BBC

BBCThe Treasury has announced the sale of its final shares in NatWest Group. This means that banks will maintain full personal ownership, almost 20 years after being bailed out by taxpayers amid the 2008 financial crisis.

This marks the iconic ending of a dramatic chapter in British banking history.

It was early on Monday, October 13th, 2008, midnight. Prime Minister Alistardarling heads into the evening and leaves a team of officials surrounded by boxes of curry and pizza, confirming details of the largest private sector state intervention since World War II.

The next morning he announced the first installment of rescue, which costs taxpayers more than the entire defense budget.

The government has spent a total of £45 billion (£73 billion in today’s money) and bought an 84% stake in the Royal Bank of Scotland (RBS).

Luke MacGregor/PA Wire

Luke MacGregor/PA WireAt the time, RBS’s balance sheet (unpaid loans) was larger than the overall UK economy. That collapse would have devastated it.

The question is, why did it take the Ministry of Finance about 17 years to sell the last pile?

And how vulnerable is it today for decades after new risks emerged, including the threat of cyberattacks from hostile states? They were widely explained in 2008, so they were still “too big to fail” – and in the UK facing another financial crisis, should taxpayers intervene again to deliver relief?

“It was never about saving the bank.”

Rick Haythornthwaite, current chairman of Natwest Group, told the BBC that the bank and its employees continue to thank them for its intervention in 2008.

“The main message to taxpayers is one of the deep gratitude,” he says. “They rescued this bank. They protected millions of businesses, homeowners and savers.”

There have been many changes since 2008. Unpaid loans have lost £1.5 trillion, with tens of thousands of employees cutting job openings.

The amount spent by the government appears to be a poor investment, but as Baroness Shriti Vadera, former senior government adviser and chairman of Prudential, as the BBC told the BRITISH CHAIR, this was not an investment, but a rescue.

“Nationalizing RBS was hardly a voluntary investment,” she says. “The key then was to assess the impact of RBS and other banks on the economy as a whole, particularly their ability to maintain function.

“It was never about saving the banks, it was about saving the economy from the banks.”

The outcome of the bank’s collapse would have been serious. Prime Minister Gordon Brown also spoke about putting soldiers on the streets.

In the book by Ex-Labour Spin doctor Damian McBride, Brown states:

“If you can’t buy food, gasoline or medicine for your kids, people will start breaking windows and helping themselves.”

Dangerous and bad mortgages

Of course, RBS wasn’t just a bank that faced collapse. The bad loan tsunami was caused by earthquakes in the US mortgage market. Risky loans to borrowers with low credit ratings were packaged and sold to banks around the world.

By 2007, they had no idea exactly where these rena bullets were hidden on the bank’s balance sheet.

Northern Rock relied on borrowing funds to fund its own dangerous mortgages, and in 2007 the BBC reported that it had sought assistance from the Bank of England. This encouraged “running in banks” and was eventually fully nationalized in February 2008.

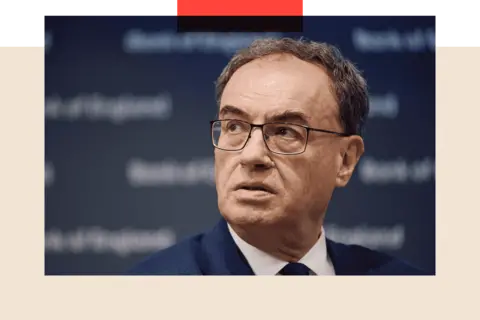

Bank of England Governor Andrew Bailey worked as the bank’s main cashier for these disturbing months. He says that if the state had not nationalized RBS, the costs would have been “immeasurable.”

“We were talking about the collapse of the banking system because we knew it at the time, so it would have been huge,” Bailey said.

Benjamin Kremel/PA Wire

Benjamin Kremel/PA WireUS banks were also suffering from deep pain. In March 2008, the Bear Stears were absorbed by Wall Street rival JP Morgan. That September, US mortgage giants Fannie Mae and Freddie Mac were nationalized. Here in the UK, HBOS was absorbed by Lloyds, and of course the Lehman brothers failed. It violated the expectations that the US government would intervene to save it.

But for the UK economy, RBS was a big deal. The UK had a large banking sector compared to the size of its economy. And within that mix, RBS was a particularly important bank.

Once calm, RB has become, to some extent, the largest bank in the world. In 2000, I bought Natwest and just a year before the crash, I bought the Dutch bank Abn Amro.

