Hedera (HBAR) has declined 10.5% over the past seven days, as technical and derivative indicators point to an increase in debilitating. Futures volumes have fallen below $100 million for the fifth consecutive day, indicating a sharp decline in speculative interest compared to the $1.3 billion peak in March.

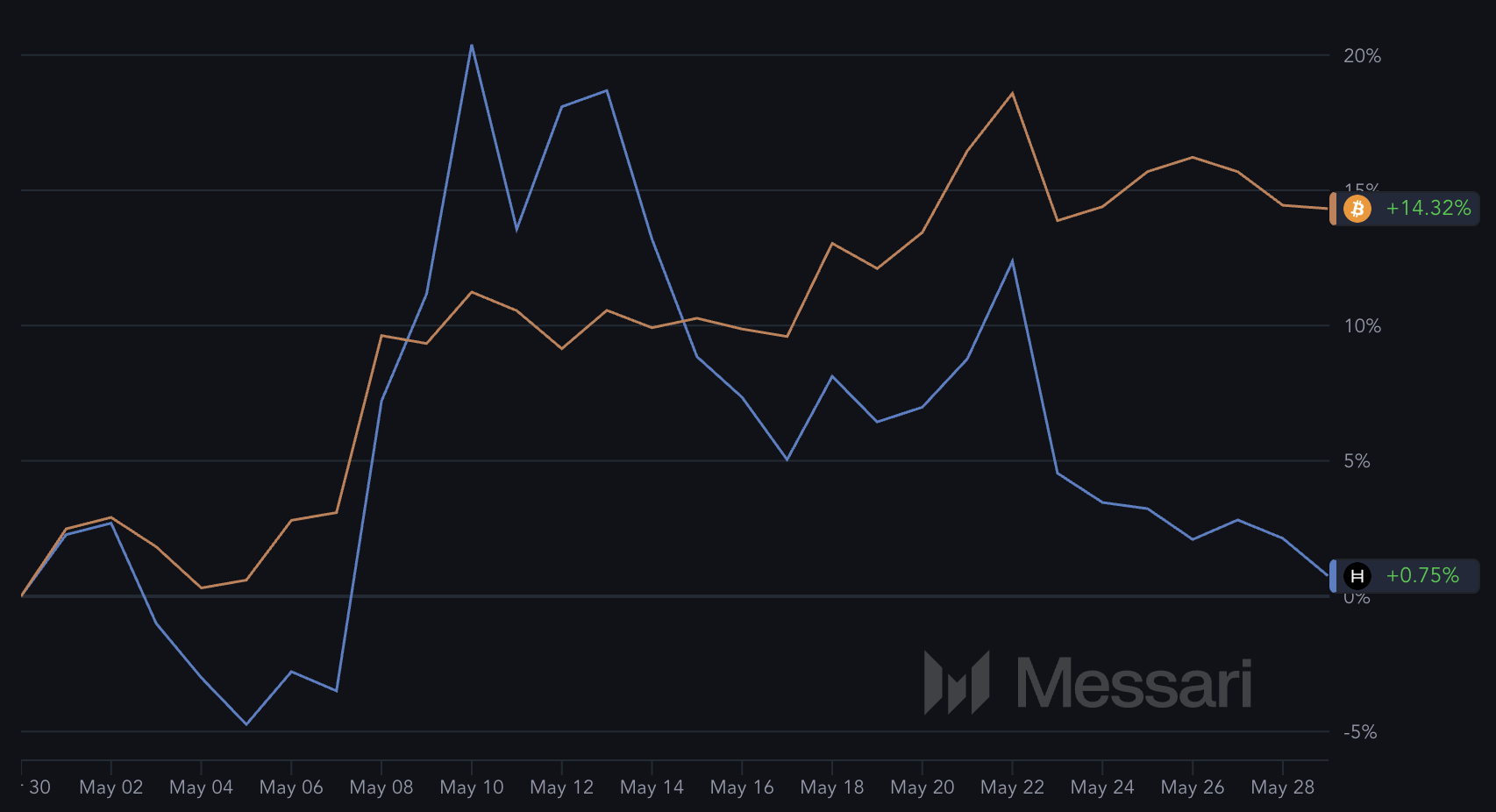

Despite historically closely tracking Bitcoin’s movements, HBAR has performed poorly at BTC’s recent rally, earning just 0.75% in the last 30 days. With the EMA line still bearish and approaching critical support at a price of $0.18, HBAR is facing critical tests that can define that direction towards June.

HBAR futures volume is below $100 million – what does that mean?

HBAR futures volume has fallen to $96.5 million, remaining below $100 million for the past five consecutive days, in contrast to the high levels seen earlier this year.

Back on March 1st, futures volume peaked at $1.3 billion, but since then both volume and open interest have been steadily declining.

HBAR futures allow traders to speculate about the future price of tokens, and their activities often reflect broader sentiment and risk appetite from both retail and institutional participants.

The recent drop points to Hedera’s careful attention to throttling speculative interest and deliberate attention in the short-term price direction, or lack of convictions.

With the 7-day EMA for HBAR futures at the lowest in three months, current price action suggests that it could be more and more driven by spot demand, rather than leveraged positioning.

This change in market structure could mean lower volatility and short-term, more organic price trends. However, without rebounding derivative activity, the upward movement may lack the momentum normally provided by aggressive speculative influx.

Hedera is behind the BTC rally. Can we catch up in June?

Historically, HBAR prices have a strong positive correlation with Bitcoin (BTC), often amplifying wider market movements.

However, the relationship appears to be weakening over the past 30 days. BTC is up 14.3%, while HBAR has only achieved 0.75% over the same period.

This difference suggests that HBAR has not yet responded to the recent bullish momentum of the crypto market, despite being typically a higher beta asset.

In previous cycles, HBAR often outperformed BTC during gatherings, but faced a sharp decline during broader market corrections, reflecting its sensitivity to changes in sentiment.

If Bitcoin reaches a new high in June, HBAR could be suitable for sharper movements upwards, as during past surges.

HBAR approaches $0.18 in support as the Bearish EMA setup lasts

Hbar’s EMA structure remains bearish, with the short-term exponential moving average still below the long-term average. This is a classic sign of ongoing momentum.

The token has been below the $0.20 mark for the last six days. This reflects the lack of sustained pressure and bullish follow-through.

This setup reinforces the careful sentiment surrounding HBAR, close to the main technical level.

Currently, HBAR is approaching critical support at $0.18, and if they lose this level, their first break since May 8th will fall below that threshold.

However, if the market changes in June and momentum improves, HBAR could surpass $0.20 to acquire areas that have not been touched since early March.

Disclaimer

In line with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. Although Beincrypto is committed to accurate and unbiased reporting, market conditions are subject to change without notice. Always carry out your research and consult with an expert before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.