The price of the Solana may be cooled from its recent highest price of $168, but the larger structure still favors the bull.

Despite the fix to $160, three key metrics suggest that this is more of a pause than a breakdown.

Funding rates remain positive, reflecting bullish sentiment

Solana’s funding rate is still green, indicating that the long position is dominant across the market. Even if prices drop slightly, traders are still paying for longer stays. In other words, most people expect prices to rise again.

There were no indications that the shorts would gain control. This usually indicates that buyers are willing to hold through volatility.

Funding rates are recurring payments made between long-term and short traders of a permanent future. If the rate is positive, the longs are dominant, paying shorts and showing bullish bias.

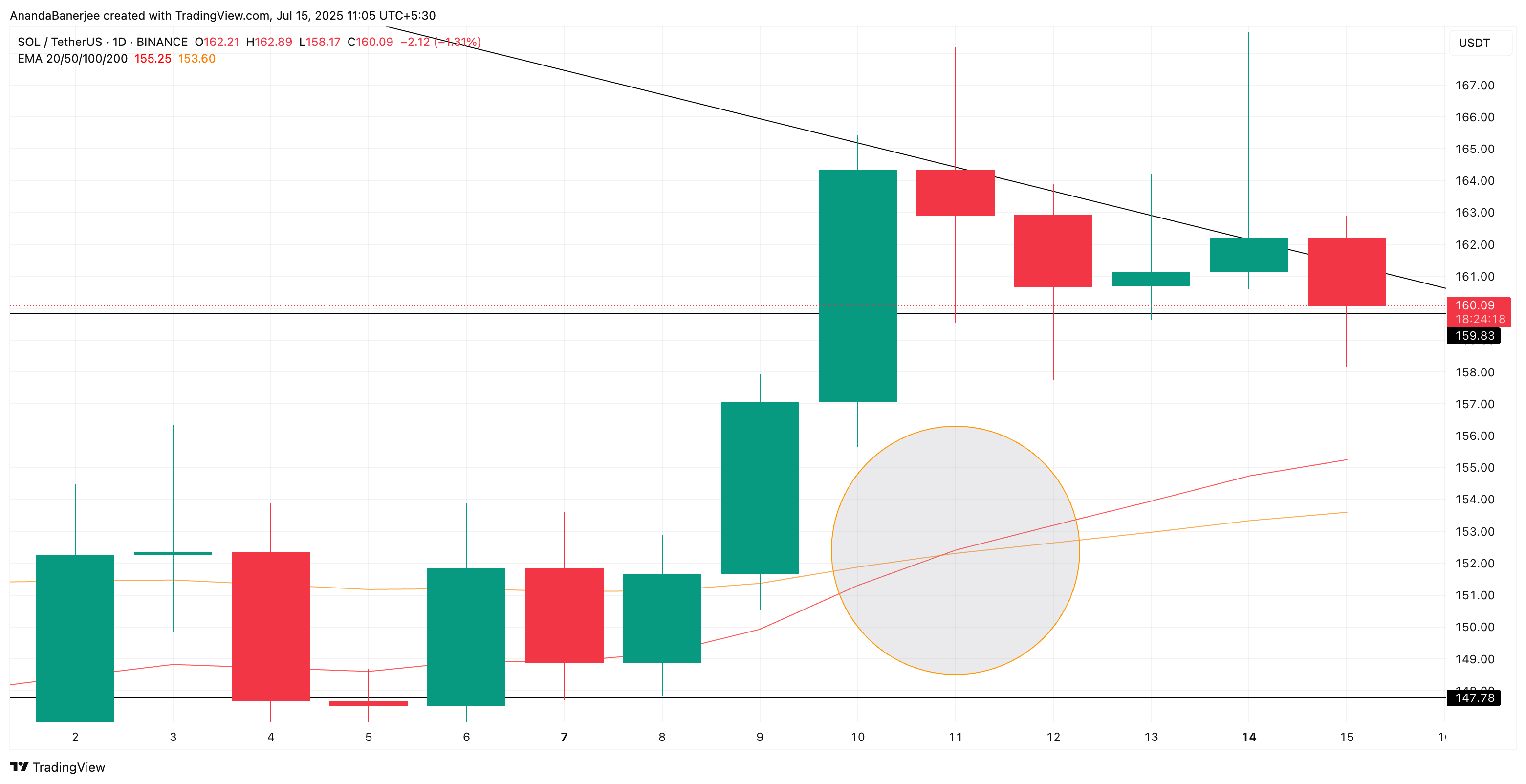

20/50 EMA Golden Crossover Checks Uptrends

Solana recently saw an intersection of 20 EMAs (exponential moving averages) above the 50 EMAs on her daily chart. This “golden crossover” is a bullish signal that suggests that short-term momentum is being taken up again. However, this crossover did not occur with strong green candles. It came to a red candle with a long core and showed the market indecisiveness.

Still, the crossover supports the idea that the trend in Sol price is moving upward, even if momentum appears to be unstable.

