Cardano prices are still rising 18% over the past week, but signs of fatigue are creeping up.

After peaking nearly $0.93, the ADA slipped to $0.86 at the time of writing, and is now balanced with vulnerable support. Under the surface, growing leverage, profitable signals, weak momentum will draw a warning picture for the next few days.

Liquidation Cluster $0.749 Signal Fault Risk

The sudden risk to Cardano prices lies in the increased concentration of long liquidation stacked just below the $0.749 mark. This $34 million cumulative zone represents traders who open bullish leverage bets in hopes of price rise. If the ADA slides further and violates that level, these positions will automatically be closed. The process known as liquidation involves a steep snowball.

About Token TA and Market Updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s daily crypto newsletter.

When traders borrow money (leverage) and prices move against them, liquidation occurs. The exchange forces these positions to close, preventing further losses and creating rapid sales pressure. For Cardano, the fact that so many longs are below $0.749 suggests that this level has become a fault line. If it breaks, the ADA could quickly fall to $0.728 or $0.687.

Under support, this large liquidation cluster is a red flag. Not only does traders reflect overconfidence, they also set the stage for automated sales in the event of a change in the market.

MVRV suggests that the holder is ready to sell

Cardano’s 30-day MVRV ratio (value realized from market value) tested positive on July 8th, and continues to climb. That is, the latest buyers are currently sitting in paper profits. MVRV compares the current price of an asset with the average price paid by the holder. When the ratio exceeds zero, it often indicates that traders can make a profit, especially in short time frames.

Currently, the 30-day MVRV ratio is 22.43%, one of the best since early May.

This coincides with an increased liquidation risk. If traders are already encouraging exits because they are already making profits, a drop near the $0.749 level can cause both manual sales and forced liquidation, creating a compound interest bearish effect.

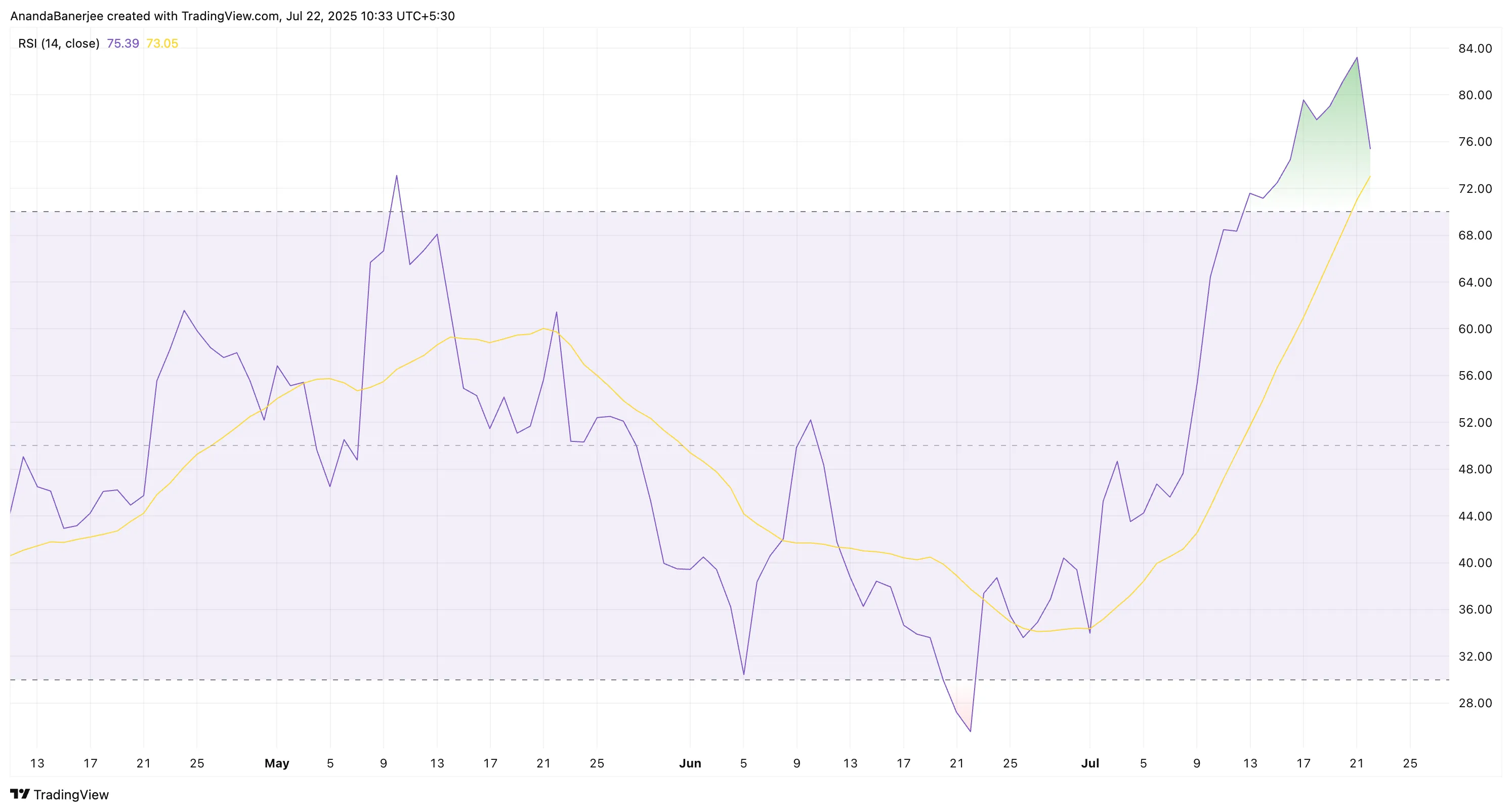

RSI indicates overheating

The momentum indicator also enhances the bearish setup. Cardano’s 14-day RSI recently touched on 82.6 and went deep into the area of overbuying, which curled down. Relative Strength Index (RSI) tracks how fast and strong prices have moved in recent sessions. Measurements above 70 suggest excessive ferociousness that often precedes the reversal.

Cardano Price Outlook: Can I keep $0.749?

Cardano Price is currently just above $0.86, but the pressure is on the rise. If the $0.86 support level (1 FIB expansion zone) is damaged, the price will be $0.84 and $0.81, exceeding the main horizontal resistance-turned support line. If you have seen the liquidation chart for a while now, pushing under the above-mentioned support level can start a long liquidation chain.

The next major support (previously resistance at 0.786 FIB) is $0.78, with a real cumulative liquidation threat looming. Despite the strong decent support levels of $0.77 and $0.75, if liquidation is stacked, compound interest sales pressure may not be able to stop.

The trend-based Fibonacci extension tool used here connects a minimum of $0.51 to the last swing high of $0.86 (support level now), then to retracement level 0.51. This tool will help you chart the next target of trending assets.

The $0.749 level (from previously shared liquidation charts) is more than just support. It is a heavily defended support backed by leveraged positions. If it breaks, liquidation pressure could push the ADA down to $0.72 or $0.68 (both FIB levels).

However, if Cardano’s price is broken above $0.93, this bearish paper is invalid. That level holds a clustered short position, with a breakout above that could reverse momentum in favour of the bull and retest the zone for perhaps $0.98.

Disclaimer

In line with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. Although Beincrypto is committed to accurate and unbiased reporting, market conditions are subject to change without notice. Always carry out your research and consult with an expert before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.