Bitcoin (BTC) has grown 3.6% in the last 24 hours, breaking above $100,000 for the first time since February 3rd. This surge rekindled bullish momentum across the market and pushed institutional interest back into the spotlight.

From the influx of ETFs to the holdings of large corporations, traditional finances are now driving the narrative around Bitcoin’s next move. As BTC’s eyes turn anew, analysts are seeing the potential changes in key technology levels and control over Altcoins.

Facilities lead when they are awake with the eyes of Bitcoin

Bitcoin rallies over $100,000 have been widely discussed on the next market framework and fuel fueling for years.

According to encrypted CEO Ki Young Ju, traditional Bitcoin cycle theory is outdated as institutional players and ETF influx reconstructs ecosystems.

Companies like Strategy have more than $53.9 billion in BTC and Spot ETFs, bringing billions to net inflows, and in the chain Analyst is adapting to a new regime led by Tradfi liquidity.

Meanwhile, mixed sentiment and growing interest in futures in options markets reflect mature assets increasingly driven by macro power and capital flows.

At the same time, momentum is shifting towards the altcoin. Raul Pal suggests that Bitcoin’s dominance peaks, causing the “banana zone,” a stage of growth for the parabolic altcoin. Coinmarketcap’s Altcoin Season Index has moved out of the “Bitcoin Season” territory for the first time in months and is currently sitting at 41.

Institutional participation remains strong as BlackRock and Fidelity ETFs continue to absorb capital.

Standard Chartered doubled the bullish outlook, fostering plans for a strategy to raise ETF demand, sovereign fund adoption, and $84 billion, boosting plans for a strategy to boost Bitcoin stocks to more than 6% of total supply, predicting the highest ever BTC for the quarter.

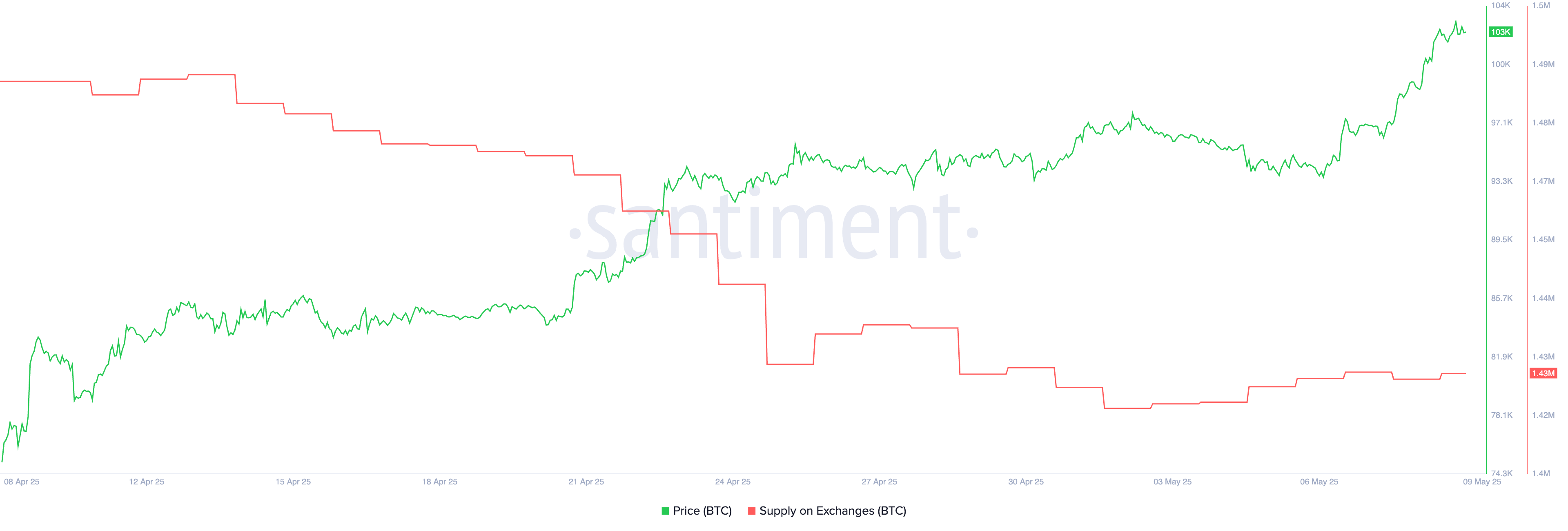

When bullish trends are maintained, BTC exchange supply stabilizes after a sudden drop

Betcoin supply on the exchange showed a sharp and consistent decline between April 13th and April 25th, down from 1.49 million to 1.43 million BTC. In just 12 days, this 60,000 BTC drop reflects one of the most important outflows seen in recent weeks, suggesting strong accumulation behavior across the market.

A decrease in the supply of Bitcoin in exchange is generally considered a bullish signal. That means investors are moving BTC to cold storage or long-term holdings, reducing the amount available for immediate sales. Conversely, an increase in exchange supply can indicate an increase in sales pressure as more BTC becomes available for potential liquidation.

Since the sudden drop, the supply of BTC for exchanges has been stable at around 1.43 million cases. This integration suggests that investors are currently holding their positions, rather than preparing for sales.

