Bitcoin (BTC) has fallen 6% in the last eight days since reaching its new all-time high, with recent technological signals suggesting increased market uncertainty. The temporarily declined whales’ activity begins to recover, suggesting that some large-scale holders may be returning to accumulation.

However, bearish indicators are mounted, with one-sided clouds showing weakness and BTC trading below the main support level. Price is just above $104,584, leaving another death threat and deeper flaws as long as the Bulls can’t regain momentum over resistance.

Bitcoin Zilla counts rebound after strong decline

The number of Bitcoin Zillas holding 1,000-10,000 btc rebounded to just 2,006 after falling to 2,002 earlier this week.

The short dip marked a noticeable short-term cut in large holders following a sharper decline from 2,021 on May 25th. However, the recovery suggests that some whales may be returning to accumulation.

Although the fluctuations were small, such changes are closely monitored as they often precede changes in market sentiment and price behavior.

Monitoring whale behavior is essential as it has a major impact on Bitcoin’s liquidity and volatility. A decrease in the number of whales indicates profit gains or distribution, often inducing attention or potential market cooldowns.

Conversely, as is currently observed, stabilization and rise can facilitate investor concerns and support high levels of price resilience.

The number of large holders recovering after a sharp drop could boost confidence among key players, reduce the risk of sales pressure significantly, and help Bitcoin maintain its current range.

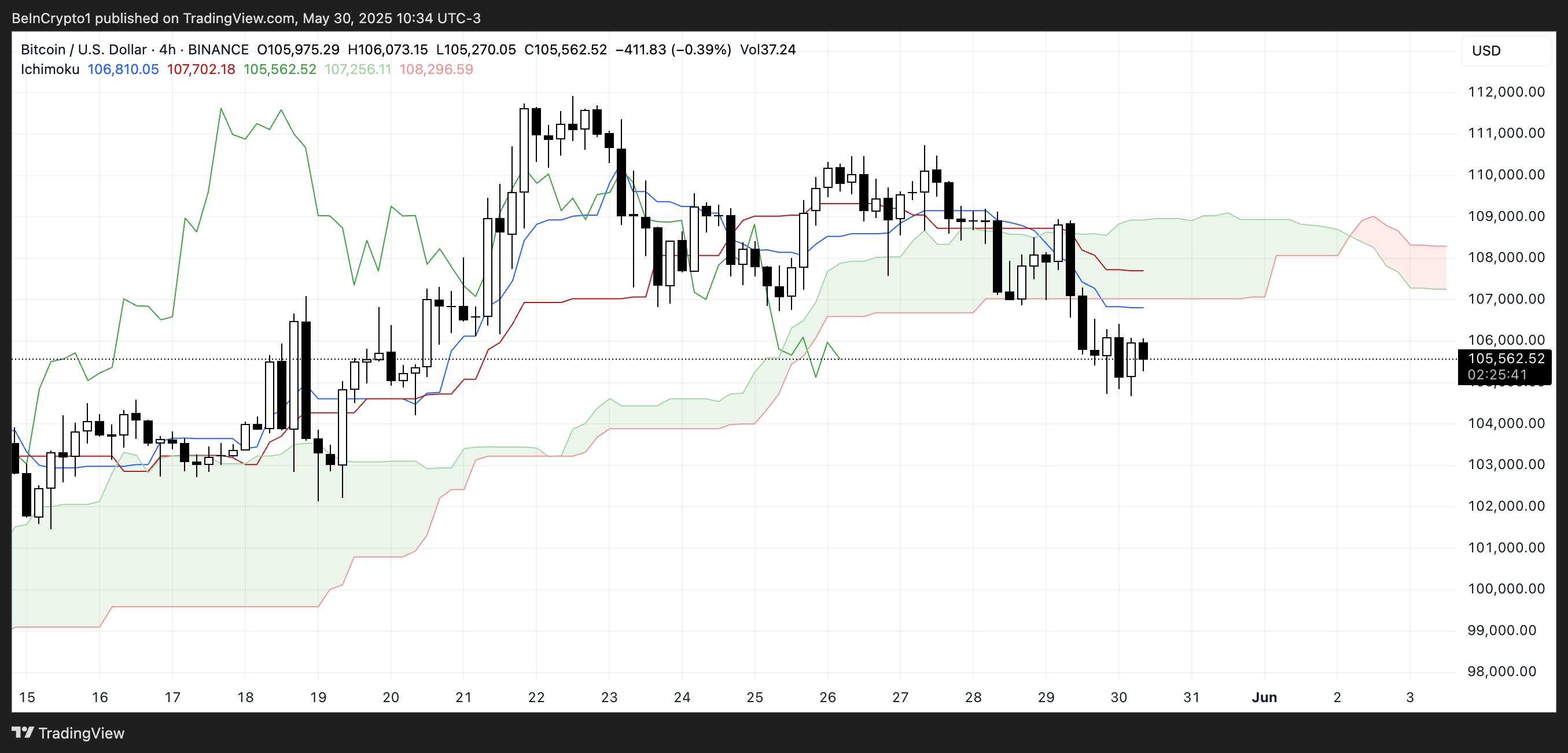

As BTC struggles below critical levels, technical indicators become bearish

One-sided cloud charts for Bitcoin show a short-term bearish structure.

