Ethereum Price is $3,677, up about 16.5% this week. I keep stomping over $3,800 just to be pushed back.

With a slightly drooping row of large stages hanging in the background, the obvious question is whether this door has finally opened or will it be closed again. Two important indicators help you understand what happens from here.

Exchange supply rate near low values

The exchange supply rate (ESR) is approximately 0.145, close to the lowest value of 0.142 this year. Raw exchange balances are used instead of ratios. This changes with staking, burn and unlocking, as it measures exchange holdings against the Circulating ETH total.

About Token TA and Market Updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s daily crypto newsletter.

A low ESR means that the exchange has only a small supply chunk and is ready to sell. That’s the setup I’m currently doing.

According to the charts, local ESR highs often came before Ethereum prices pulled in. Therefore, a low ESR level will create confidence.

If the ESR rises while the price slips, it usually means that a non-stacker or large owner is moving to exchange coins, and the dip can continue.

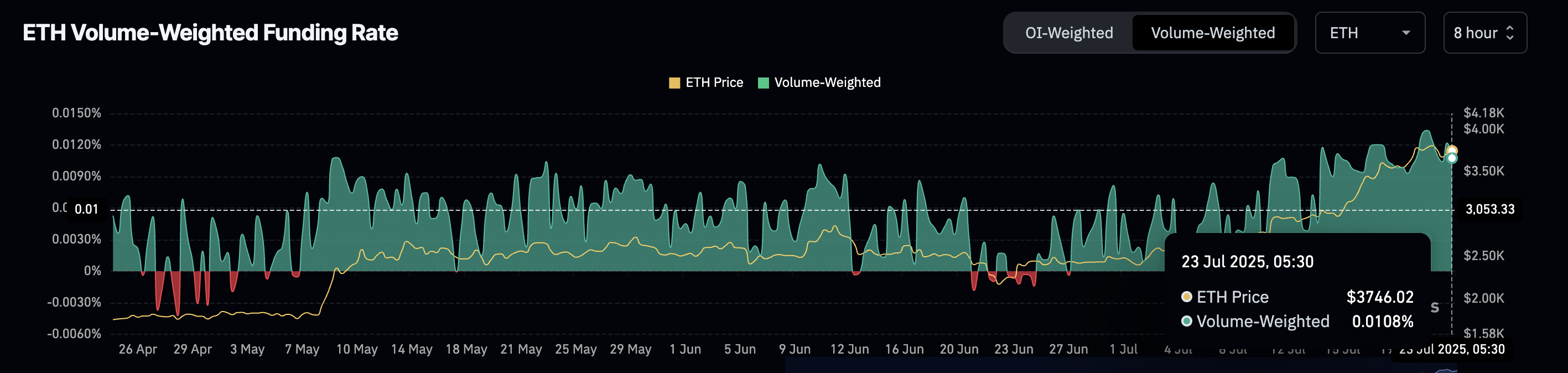

Funding and open interest

With open interest rates of around $55.9 billion, many futures jobs are open. The funding rate is close to 0.01%, but still positive, but lower than recent spikes (those above 0.02% can be a concern as it means high long leverage).

The current market structure means traders are leaning long (expected to increase prices), but they are not paying a heavy premium to stay there. It says that leverage exists rather than extreme. This is a healthy scenario, and ETH price gatherings look spot-driven.

Funds are the longing fees you pay each other to keep your permanent price close to the spot. Open interest is the total value of all open contracts.