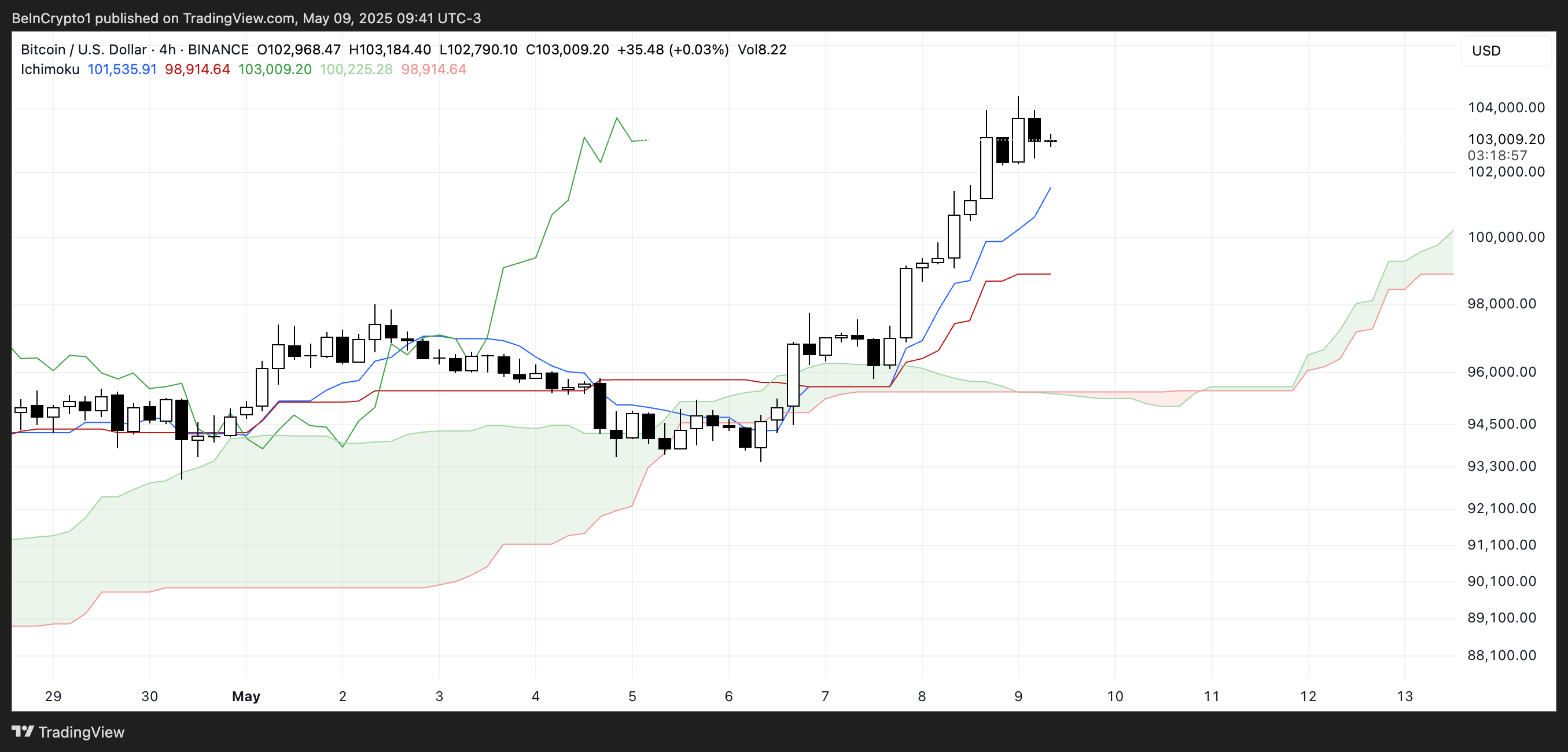

The one-sided cloud for BTC shows strong bullish momentum. Prices are well above the green clouds (spiders), indicating a clear uptrend.

The Tenkan-Sen (blue line) and Kijun-Sen (Red Line) Slope face upwards, and Tenkan-Sen is located above the Kijun-Sen, another confirmation of strength.

The main span A (top of the green cloud) is above the leading span B (bottom of the cloud), with the forward cloud rising thickly, suggesting strong support levels and continuous trend intensity.

The delayed span (green lines) are placed above the clouds to further support the bullish outlook. The bias remains strong and bullish, as long as the prices do not close under the blue Tenkansen or the clouds fade or red.

Bitcoin uptrend remains the same, but you need to keep $99,000 in support

Bitcoin’s EMA line is currently showing strong bullish momentum, with the short-term average positioned rather than the long-term one. If this upward trend holds, Bitcoin’s price could soon challenge resistance to $106,296.

A successful breakout beyond that level could trigger a move heading towards $109,312, potentially opening the door for the $110,000 historic test for the first time.

However, if Bitcoin loses steam, the important level to look at is $99,472 support.

The drop below could change feelings and push the price down to $94,118 for the next major support.

Disclaimer

In line with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. Although Beincrypto is committed to accurate and unbiased reporting, market conditions are subject to change without notice. Always carry out your research and consult with an expert before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.