After several failed attempts to break the $110,000 price mark over the past week, major coin Bitcoin could be set up for a decisive breakout.

Data on the chain shows that coin accumulation is quietly intensifying, and bullish signals are beginning to match.

When the miners hold it, Bitcoin supply tightens, and speeds are low for the first time in three years

BTC speeds have gradually declined since July began, indicating that coins are in a low supply environment. On July 8, on-chain metrics, which measure the frequency at which BTC changes hands over a certain period, were closed at a three-year low of 12.68.

As assets slow down, fewer coins pass through the network, indicating that holders are choosing to sit tight rather than trade or sell.

This is a bullish signal, reflecting a growing conviction among investors and a gradual tightening of liquid supply, so rising demand could lead to higher prices.

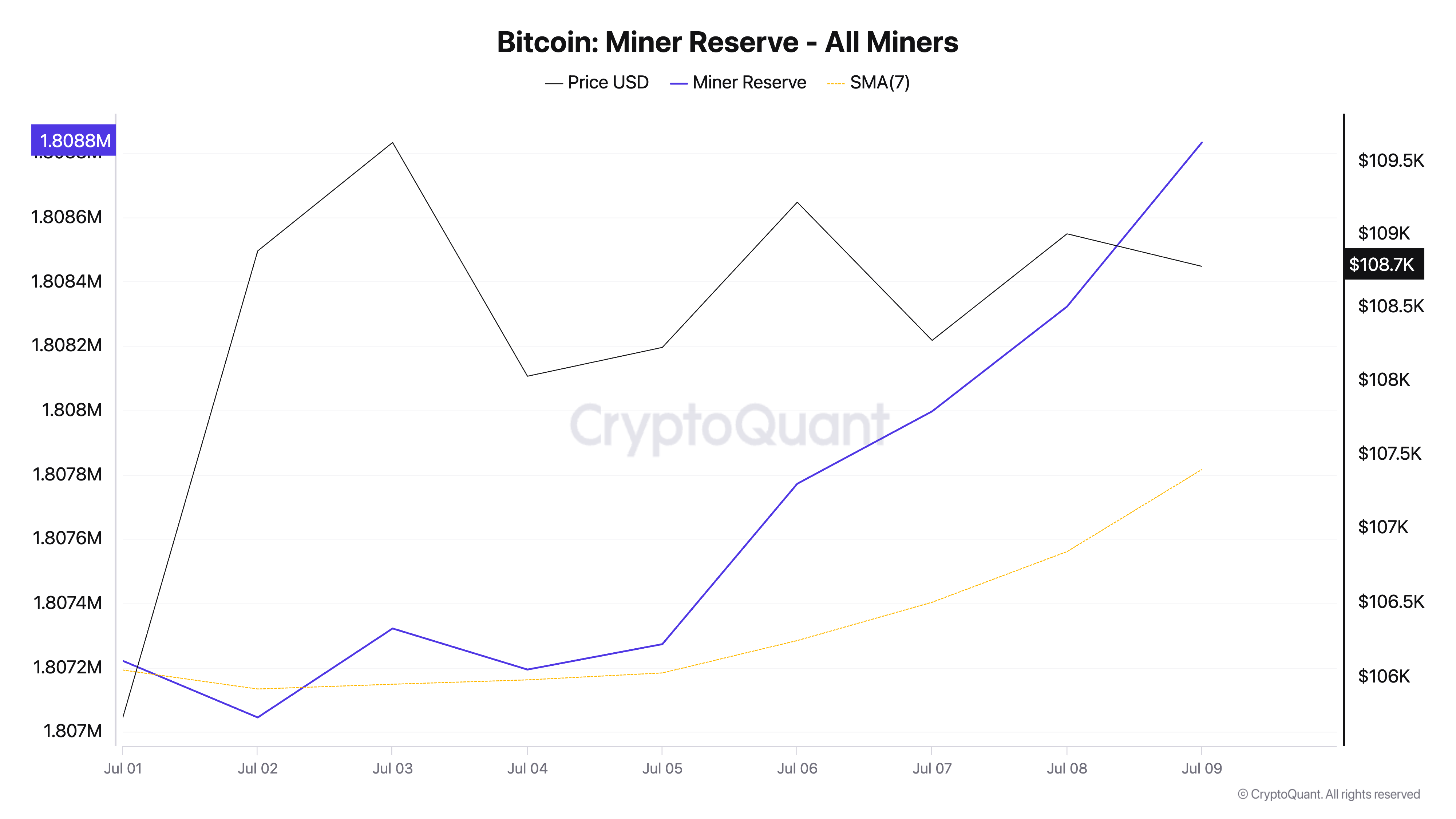

Additionally, Bitcoin’s minor reserves have steadily climbed over the past week. Data from Cryptoquant shows miners have added 1,782 BTC to their holdings in the past seven days, pushing the entire miner reserve to 1.81 million coins at press time.

