Global markets have gained advantage as the fallout from the recent US attack on Iran’s nuclear facilities and the global economy are shocked.

However, despite growing economic uncertainty, some registered US crypto stocks have been making a marked move and are attracting investors’ attention.

Coinbase (coin)

Coinbase’s Coin is one of the crypto stocks gaining momentum in today’s pre-market trading. This comes when stocks are gaining attention after the exchange announced that it secured a MICA license in Luxembourg and granted legal authority to provide crypto services to all 27 EU member states.

By choosing Luxembourg, Coinbase is at the heart of the EU’s digital assets ecosystem.

This development strengthened the price of coins, increasing by 4% in pre-market trading. At the time of writing, its Chaikin Money Flow (CMF) is 0.17, a rising trend, highlighting the demand for coins.

As purchase pressure rises, the value of the stock could rise to $316.06 as the daily trading progresses.

Circle Internet Group (CRCL)

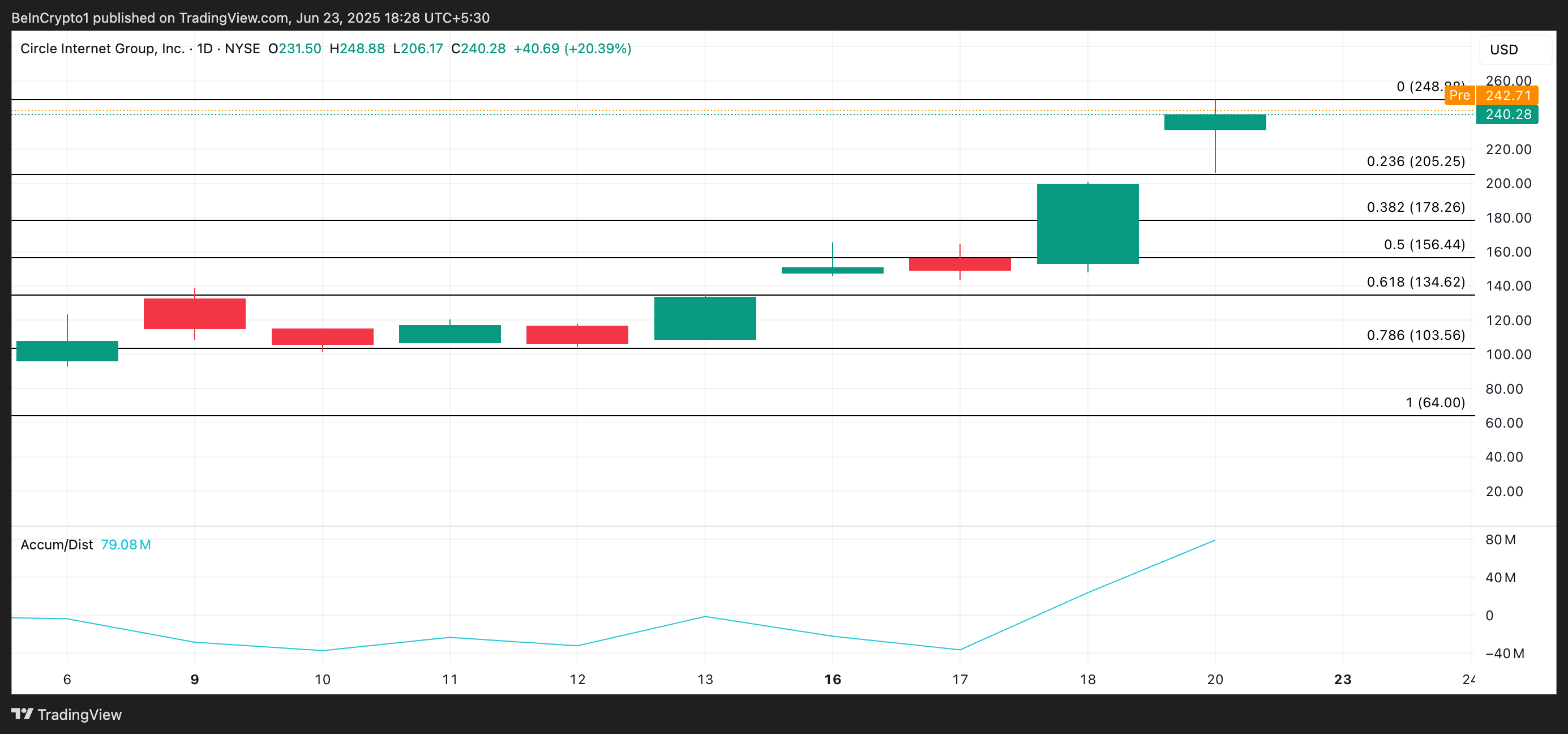

Circle share rose 10.16% in pre-market trading on Monday, as stocks surged 20.39% last Friday. Stablecoin publishers continue to benefit from growing institutional interest in USDC Stablecoin and recent renewed optimism about IPOs.

On the daily chart, the stock accumulation/distribution (A/D) line is 79 million, up over 220% in the past day.

The A/D line measures money in and out of assets by combining price data and volume data. As the A/D line rises, it indicates that the purchase pressure exceeds the sales pressure, suggesting a possible price increase.

If demand for stocks continues to grow, CRCL could potentially expand its profits to a new history high.

On the other hand, if the purchase pressure is leaning, the value of the stock could immerse in $205.25.

Iren

Aylen has grown by 6% and continues to gain momentum after a successful $550 million supply of 3.50% convertible senior notes in 2029.

At the time of this writing, the stock’s relative strength index (RSI) has risen at 65.59, indicating demand for AltCoin.

The RSI indicator measures the market conditions for asset acquisitions and overselling. It ranges from 0 to 100. Values above 70 suggest that the asset is over-acquired and paid for a price drop, while values below 30 indicate that the asset is over-sold and may witness a rebound.

Aylen’s RSI measurements indicate that market participants prefer accumulation over distribution. If this trend continues, the stock’s prices could rise to $11.72.

On the other hand, if demand falls, the stock’s value could fall below $10.46 and to $9.52.

Disclaimer

In line with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. Although Beincrypto is committed to accurate and unbiased reporting, market conditions are subject to change without notice. Always carry out your research and consult with an expert before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.