The XRP appears to be taking a break after bolting it to $3.65, the highest ever.

Like other unprecedented milestones, even this comes with signs of potential short-term cooldowns. Instead of panic, however, this could simply be a pause before XRP prices resume rallies to higher levels. This is what data says.

MVRV ratio flushes early profit acquisition signal

The first flag comes from the 90-day MVRV (market value to realised value) ratio and is currently rising to 48.07%. This number tracks the amount of profit wallets that have held XRP for 90 days.

Historically, high measurements of MVRV suggest that owners may start selling to close their profits soon.

About Token TA and Market Updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s daily crypto newsletter.

To give context: Back on January 31st, when the XRP price fell from $3.11 to $2.58, the same 90-day MVRV level ~48% preceded a sharp drop of 17%. That pullback is faster and the same setup is again formed.

Even the 30-day MVRV warns against a sale that could be sitting at 39%, the second-highest reading in six months. This means that new holders also have healthy profits, which usually creates some selling pressure.

The market value of the Realized Value (MVRV) ratio indicates the profits realized by existing holders. Too high suggests many unrealized benefits of the system, often leading to a sale as holders cash out.

Exchange inflow is surprisingly low

However, the MVRV ratio suggests that holders can sell, but actual behavior is currently different.

On-chain data shows that only 13.34 million XRP worth around $48 million at current prices have moved to exchanges. This is very low in the best scenario ever.

Compare this to previous gatherings, like the local tops in May or January. This time, despite being XRP’s greatest ever, the data tells a different story. The holders are not in a hurry to leave.

Exchange inflow tracks the amount of XRP sent to central exchanges. Spikes usually mean people are ready to sell. Low inflows suggest traders’ confidence and retention, even at high prices.

So, while MVRV says that profits are rising, the inflow measurements say no one has hit the sell button yet. That fork supports the idea that this rally hasn’t finished.

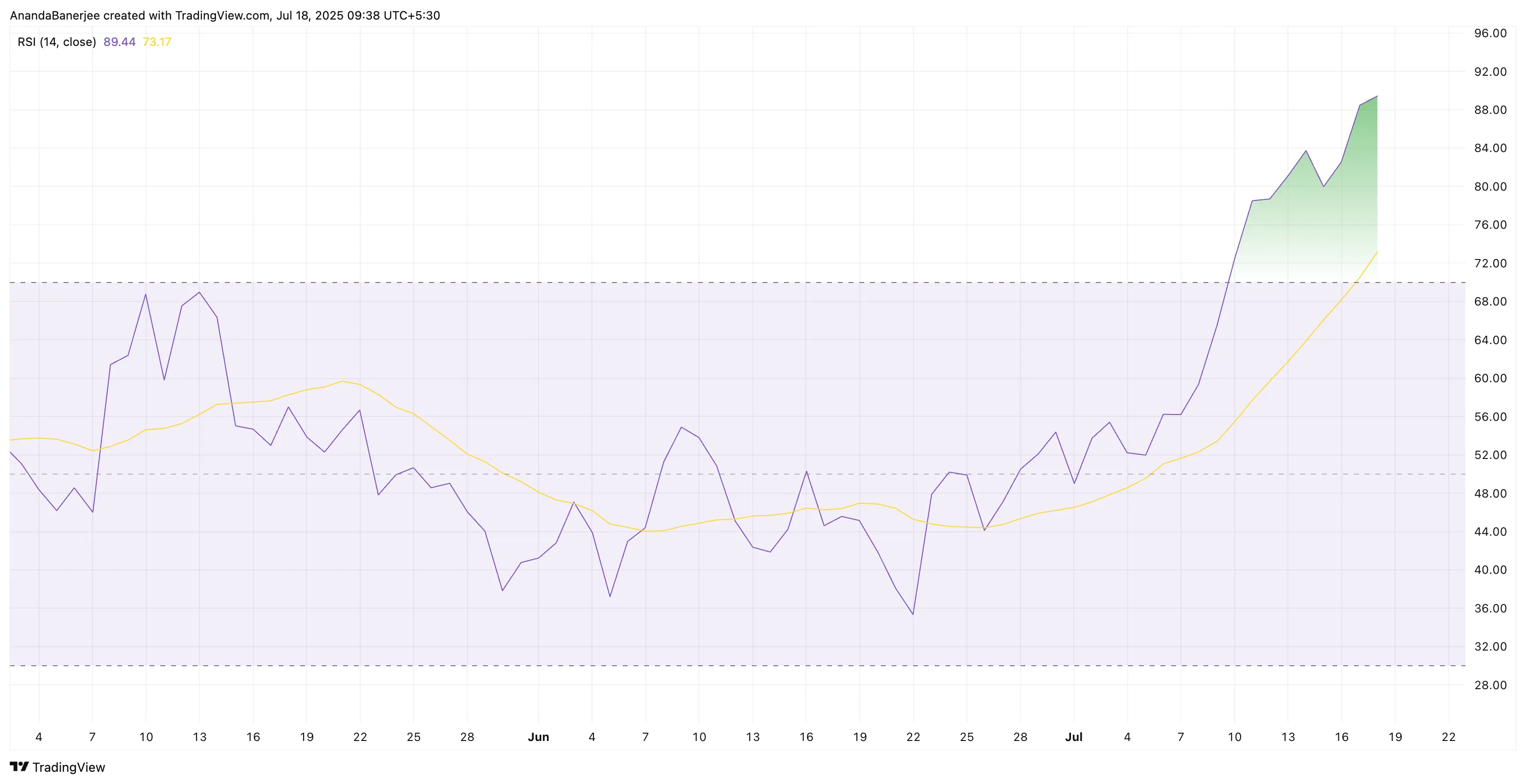

RSI flashes warnings that have been bought out. Temporary XRP price cooldown

The XRP’s powerful gathering pushes the daily RSI (relative strength index) to 89.44, signaling an extreme excess of conditions. This is consistent with overheated MVRV levels, suggesting that short-term excitement may be at peak. Historically, RSIs above 85 are often ahead of cooling-off periods or short pullbacks, even strong bull trends.

RSI measures how fast and how strong the price moved. If you exceed 70, your assets may be rising rapidly, and you may see short-term weaknesses.

XRP price action suggests that $2.95 remains important support

The XRP price is currently trading at $3.59 at the 1.618 Fibonacci expansion level. The uptrend remains intact, but the current on-chain (to be precise, MVRV 90-day metric) and RSI signals suggest a cooldown to $2.97 is possible.

So the $2.95 zone, which coincides with the previous Fibonacci level, is important. As long as XRP prices exceed this level, bullish setups will remain in effect. A short-term immersion towards it will not negate the rally, but may instead provide a potential re-entry point.

However, a clean break below $2.95 can cause deeper flaws when combined with profitable stints and increased exchange inflows. Until then, the pass to $4.64, a 2.618 FIB extension, remains the main target.

Also, if you’re looking for a new all-time high that relies on pullbacks cleanly on resistance levels with XRP prices of $3.59, and looking for a new all-time high, the short-term bearish hypothesis relying on pullbacks will be invalidated.

Disclaimer

In line with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. Although Beincrypto is committed to accurate and unbiased reporting, market conditions are subject to change without notice. Always carry out your research and consult with an expert before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.