Bitcoin recently reached its best newest (ATH) ever, but encountered a short pullback as the market heated up.

However, due to the resilience of the ETF market, Bitcoin has largely returned to normal. A significant influx of ETFs allowed Bitcoin prices to quickly push past previous ATH.

Bitcoin is ready to bounce

Following a similar spike in June, the transaction (NVT) ratio skyrocketed earlier this month. The NVT ratio measures the relationship between network values and transaction activity.

The rise in the NVT ratio suggests that the network value exceeded transaction activity. This is generally a sign of overheating in the market. This tends to cause a reversal.

The same was clear with Bitcoin’s recent dip as the market cooled down. Nevertheless, the NVT ratio is now returning to monthly lows, providing Bitcoin with room for potential gatherings.

About Token TA and Market Updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s daily crypto newsletter.

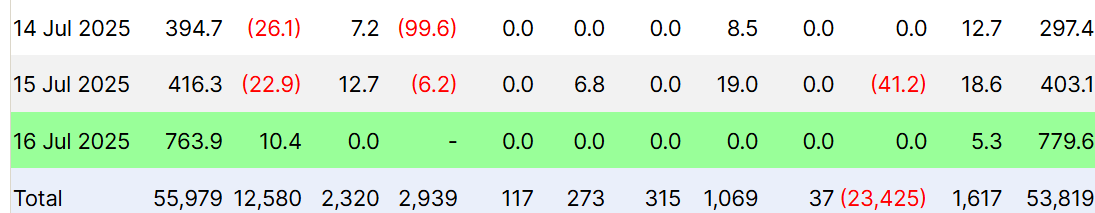

This week, Spot Bitcoin Exchange-Traded Funds (ETFs) saw an influx of over $1.5 billion. The institution’s money inflows emphasizes that investors are confident in the potential of Bitcoin despite market cooling.

These ETF inflows demonstrate resilience among institutional investors who continue to add Bitcoin to their portfolios rather than sales. If this trend continues, institutional support provides stability, allowing Bitcoin prices to be driven upwards.

BTC prices are from the highest ever to inch

Bitcoin is currently trading at $118,325 and faces resistance at the $120,000 level. This resistance is important for Bitcoin if you want to go back to the $123,218 ATH. A 4.1% gap reaches ATH indicates growth potential, but Bitcoin needs to secure support of over $120,000 to make this happen.

If Bitcoin can push beyond $120,000 and above $122,000, it can rise to a new all-time high. Current market conditions and ETF inflows support bullish outlook and have a considerable opportunity to break resistance.

However, the risk of making profits remains, which could lead to a price drop. If Bitcoin faces sales pressure, it could erase some of its recent profits and return to $115,000. This will invalidate bullish papers and retest Bitcoin for lower support levels.

Disclaimer

In line with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. Although Beincrypto is committed to accurate and unbiased reporting, market conditions are subject to change without notice. Always carry out your research and consult with an expert before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.