there are indications that the TRX could be overvalued in the short term, which could encourage pullbacks.

Tron is overrated

Tron’s network value (NVT) ratio (NVT) ratio has skyrocketed, reaching its highest level in a month and a half. NVT measures the ratio of the market value of a network to transaction volume.

In many cases, NVT rises indicate that the market value of the asset exceeds transaction activity, suggesting an overvaluation. For TRX, this increase in NVT is a potential red flag.

As the NVT ratio rises, TRX could face downward pressure as investors adjust their expectations. Overvaluation of tokens can lead to sales, especially when market sentiment shifts to attention.

As a result, price adjustments seem likely, especially when the broader cryptocurrency market is experiencing cooling periods.

Despite concerns about overestimation, the overall macro momentum of TRX may not lead to sharp corrections. IntotheBlock’s IOMAP indicator shows a strong demand zone of between $0.268 and $0.276, with around $138.9 billion TRX worth about $4 billion being purchased.

This substantial accumulation zone provides a buffer for TRX as it is unlikely that investors buying at these levels will sell without profits.

Demand zones are important as they represent price ranges that may prevent the TRX from going too far. Just as the market has shown interest in this price range, the chances of TRX falling below $0.276 in the short term.

If TRX does have a fix, it is expected to find solid support within this zone, with prices exceeding the important $0.276 level.

Do you want a dip at TRX price?

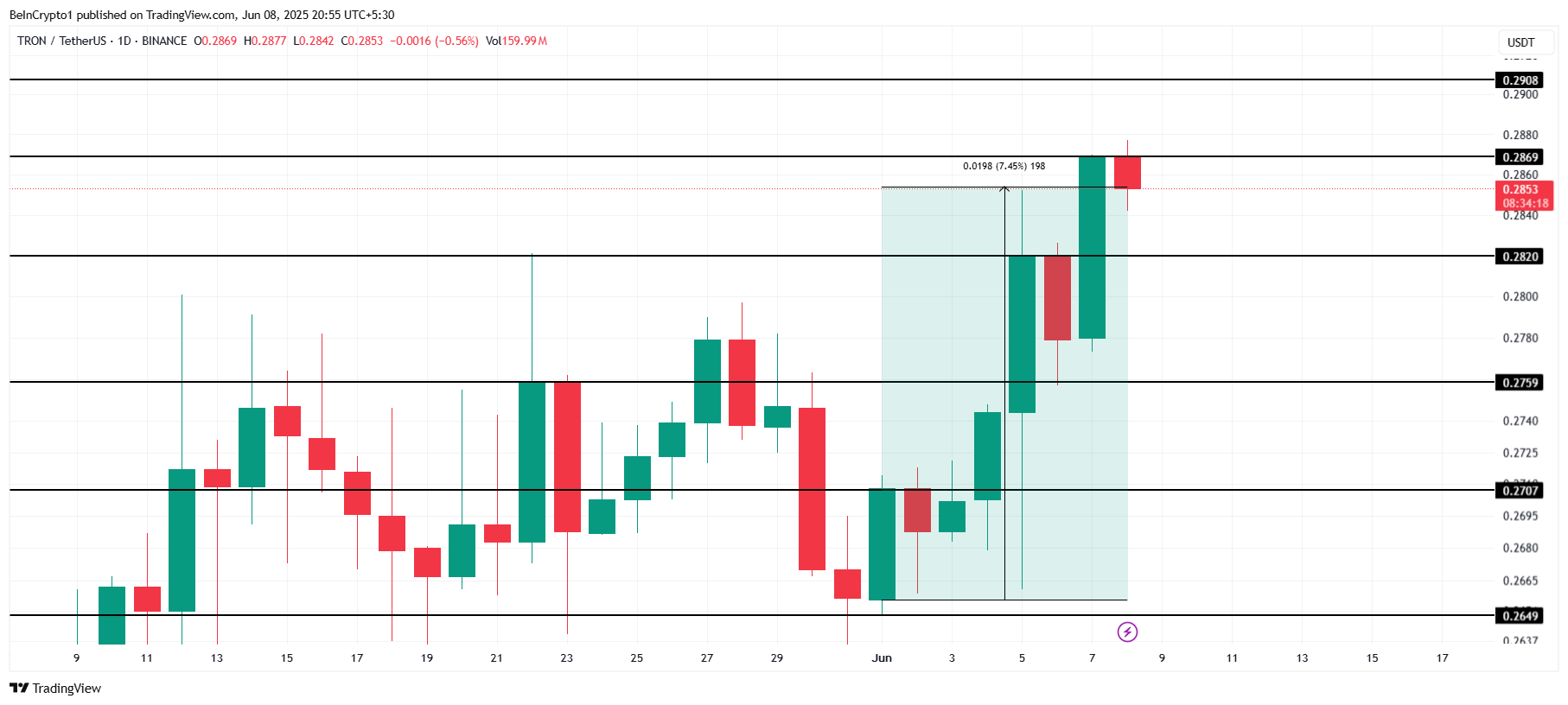

TRX has won 7.45% in the past week and is trading at $0.285 at the time of writing. He is currently facing resistance at $0.286. Given the recent price rise, tokens are approaching a key point.

If the TRX does not violate the $0.286 resistance, it could potentially face pullbacks as investors make profits.

If overvalued conditions cause a price drop, the TRX could fall below $0.282 and head towards a support level of $0.275. Below this level, you should get price support as there are strong zones with demand zones ranging from $0.268 to $0.276. The correction is moderate and is expected to prevent a more severe decline in demand zones.

On the other hand, if the broader market remains bullish, the TRX could push past the $0.286 resistance level. If this barrier is successfully violated, the TRX can move to $0.290. This will override the bearish outlook and set the stage for even higher prices.

Disclaimer

In line with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. Although Beincrypto is committed to accurate and unbiased reporting, market conditions are subject to change without notice. Always carry out your research and consult with an expert before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.