The popular Altcoin Solana has grown by 2% over the past 24 hours as the broader crypto market shows signs of resilience.

But beyond the general market recovery, Sol’s upward movement is driven by hints for a renewed institutional interest in the coin and its ecosystem.

Did Solana prepare the rally? NASDAQ submits fuel momentum

According to a 40-F filing dated June 18th, Canadian Asset Manager Sol Strategies, a company focused solely on the Solana Ecosystem, has filed compliance documents with the U.S. Securities and Exchange Commission (SEC) and has indicated its intention to list them in the NASDAQ.

While still waiting for approval, the filing represents a bold step towards providing institutional investors who are exposed directly to Solana-based assets through traditional markets. The development sparked a new wave of cautious optimism among Sol Hodler, raising prices today.

The timing of this filing also coincides with increasingly bullish on-chain signals, such as the coin liquidation heat map.

A liquidation heatmap is a visual tool that traders use to identify price levels where large clusters of leveraged locations are likely to be cleared. These maps highlight areas of high fluidity. Often there are bright zones that are color coded to indicate intensity and represent greater liquidation possibilities.

Typically these price ranges are magnets for price action. This is because the market will cause liquidation towards these areas and open up fresh positions.

Therefore, in the case of SOL, the dense liquidity cluster around the $160 level suggests a strong trader’s interest in buying or covering short positions at that price. This sets the stage for a short-term gathering towards that zone.

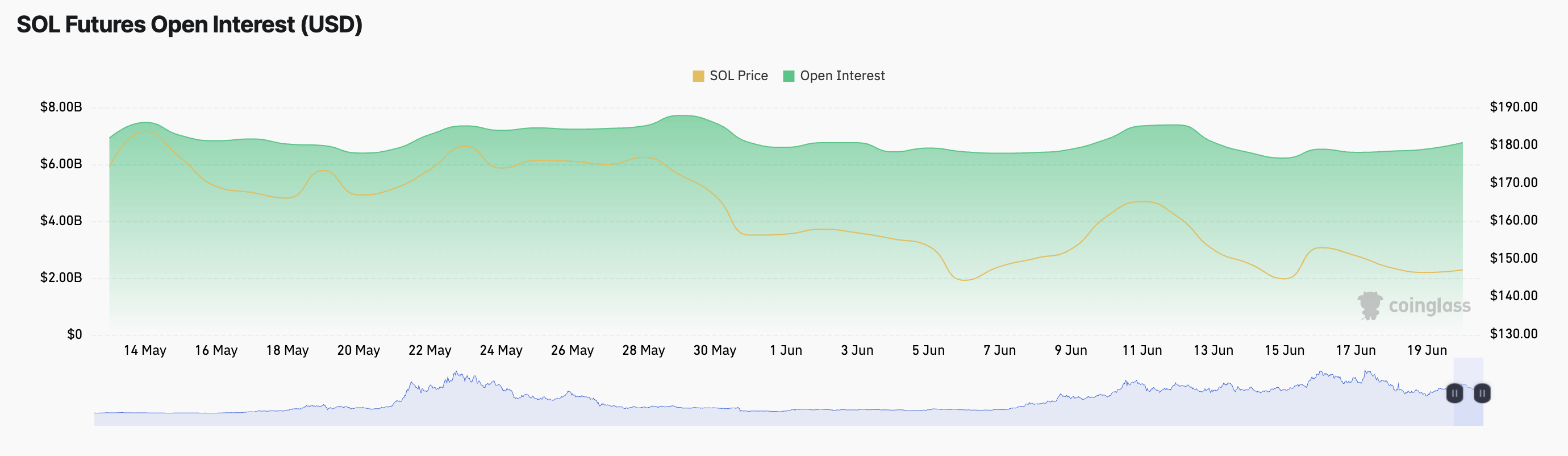

Furthermore, Sol’s open interest (OI) has risen 3% over the past day, indicating an increase in leveraged participation in Sol futures.

The rising OI suggests that more capital is flowing into the coin derivatives market.

Can fresh demand cause breakouts above $160?

Since early June, Sol has been trading within a tough range, facing resistance at $153.59 and found support at $142.59. A potential push to $160 will require a critical breakout that surpasses this resistance. This can only occur when new demand enters the market.

Without updating the purchase pressure, current momentum could stall. If buyers begin to show signs of fatigue, Sol risks reversing recent profits and retesting support at $142.59.

A breakdown below this level could open the door for a deeper correction as the Sol Coin price is towards $134.68 as Q2 ends.

Disclaimer

In line with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. Although Beincrypto is committed to accurate and unbiased reporting, market conditions are subject to change without notice. Always carry out your research and consult with an expert before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.