The content on this page is accurate as of the date of posting. However, some of your partner offers may have expired. Check out our list of the best credit cards or use the CardMatch™ tool to find the one that suits your needs.

President Trump has campaigned on the implementation of tariffs. This is a policy that many believe will raise prices. Since his election in November 2024, Trump has continued to advance his tariff agenda. Most recently, in April, he announced a tariff plan that overturned the stock market and rekindled fears about a potential recession.

Creditcards.com surveyed 1,000 US adults in April to understand how spending habits have changed since Trump’s election and how fear of price increases affects financial decisions. This report follows surveys conducted in February and December.

Important findings:

37% of Americans, one in five Americans are destined to stock up items since November 2024, and an additional 14% plan to start stocking up soon was a massive purchase in November 2024, when large Americans made large purchases, fearing prices rise, but it is said that it is less likely that voters will say they will be said to be at least less than half of a atypyther voters than half of a bytypyther voters in April. Three out of 10 Americans are hoping they will enter or worsen credit card debt this year

Almost half of Americans are industrializing or starting stocks

Since November 2024, 37% of Americans say they have stockpiled items, and a 14% plan is planned soon. Stockpilings are more common among Kamala Harris voters (44%) than Trump voters (31%).

The most commonly stocked items include food (74%), personal care items (60%), toilet paper (48%), water (47%), and household items (43%). Others have medical supplies (39%), over-the-counter medications (26%), firearms or ammunition (13%).

Of those stockpiled, eight in 10 say fear of price increases played a role. It is a key role (51%) or a small role (28%). This concern is also more common among Harris voters (82%) than among Trump voters (72%).

“The fear of rising prices means that many people stock up all sorts of items, from toilet paper to electronics,” said John Egan, personal finance expert at CreditCards.com. “It makes sense to stockpile certain items to avoid tariffs, but you only buy what you actually need and what you actually use. Otherwise you could end up spending too much.”

Since November 2024, almost half of Americans have made large purchases

Almost half (48%) of Americans have purchased over $500 since November 2024, including 47% of Harris voters and 51% of Trump voters.

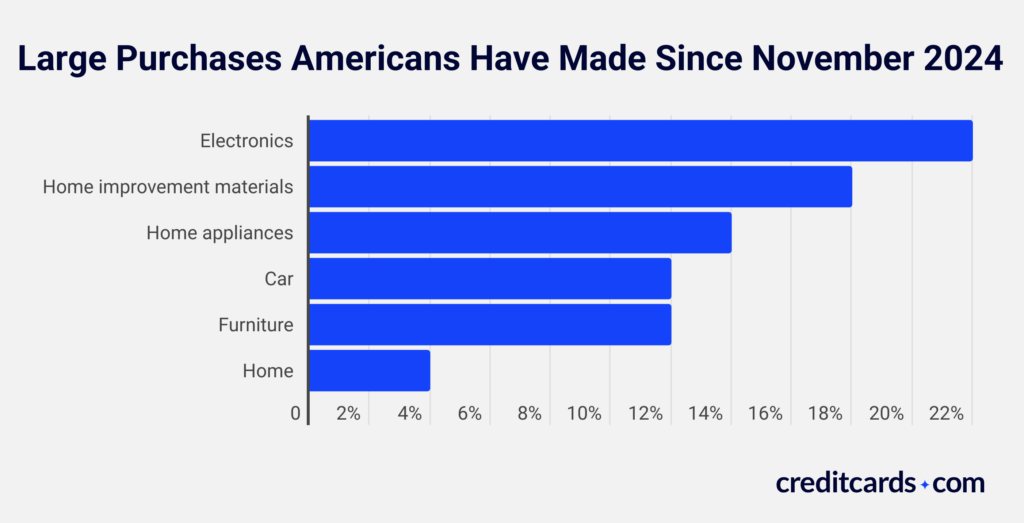

The most common purchases are electronics (22%) and home improvement materials (18%). Others report buying appliances (14%), cars (12%), furniture (12%), and houses (4%).

The fear of rising prices affected many purchases. 36% said they played a major role, while 22% said they played a small role. This factor was more common among Harris voters (67%) than among Trump voters (51%).

Spending habits will change in April, and many will exacerbate their credit card debt

In April 2025, more than half of Americans plan to adjust their spending. 15% plan to spend significantly more (4%) or slightly more (11%), while 41% plan to spend slightly less (22%) or significantly less (19%). Meanwhile, 45% expects spending to remain roughly the same.

Three in 10 (28%) Americans say they are likely to get into credit card debt or worsen this year.

One in five Americans destined

Some Americans are also engaged in “expenditures of destiny.” You are spending money dealing with anxiety, fear, or pessimism about the future. About 5% of Americans classify recent spending as fate spending without a doubt, with 13% and 19% unsure. This diagram is stable from what I found in a February 2025 report. Fateful spending is almost twice as common among Harris voters (26%) than among Trump voters (14%).

“Economic uncertainty often causes people to cut their spending. However, amid the threat of tariffs on US imports, some may stockpile, make large purchases, or engage in “fate spending,” Egan says. “Unfortunately, these actions can lead to accumulating credit card debt. Ideally, you should use cash to make purchases in these circumstances and ensure as much saving as possible.”

Methodology

Post-trade war consumer sentiment was conducted by YouGov using a nationally representative sample of 1,000 US adults interviewed online between April 11th and April 14th, 2025. The adjusted error in sample rate based on the overall sample is approximately 3.57%.

Editorial Disclaimer

The editorial content on this page is based solely on the objective evaluation of the author and is not driven by advertising dollars. It is not provided or entrusted by the credit card issuer. However, you may receive a reward if you click on a link to a partner’s product.