Price Action is currently located under the green and red-covered spider (cloud). Bitcoin shows that it is trading in a zone of weakness compared to historic and projected momentum.

The cloud of this is red, suggesting that it will remain bearish unless the bias in trends in the near future breaks the cap.

The Tenkan-Sen (blue line) is located under the Kijun-Sen (Red Line) to confirm the short-term downward momentum. Both lines are angled downwards, another bear signal.

The Chikou span (green lag line) is below both price and cloud, reinforcing the lack of bullish confirmations on current momentum.

The future cloud will also be narrower. This could suggest a potential equilibrium or integrated zone. For now, the one-sided component is tailored to the bearish outlook. In a bullish shift, you need a price to break above the clouds and turn future spiders from red to green.

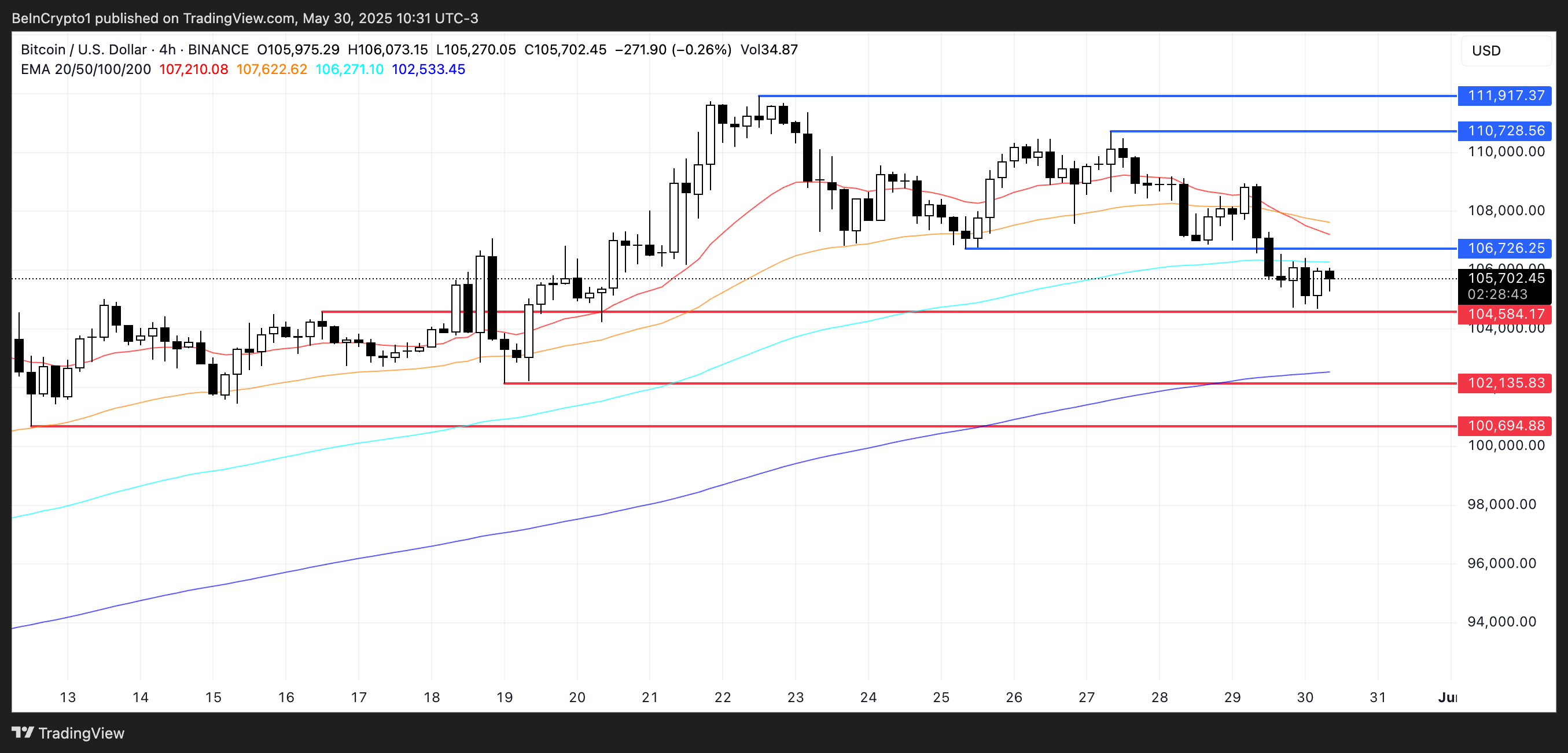

Bitcoin faces potential death

Bitcoin prices have recently formed a death cross, with technical indicators suggesting that another indicator may be on the horizon. The price is currently at $104,584, slightly outweighing key support. It serves as a short-term floor.

If this support fails, the next downside target is $102,135, potentially as low as $100,694 if sales pressure is increased.

The presence of back-to-back death crosses, coupled with weakening of price actions near these levels, increases the chances of deeper corrections in the short term.

On the bullish side, if Bitcoin can take the recovery and establish strong momentum, it could retry resistance at $106,726.

A break above this level could cause sharper movements towards $110,728, and if the rally accelerates, it’s even more likely to reach another $112,000.

Disclaimer

In line with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. Although Beincrypto is committed to accurate and unbiased reporting, market conditions are subject to change without notice. Always carry out your research and consult with an expert before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.