That backer boss, Fred Goodwin, was knighted for his services to banking. But Goodwin has become a lightning bolt of public outrage over the risks taken by the banks and the bonuses collected by executives.

He left a pension of £700,000 a year, but was later stripped of his knights.

Reuters

ReutersFollowing the rescue, thousands of businesses complained that RB, a banker appointed to help them out of the crisis, had driven them to the wall, pushing them into bankruptcy and selling their businesses at knockdown prices.

RBS was the child of the posters of bank recklessness, hub arrogance, greed and cruelty.

So why did it take so long for the government to sell out from RBS? With a loss of £1 billion?

Is it wrong to hold it for a long time?

At the same time, the government acquired shares in RBS and also acquired shares in Lloyds. However, it was sold in May 2017 and brought profits of £900 million.

RBS was far more complicated than Lloyds because it had a large US business that was subject to a long investigation by the US Department of Justice. The prospect of a heavy fine has been on banks for years and proved well discovered in 2018 when he was fined $4.9 billion (£3.6 billion) for his role in the US mortgage crisis.

RBS was also an investment that was rather unattractive. It announced a loss of £24 billion in 2008. This is the biggest loss in the history of the UK business. We added losses every year until 2017.

These concerns have led to a decline in stocks, and the government has been reluctant to sell the stock at a low price, as it crystallizes politically unpleasant losses for taxpayers.

Reuters

ReutersAfter all, following 2010, austerity was the name of the game, and then Prime Minister George Osborne was never seen to cause losses by selling RBS stocks when they were cutting back elsewhere.

But many think it’s a mistake because it extended the dislike of private shareholders to buy shares in government-owned companies, like chicken and eggs.

As Baroness Vadera states, “I don’t know if it needs to take 17 years from the stock.”

It’s unlikely to collapse — but it’s not impossible.”

Haythornthwaite, who took on the role of chairman of Natwest Group last April, explains the sale of the final shares, a “symbolic” moment for banks, its employees and investors, but also on a wider scale.

“I hope it’s a symbolic moment for our country (so much),” he says. “We can put this behind us, which allows us to really look to the future.”

But how exactly does that future look? And have you really learned lessons from the past?

Andrew Bailey certainly thinks that. He says it’s unlikely that taxpayers will have to step in if the bank collapses now.

Now there are alternative ways to rescue failed banks, he says.

“The big difference is that we think we can handle the (bank crisis) without using public funds,” Bailey says. “The important thing is that they have to maintain the continuity of their activities because it is important to the economy.

“When we say we’ve resolved it as ‘too big to fail,’ I think what we mean is, to be precise, we don’t need public money. ”

It is true that the Bank of England is currently testing the banks far more rigorously to see how they deal with pressures like housing prices collapse, unemployment, or ramp-stretched inflation.

Sir Philippe Augal, a veteran of the city of London and author of several books on banking, agrees that British banks are in a more resilient position than in 2008.

“What has happened to improve things since then is that the amount of leverage in the system has come down very quickly and the capital cushion (…) that banks have to hold is significantly increased. So it’s less likely that banks will collapse, but not impossible.”

Cyber risk never disappears

There are also new risks to consider today.

Get hit with a series of cyberattacks that have recently hit popularly named systems like Marks, Spencer, Co-Op, Harrods. If the attack takes away important banking functions like business lending, company pay, and ATMs, it would be far more damaging.

Certainly, what he calls the “league table” of financial risk, and Andrew Bailey identifies the threat of cyberattacks as a rapidly growing threat.

“Of course you need to mitigate that, but (cyber) is a risk that never goes away because it constantly evolves,” he says.

“We deal with bad actors who continually improve the line of attack, and I have to always say to the institution, ‘You have to keep working on this.’ ”

The recent collapse of US banks, such as Signature Bank and Silicon Valley Bank, underscores another major risk. Customers don’t need to queue around the block to pay. Run in seconds with key strokes on your laptop or mobile.

Banks are built on trust. Customers believe they can put their money in and put it back whenever they want. And the good old banking journey is now a modern digital banking run.

However, banks still don’t look like normal businesses. They are not independent entities, but interconnected and together form the bloodstream of the economy.

They are arteries where credits are extended, wages are paid, and savings are hidden or withdrawn. And when those arteries are blocked, bad things happen.

That’s true today, just like in 2008.

BBC Indepth is the home of websites and apps for the best analytics, with a fresh perspective that challenges assumptions and deep reporting on the biggest issues of the day. We will also introduce thought-provoking content for BBC Sound and iPlayer as a whole. You can send feedback on the details section by clicking the button below.