Solana Price still outweighs key support. The structure is the same

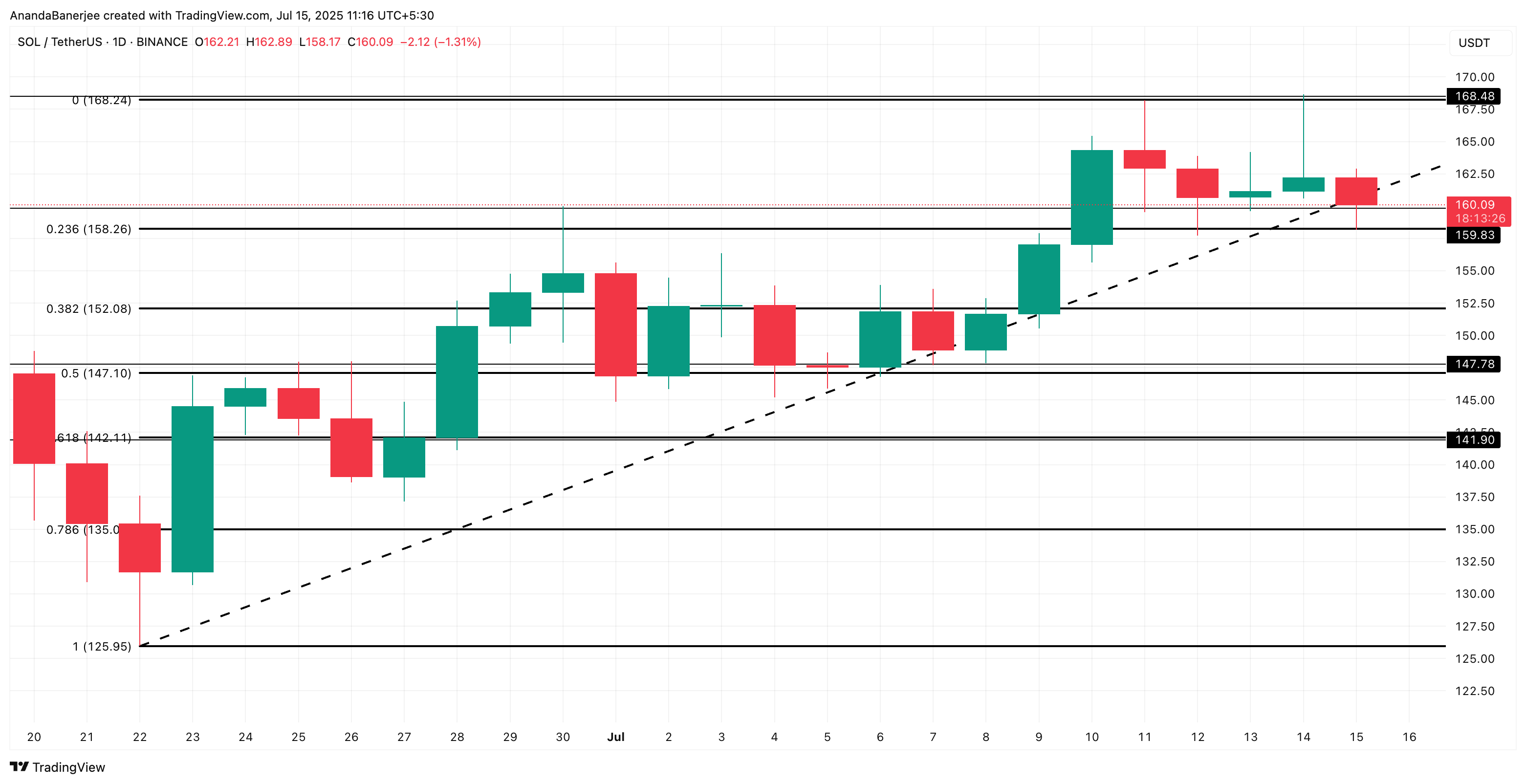

Despite the pullback to $160, Solana is still held above the main support zone of nearly $158, as predicted by the Fibonacci Retracement Indicator, a tool that helps chart key support levels during uptrends.

The advantage is that if Solana regains $168 and the funding rate remains positive, the next leg of the rally opens. This will allow Sol Price to reach $179, or even $184.

However, there will be a clear divergence of bearish RSI between July 10th and July 14th. The SOL price has been higher, but the RSI has been lower heights. Even if Sol Price is pushed up, it’s a sign that the momentum is weakening. This difference often leads to short-term corrections, but we can see this now.

The RSI also begins to curve down after approaching the signal line, which is added in case of temporary cooling.

RSI (Relative Strength Index) is a momentum indicator that tracks how strong trading pressure is. When prices rise and RSI drop, it means momentum is declining.

Bearish RSI divergence could negate wider bull structures following flooding of less than $158. Also, a $152 (0.382 FIB level) or low ($147) revision could potentially turn the structure over a short time frame.

Disclaimer

In line with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. Although Beincrypto is committed to accurate and unbiased reporting, market conditions are subject to change without notice. Always carry out your research and consult with an expert before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.