Bitcoin (BTC) has shown weakness, sliding into the $115,000 range, further pulling it away from recent highs.

Amidst the intense sales pressure associated with Galaxy Digital, several days of offloading powered by one of the largest known BTC whale wallets.

Doormant Bitcoin giants mix when digital pressure in the galaxy peaks

Blockchain Analytics Tool LookonChain has announced that Galaxy Digital will value the 2,850 BTC at $330 million and will be replaced early on Friday. The transaction was added to more than 12,800 btc ($1.5 billion) and moved to the exchange within 24 hours.

“It appears that Galaxy Digital has already dumped 10,000 BTC ($11.8 billion)! It has withdrawn its $370 million USDT in the last three hours,” Lookonchain previously reported.

The bitcoin sold comes from the address of the legendary whale holding 80,009 btc, worth around $9.6 billion before its sale.

This address began moving coins to Galaxy Digital on July 15th. According to multiple posts from LookonChain, the full transfer was completed by July 18th. Over 40,000 BTC travelled in just one day, sparking market concerns.

“It appears that Bitcoin OG with 80,009 BTC is selling BTC. In the past hour, we have transferred 9,000 BTC (1.06B) to Galaxy Digital.

Sales pressure has been heavily heavy on the short-term price of Bitcoin, but some traders believe the worst could end.

In addition to market uncertainty, several long-term Bitcoin wallets suddenly became active in July, sparking speculation that more sales could continue. Three wallets, perhaps tied to a single entity, moved 10,606 BTC worth $1.26 billion this week, according to the Blockchain Analytics platform SpotonChain.

All wallets received their BTC on December 13th, 2020. Bitcoin was on sale for $18,803. At today’s prices, these Bitcoin tokens recorded a gain of 6.3 times.

Doormant Bitcoin wallets wake up in large numbers in July

LookonChain also identified the wallets of whales that have been dormant for 14. This week, we transferred 3,962 btcs ($468 million) to our new address.

The same wallet received Bitcoin at $0.37 per coin in January 2011, making it one of the oldest addresses to re-activate in memory recently.

At the beginning of July, another wallet moved 6,000 btc ($649 million) after six years of quiet. All three cases include long-term holders moving to a new wallet or replacement.

X (Twitter) community members are attracting attention. Some speculate that these atoshi-era bitcoin holders may be preparing to leave between their next bullish legs.

“There have been a lot of old Bitcoin transfers recently,” one user posted. “Are they ready to sell out during the next bull run?” I wrote one user.

Combined with Galaxy Digital’s recent liquidation activity, these aging wallets remeasures suggest a changing and dynamic in the crypto market. Older supplies are increasingly being relocated ahead of expected volatility.

While the foundations of Bitcoin remain strong, the trend in whale movement coins in July has injected new uncertainty into the short-term outlook. Currently, traders are monitoring volatility to ensure sales are taking place, and investors are hoping that a fresh influx will allow BTC to return to its new high.

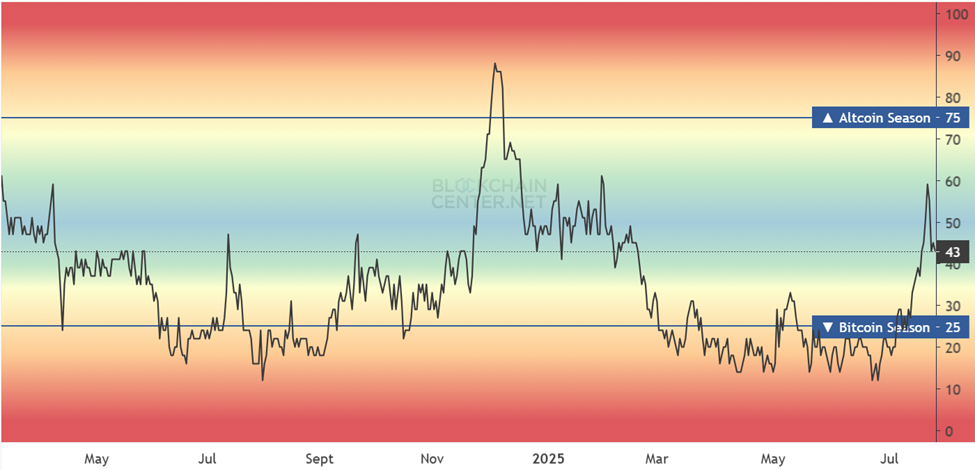

Meanwhile, as a bitcoin jelly spook market, Altcoin Traders informs the capital turnover that could catalyze AltSeason.

This expectation will coincide with a sharp decline in Bitcoin’s advantage. The index fell from 64% to 60% between July 17th and July 21st.

The index attempted a modest recovery on Friday, but at the time of this writing there was 61.55% reads.

The dominance indicator of the decline suggests that investors are spinning from Bitcoin to altcoin. This trend is one of the earliest signs of the emerging altcoin season.

The 43 Altcoin Season Index indicates that the crypto industry is not in AltSeason yet. However, the rising trajectory further supports changing market momentum.

Disclaimer

In compliance with Trust Project guidelines, Beincrypto is committed to reporting without bias and transparent. This news article is intended to provide accurate and timely information. However, we recommend that readers independently verify the facts and consult with experts before making decisions based on this content. Please note that our terms and conditions, privacy policy and disclaimer have been updated.