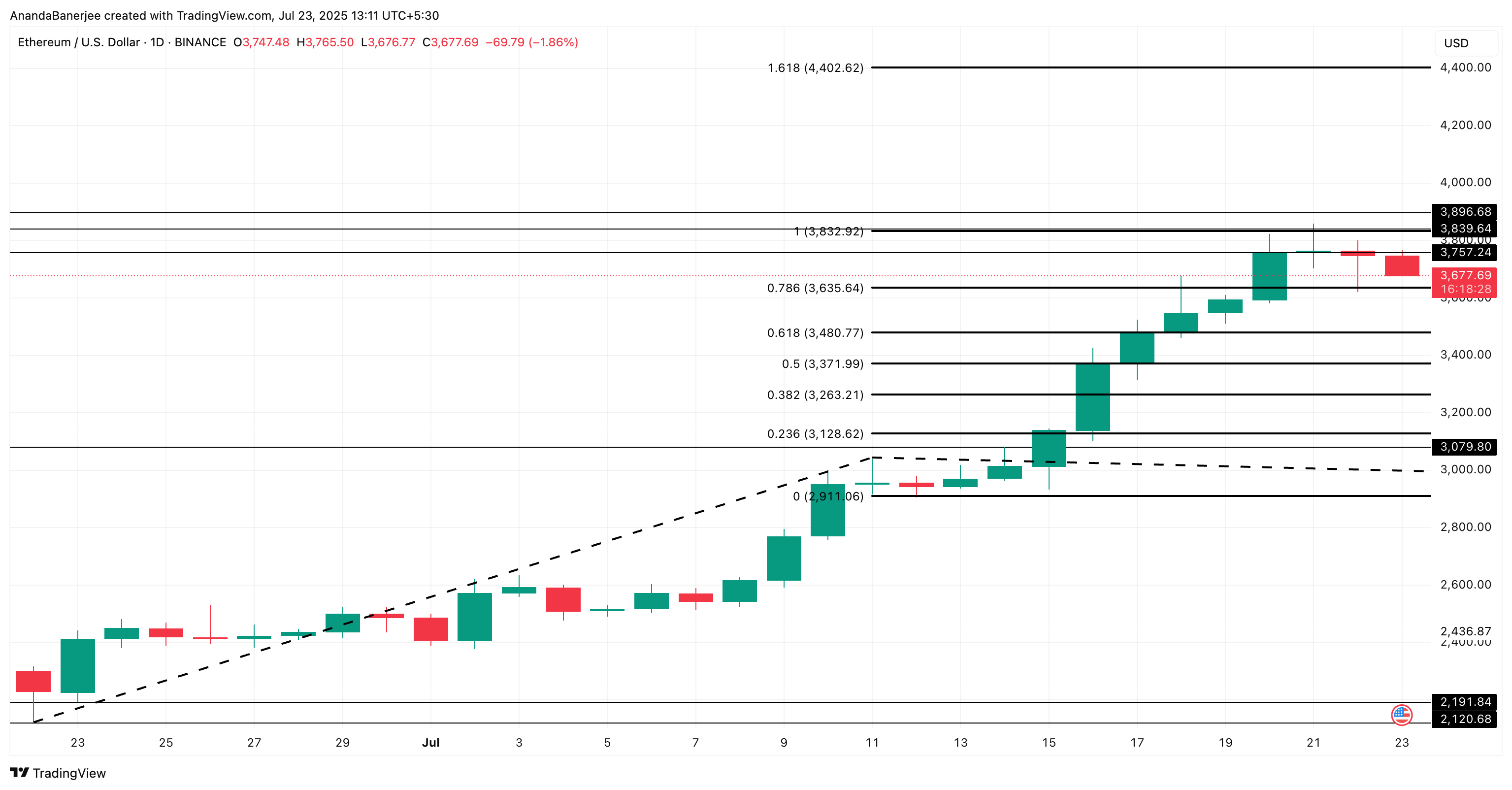

Ethereum (ETH) prices must win important levels

ETH is traded within two important ranges: $3,832 and $3,635 (0.786 FIB level). As the higher level (resistance) suggests, the actual block is just above the “$3,800 door.” But simply violating $3,832 in resistance like before may not be useful.

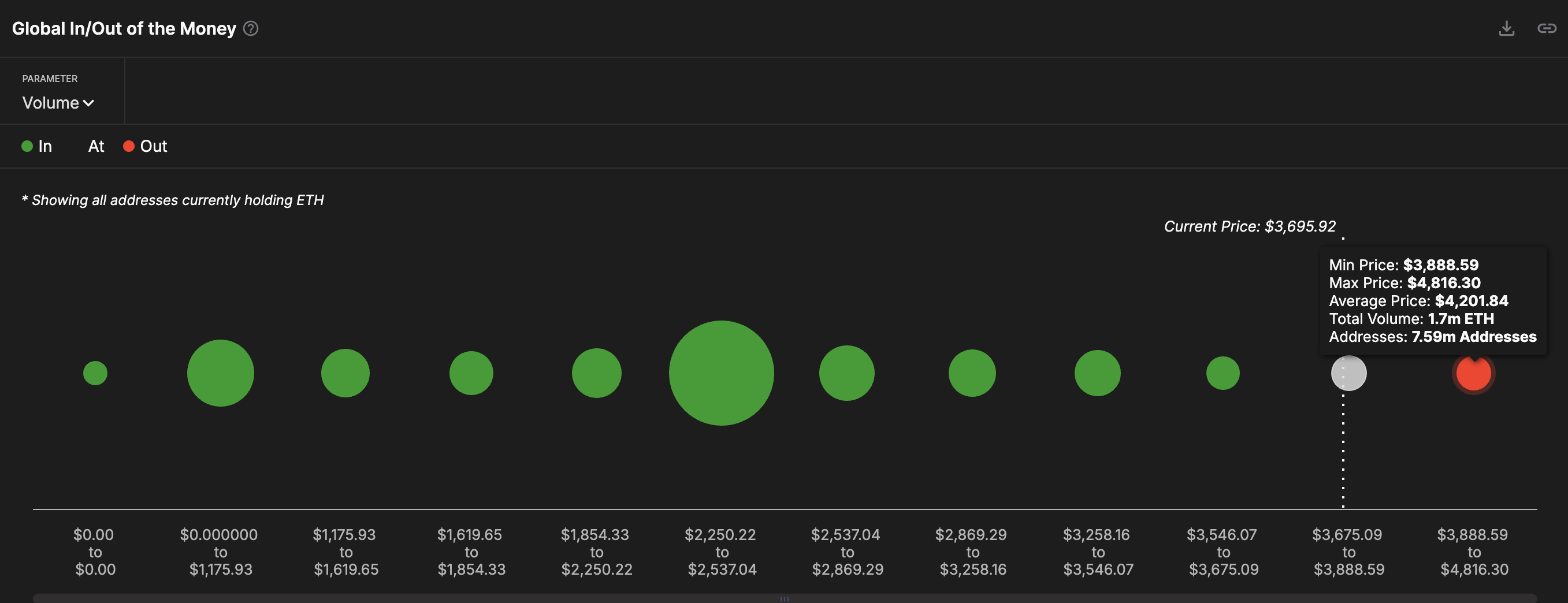

There are holder clusters over $3,888, which must also be violated. That cluster could explain why Quick is over $3,800 fade. Many wallets are broken there and are stretching their strength.

A day close over $3,896 opens the door to $4,402 (1.618 extension). If ETH is fixed again, $3,635 is initial support, then $3,480. Drops under these levels will quickly weaken bullish setups with increased ESR.

Fibonacci flags general reaction zones. The Money of Money Map shows where many wallets have purchased. These areas often validate the FIB level and act as actual resistance or support.

However, if ETH prices fall below the $3,128 or 0.238 FIB expansion levels, the entire short-term bullish hypothesis could be invalidated.

Disclaimer

In line with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. Although Beincrypto is committed to accurate and unbiased reporting, market conditions are subject to change without notice. Always carry out your research and consult with an expert before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.