The political fallout between President Donald Trump and Elon Musk may have set the stage for Bitcoin’s next breakout.

The two once lined with anti-establishment sentiment, but recent splits over spending, crypto and narrative control have already reshaped the market, and it is possible that Bitcoin (BTC) is ready to make a profit.

Bitcoin thrives on Trump and Mura’s fallout

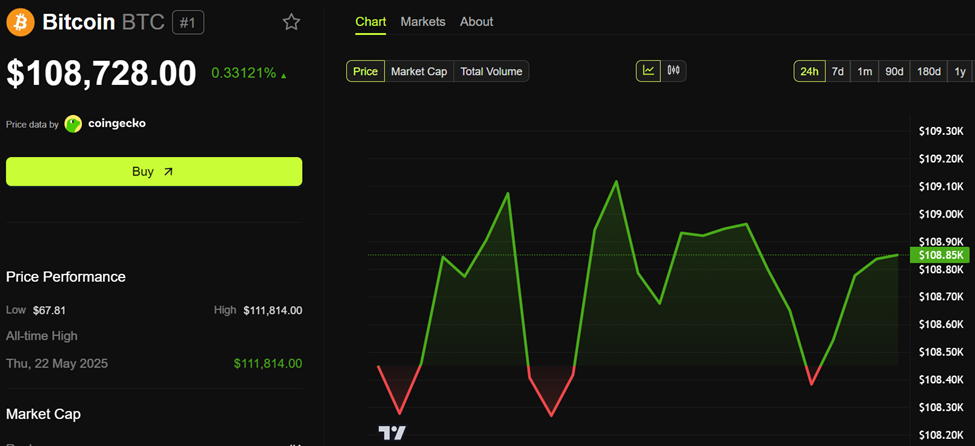

At the time of writing, Bitcoin was trading at $108,728, an increase of 0.33% over the past 24 hours. Pioneer Crypto continues to show strength despite what appears to be a stagnant upward potential.

One of the catalystsIt was Elon Musk, who launched his own political movement.He is the American Party. This political measure centers around spending cuts, fintech reform and, most notably, full support for Bitcoin.

Musk’s claim that the American party will adopt Bitcoin as its reserve currency is a bullish foundation for Pioneer’s crypto despite Trump’s backlash.

The US president labelled the move to effect as betrayal and threatened to halt Tesla’s SpaceX contract or retaliation deal.

The way new parties incorporate Bitcoin into the platform is unique. Musk has long been a contradictory to the code, which indicates a formal political commitment.

The iconic clash between Trump and Musk destroys the traditional Republican donor line and brings some kind of shift in the mask movement.

Pro-Bitcoin law could accelerate if the party even gains modest traction in Parliament.

Investors have treated the Trump Musk feud as a partisan fight and a geopolitical shock.

Trump recently signed the law on his trillion dollar “one big beautiful bill” to raise the debt cap and lock it up with tax cuts, but Musk opposed the measure.

The tech billionaires sought financial restraints, but differences in opinion sparked a deeper rift.

Nevertheless, the market took a different view, with Bitcoin jumping 4.8%, breaking past $109,000, marking the closest week to date.

Analysts are now seeing the potential for Bitcoin’s rise, a rally driven by macro climate and historical data rather than politics.

The goal comes after Reuters reported a July 2nd research note from Bitwise, indicating that Bitcoin prices tend to rise 30% 50 days after the market suffers from geopolitical shocks.

“These tailwinds set a constructive background for Bitcoin and crypto assets…” writes Bitwise analysts Andre Dragosch and Ayush Tripathi.

Implications? If the historical trend repeats, Bitcoin could gather towards $136,000 by mid-August.

Bitcoin benefits from the collapse of the dollar

Meanwhile, the financial background continues to strengthen Bitcoin’s core narrative. Trump’s bill adds an estimated $7 trillion to national debt over the next decade. That spending rekindled the horrors of the decline of the dollar, the theme of Bitcoin thriving.

“The currency collapse game has just strengthened another level,” analysts David Brickell and Chris Mills wrote weekly linking the dot newsletter.

Economist Elkan Öz adds more context to YouTube, in contrast to the decentralized spirit of Musk’s capitalist persona and Bitcoin.

“In Bitcoin… there are no “bosses” like musk. Nakamoto atoshi…I don’t have the authority to be like CEO,” he said.

Öz argues that while Musk is trying to rebuild the system, Bitcoin is already operating outside it, and may ultimately benefit from the feud more than either man.

Traders seem to hold their position. Bitcoin has been consolidated for over $107,000, with tapering sales pressures and institutions showing renewed interest.

“The strong players below $95,000 have not been sent off, indicating stable interest,” Yuma observed.

Still, the risk remains. Regulatory pushbacks are looming threats, especially when Musk’s political ambitions cause retaliation from federal agencies.

For now, however, this feud amplifies the Crypto story and strengthens the role of Bitcoin in America’s changing political economy.

The reason why Trump Musk’s feud could be bullish for Bitcoin was first introduced in Beincrypto.

destruction:

destruction:  4. If the party even gets minimal influence in parliament, it could accelerate the $btc law

4. If the party even gets minimal influence in parliament, it could accelerate the $btc law