Top Meme Coin Dogecoin saw a noticeable surge in interest from large owners last week despite relatively restrained price action.

Doge trades within a narrow range and has little momentum to break out in either direction. With the accumulation of climbing whales, altcoins may be ready for a short-term upward breakout.

Doge sees a 112% surge in whale accumulation despite price stagnation

According to IntotheBlock, Doge is paying attention to a 112% increase in large owner Netflow over the past seven days.

Large holders are the addresses of whales that hold more than 0.1% of the distribution supply of assets. Their Netflow tracks the difference between the coins they buy and the amounts sold over a specific period.

As Netflow increases for large-scale holders of assets, more coins/tokens flow into your wallet than these major investors go out. This trend shows that these holders are accumulating Doge amid poor price performance, indicating confidence in future value.

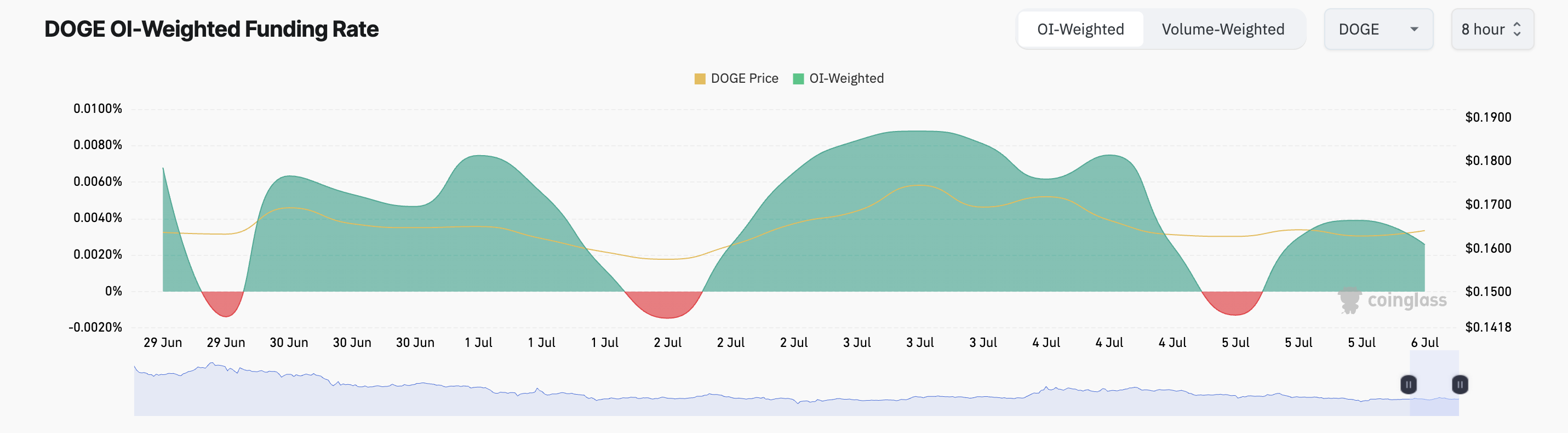

Furthermore, while Doge’s prices remain largely unresponsive to improved sentiment in the broader market, futures traders continue to show convictions. This is reflected in the sustained demand for strengths. For each Coinglass, the current coin funding rate is 0.0026%.

Funding rates are periodic payments between traders on permanent futures contracts to line up contract prices with spot prices. If the funding rate is positive, there is a high demand for longer positions. This means that more traders are betting on Doge’s price increase.

Whale accumulation suggests a surge of $0.175

If this trend of whale accumulation continues and positive emotions increase, Doge may be ready for a breakout to the $0.175 level. This move marks a major reversal from the recent integration phase.

A break beyond this critical price barrier could open the rally door towards $0.206. However, if you buy a pressure crater, the Altcoin price could drop at $0.148 to retry support.

Disclaimer

In line with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. Although Beincrypto is committed to accurate and unbiased reporting, market conditions are subject to change without notice. Always carry out your research and consult with an expert before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.