The increase in BTC’s mining reserves since the beginning of July suggests a change in miners’ behavior towards retention rather than selling, as the market presses more heavily at rising rally above $110,000.

Bitcoin could surge if traders reach zero in the $110,000 liquidity zone

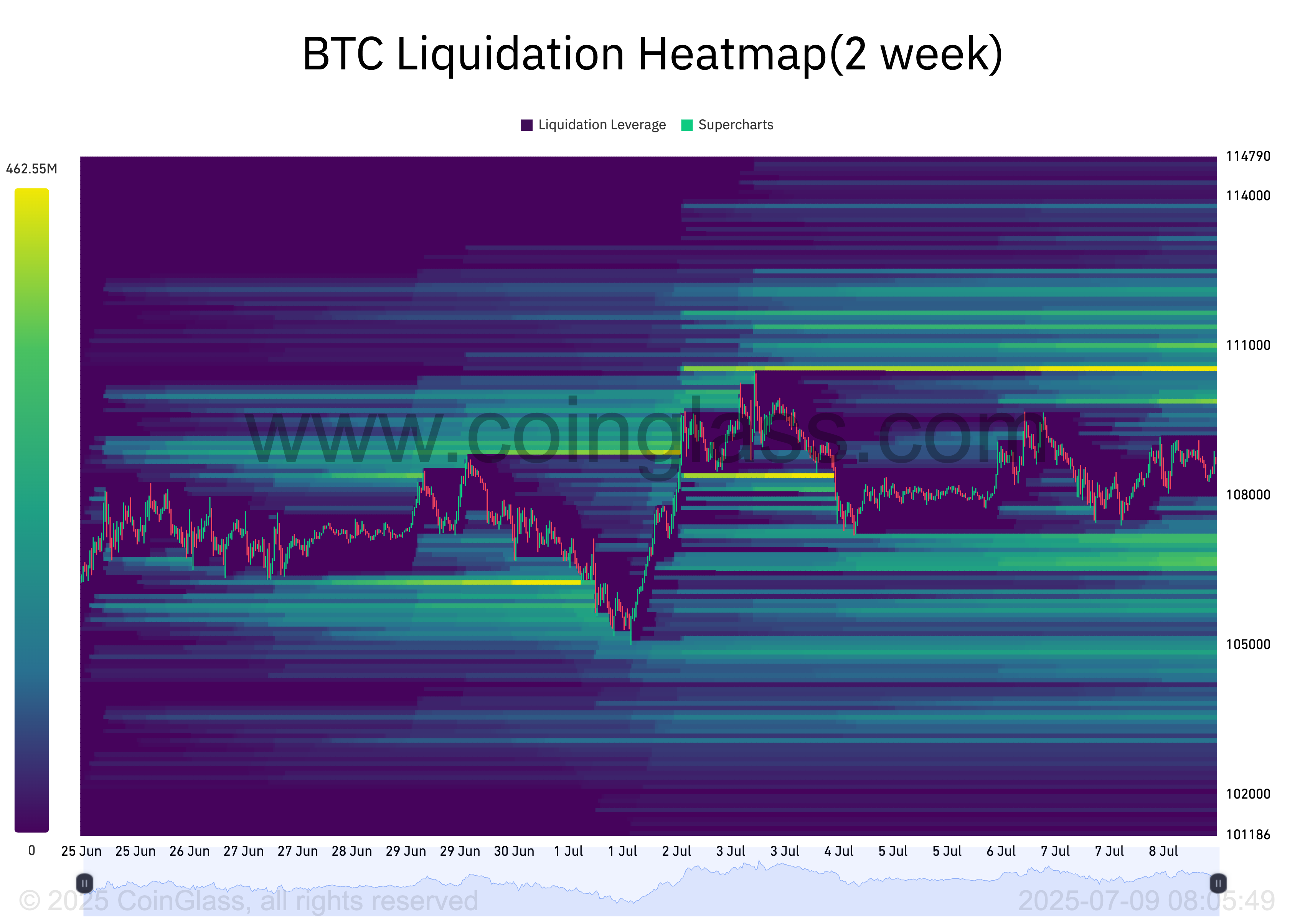

The BTC liquidation heat map rating shows significant liquidity concentrations around the price range of $110,473.

The liquidation heatmap identifies the price level where clusters at leveraged locations are likely to be cleared. These maps highlight areas of high liquidity, often color coded to indicate intensity, with bright zones (yellow) representing greater liquidation potential.

Typically these cluster zones act as magnets for price action. This is because the market tends to trigger liquidation towards these areas and open up fresh positions.

Therefore, in the case of BTC, a large amount of liquidity cluster at a price level of $110,473 shows strong traders’ interest in buying or closing short positions at that price. It creates a room for a potential surge.

However, this does not happen if sales pressures gain momentum and new demand fails to enter the BTC market. In this case, the coin’s price could drop to $107,745.

The price of BTC could slid to $104,709 if the purchase pressure is low.

When Minor and Hodler’s clampdown first appears in beincrypto, Post Bitcoin prepares the supply aperture.