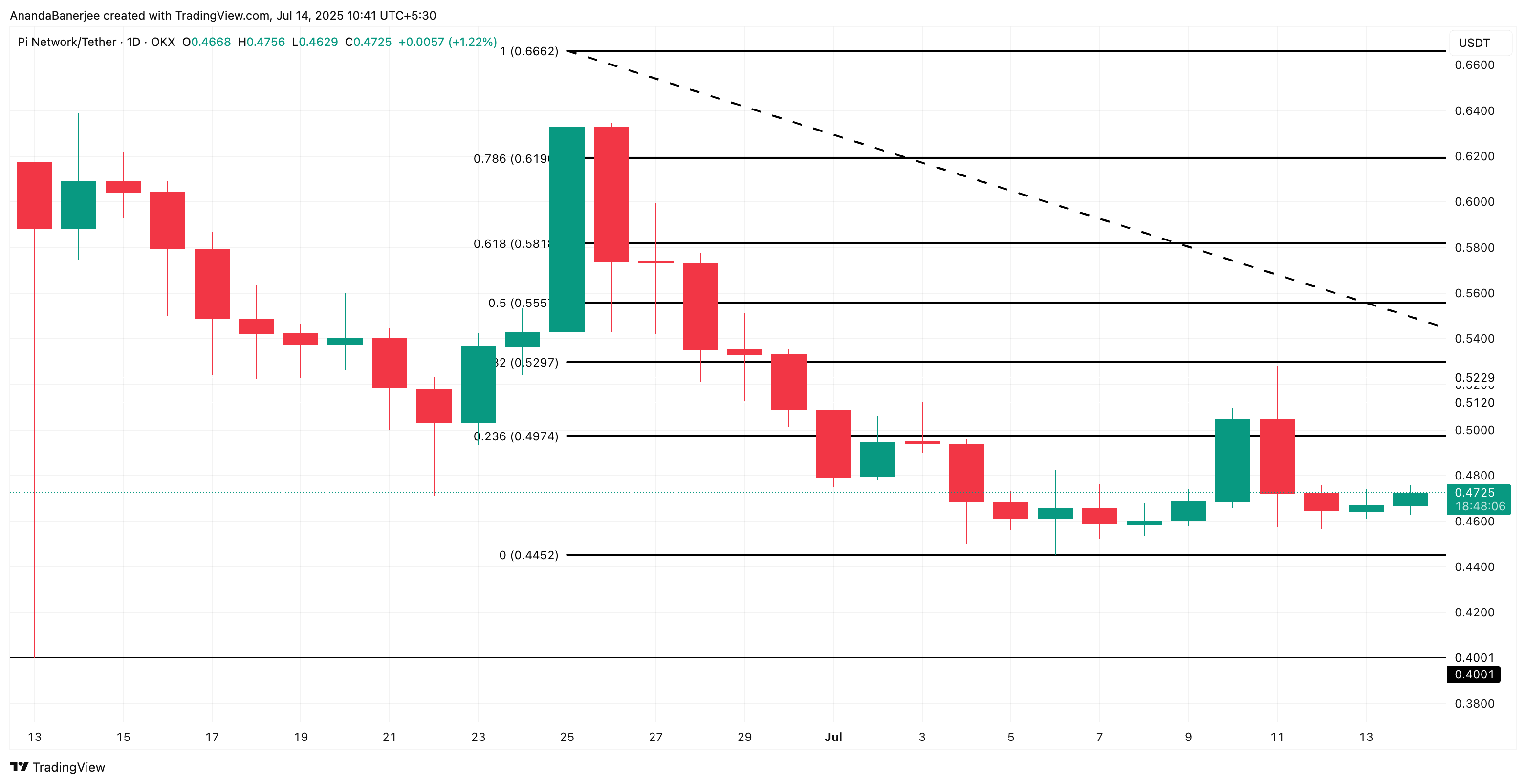

Pi Coin is hovering dangerously close to key support levels after the trading week is late. At press, Pi Price is $0.4725, struggling to surpass levels above $0.4452.

While on-chain metrics show no strong belief in either, some cracks in bearish momentum are beginning to emerge.

Open interest and funding rates indicate a suspension

PI prices show signs of hesitation. Coinalyze (over a four-hour time frame)’s aggregated open interest has hovered around $10.09 million, and has not even been shown to be a major directional conviction over the past few days. This means that traders are not actively building new strengths or short positions, suggesting indecisiveness.

Meanwhile, the aggregated funding rate rose to +0.0274, while the projected funding rate was even higher to +0.0516. Simply put, this means that Pi Coin Longs are slightly dominant and willing to pay a premium to hold positions that are usually a sign of bullishness.

Open profit refers to the total number of unstable contracts in the market. In general, as open interest increases, more traders are entering the market and supporting current trends. Funding rates are the recurring fees paid between long and short traders. A positive value means that the length is dominant. The negatives suggest that the shorts are under control.

Overall, flat open profits with rising funding rates indicate a mild, long bias, but with PI coins, there is no strong confidence.

