What is said to be the biggest daily movement of a coin in more than a decade in Bitcoin history, a long-term whale wallet moved 80,000 BTC on Friday.

This historic transaction marks the biggest move of an old coin in eight years. It has caused a ripple of the crypto market and rekindled concerns about sales pressure from long-term holders.

The Bitcoin market was shocked as early miners moved $8.6 billion in BTC

The long-term BTC whales, believed to be early miners, shook the crypto market on Friday. The entity moved 80,000 BTC (approximately $8.6 billion).

According to Arkham Intelligence, the coin, which had not been touched for over 14 years, began moving early Friday mornings and was sent entirely to the new address by 3:00 PM UTC. This is called one of the biggest daytime moves of coins 10 years ago in BTC history.

The entity manages 161,326 BTC and is currently worth more than $17.4 billion. As 80,000 BTC moves, 120,326 BTC has not yet been touched by the whale’s wallet.

A $110,000 liquidity signal could be rebound

Such long coin movements are generally considered bearish signals. The transfer caused a wave of sales across the BTC market, bringing Kingcoin to shut down its $107,000 price region on Friday.

When trying to recover from the bearish effects, the coin traded at $108,196, reducing the modest 1% over the past 24 hours.

However, despite short-term bearish pressures, on-chain data suggests that bullish strength remains intact. According to Coinglass, the BTC’s liquidation heatmap shows a dense liquidity cluster around the price mark of $110,567.

A clearing heatmap is a tool for identifying price levels where large clusters of leveraged locations are likely to be cleared. These maps highlight areas of high fluidity. Often there are bright zones that are color coded to indicate intensity and represent greater liquidation possibilities.

These liquidity zones act like magnets for price action as the market moves naturally towards them, triggers stop orders and opens new positions.

For BTC, the liquidity cluster around the $110,567 level shows the interest of traders in buying or covering short positions at that price. This setup could drive short-term gatherings if bullish momentum overpowers the sell-side pressure in the BTC spot market.

Futures traders remain resilient

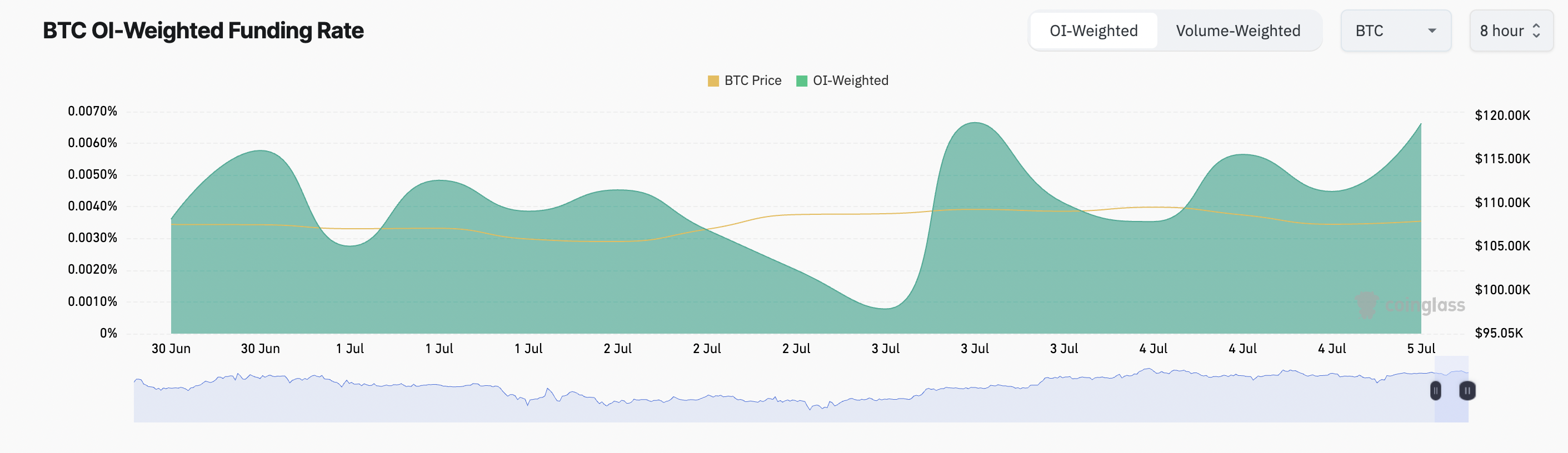

BTC’s funding rate remains positive despite recent whale activity. At the time of reporting, it was 0.006%, indicating that futures traders are still bullish and are still in their long positions with key coins.

Funding rates are periodic payments exchanged between traders in permanent futures markets designed to keep contract prices in line with the spot market. When the funding rate is positive, traders who hold long positions pay for those who hold short positions and show bullish feelings in the market.

Conversely, negative funding rates mean that shorter positions are paying longer distances.

In the case of BTC, even after a long-term, large-scale move of coins, a stable positive funding rate indicates that traders are confident in the long-term strength of their assets.

After the whale’s movement, the BTC holds the ground. Is $110,000 the next goal?

The awakening of dormant markets has scared some traders and encouraged sales, but the above metrics still show that the BTC market is absorbing bearish pressure from the supply spike without a complete emotional change. There was no complete emotional change as many traders still positioned for further gains.

If this bullish emotion is held, the coin could regain strength and gather towards $109,267. A break above this level could drive speeds towards $110,442.

However, if Selloff is a spike, the Bitcoin price could slip to $106,259. If there is a stronger bearish momentum, the price could drop to another $103,952.

Disclaimer

In line with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. Although Beincrypto is committed to accurate and unbiased reporting, market conditions are subject to change without notice. Always carry out your research and consult with an expert before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.