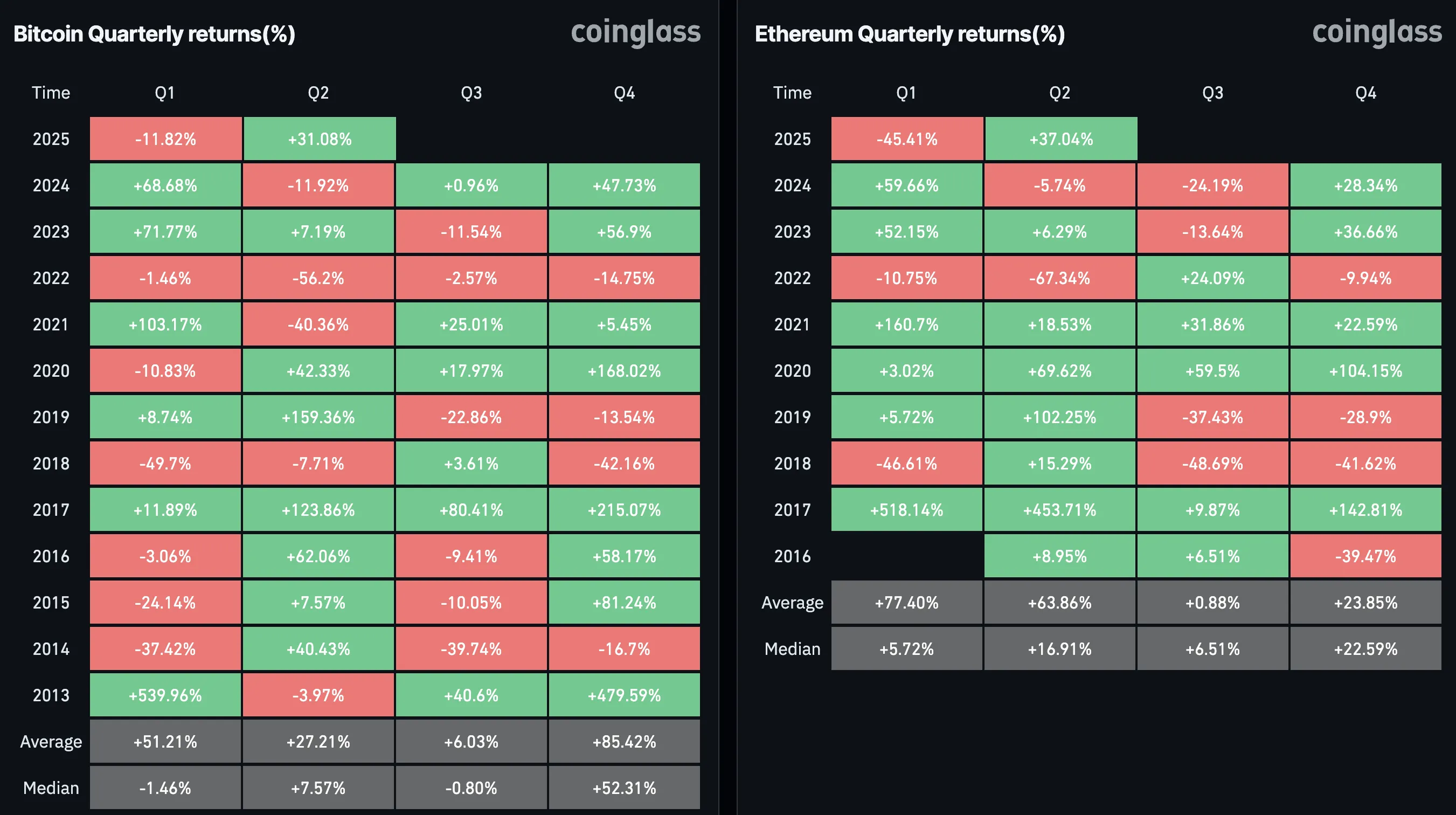

After a year-long volatile start, Bitcoin has regained its foothold, appearing to have surged by 31.41% in the second quarter after a 11.82% decline in the first quarter of 2025.

The rebound rekindled pressing questions for investors. Is the bullish cycle of Bitcoin still still in place, or are we approaching the end of the line?