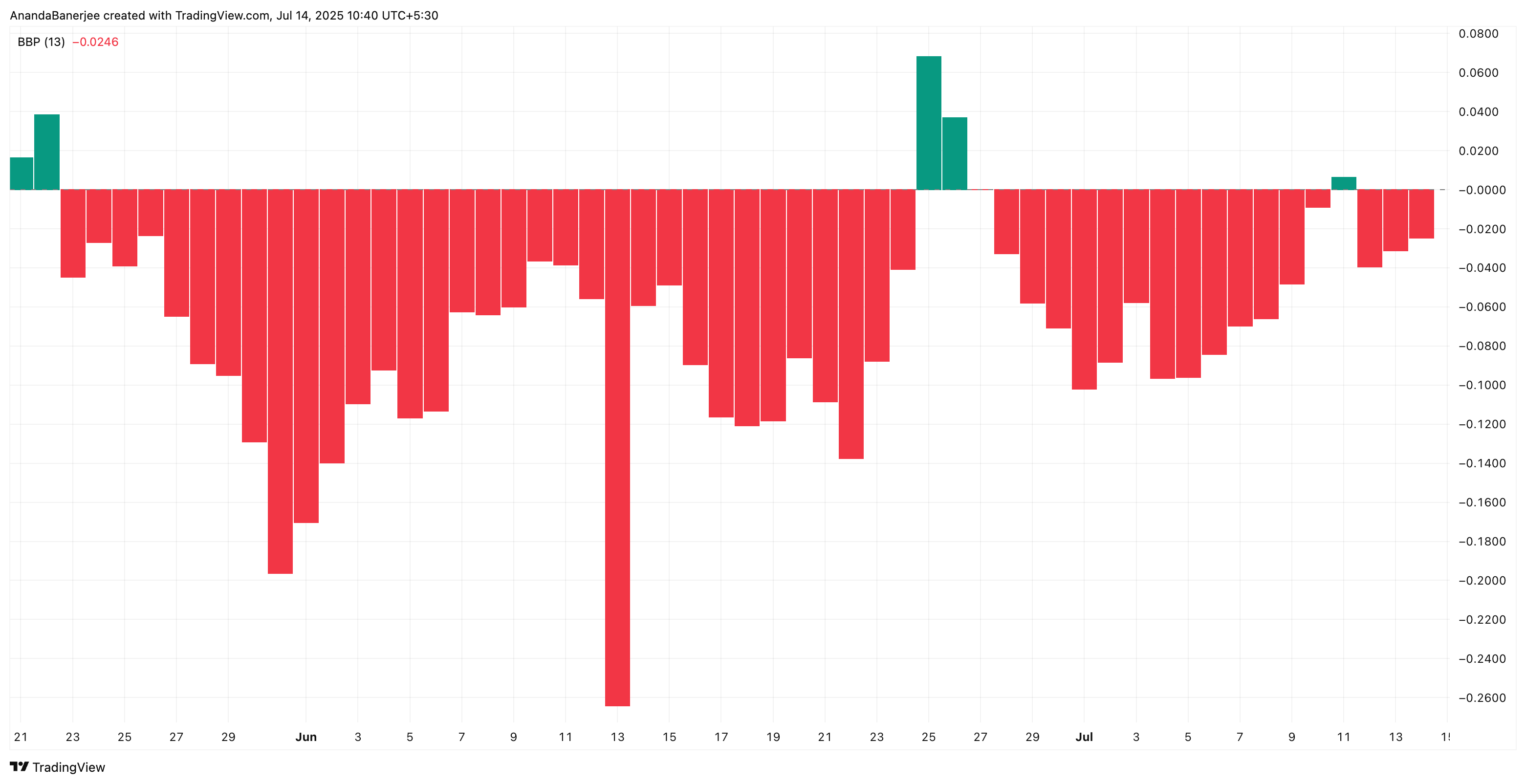

The bear’s power is losing steam

The market has leaned slightly longer, but there are no convictions as funding rates rise and open interest remains flat. This hesitation is reflected in the Bullbear Power Indicator, which is part of the Elder Ray Index, which tracks the strength of the buyer/sellers in the market.

At the time of writing, bear power continues to weaken, indicating that bearish momentum is declining.

PI Price Analysis: Main support is still retained

The Pi Coin (PI) is currently trading at $0.4725, just above the key support level, above $0.4452. This level was derived using the Fibonacci retracement tool drawn from late June to July 6th.

Fibonacci Retracement is a technical tool that traders use to identify potential support and resistance levels by measuring how much the price has been pulled back from recent movements.

So far, despite the wider downtrends in the Pi, this support has been preserved. A breakdown below $0.4452 could potentially expose Pi Coin to a sharper fix towards its next major support, $0.4001.

Conversely, if momentum is constructed, the next rising resistance is $0.4974, the level at which the PI price has been rejected several times. Daily closures above $0.4974 could lead to bullishing in the short-term and negating the bearish hypothesis.

Disclaimer

In line with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. Although Beincrypto is committed to accurate and unbiased reporting, market conditions are subject to change without notice. Always carry out your research and consult with an expert before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.