Stub coins shaping a new bullish cycle

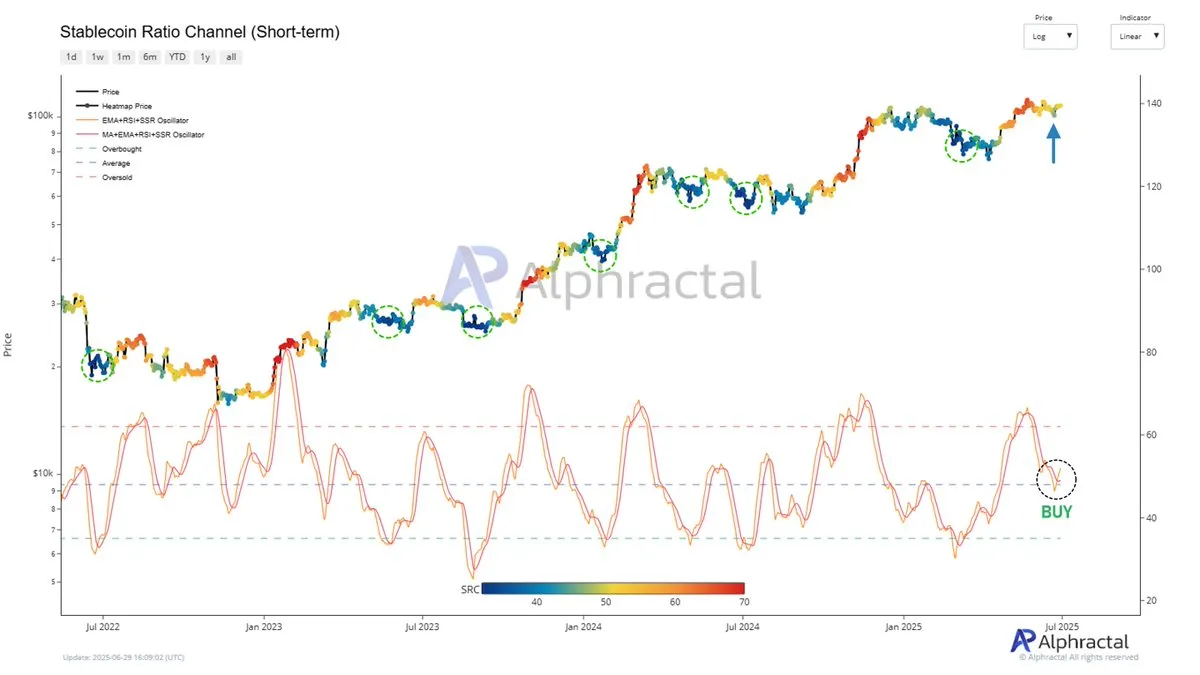

In a recent post on the X platform, Joao Wedson, founder and CEO of Alphractal, highlighted three important Stablecoin Metrics: Stablecoin SupplyRatio (SSR) oscillators, long-term views of Stablecoin ratio channels, and short-term views of Stablecoin ratio channels. Wedson says these indicators show optimism and offer promising investment opportunities.

“Currently, these metrics do not show any excess conditions and suggest that Bitcoin (and other cryptos) could continue to rise for several more months,” Wedson shared.

First, an on-chain stubcoin supply ratio (SSR) oscillator acts as a “compass” and measures the market capitalization of Bitcoin compared to the total security market capitalization smoothed by a 200-day moving average and standard deviation.

This metric identifies potential purchase opportunities when Bitcoin is undervalued compared to stable liquidity or warns of overheating markets. Recent alfractal data shows that SSR oscillators have not yet reached sales signals, suggesting that Bitcoin still has room for growth.

Additionally, the Stablecoin ratio channel provides deeper analysis in both long-term and short-term perspectives.

The long-term view will help identify purchase opportunities when Bitcoin is reasonably priced compared to Stablecoin liquidity, whilst warning investors of overvaluation.

On the other hand, due to the high vibration frequency, the short-term view is suitable for swing trading strategies and provides momentum signals for short-term trends. Alphractal’s charts have shown recent “purchase” signals, particularly since early 2025, strengthening confidence in the ongoing bull cycle.

According to Coinglass, the 31.08% recovery in Bitcoin and a surge in Ethereum (37.04%) in Q2 2025 reflect the strength of the crypto ecosystem.

However, the risk remains. Stubrecoin’s trust could be affected by global regulatory volatility, especially as countries like the US and the EU tighten their surveillance. Nevertheless, the outlook remains positive with low interest rates. The US Treasury also predicts that the Stablecoin market could reach $2 trillion.

Disclaimer

In compliance with Trust Project guidelines, Beincrypto is committed to reporting without bias and transparent. This news article is intended to provide accurate and timely information. However, we recommend that readers independently verify the facts and consult with experts before making decisions based on this content. Please note that our terms and conditions, privacy policy and disclaimer have been updated.