Bitcoin has surged to a new all-time high (ATH) over the last 24 hours, nearly breaking the $112,000 barrier.

The rise follows a positive trend from the beginning of the month, strengthened by whales that have maintained their position despite substantial sales activities from other investors groups.

Bitcoin holders sell and whales hold

Current market sentiment reveals that various cohorts of Bitcoin holders are in distribution mode. Retailers, especially those with 1-10 BTC, are selling, contributing to increased supply in the market. This behavior promoted price volatility.

The notable exception is entities that carry between 1,000 and 10,000 BTC. These whales are in accumulation mode, which is a behavior in contrast to the broader sales trends. Their approach is systematic and non-emotional, ensuring the stability of Bitcoin prices despite retailer sales.

Whales have long been a stabilizing force in the Bitcoin market. Unlike small holders who respond to short-term fluctuations, large Bitcoin holders usually follow a strategic, long-term outlook.

Their resilience was important in supporting the value of Bitcoin, especially during times when retailers were driving price drops. As a result, whales prevented a significant drop in prices and provided a stable basis for the recent surge.

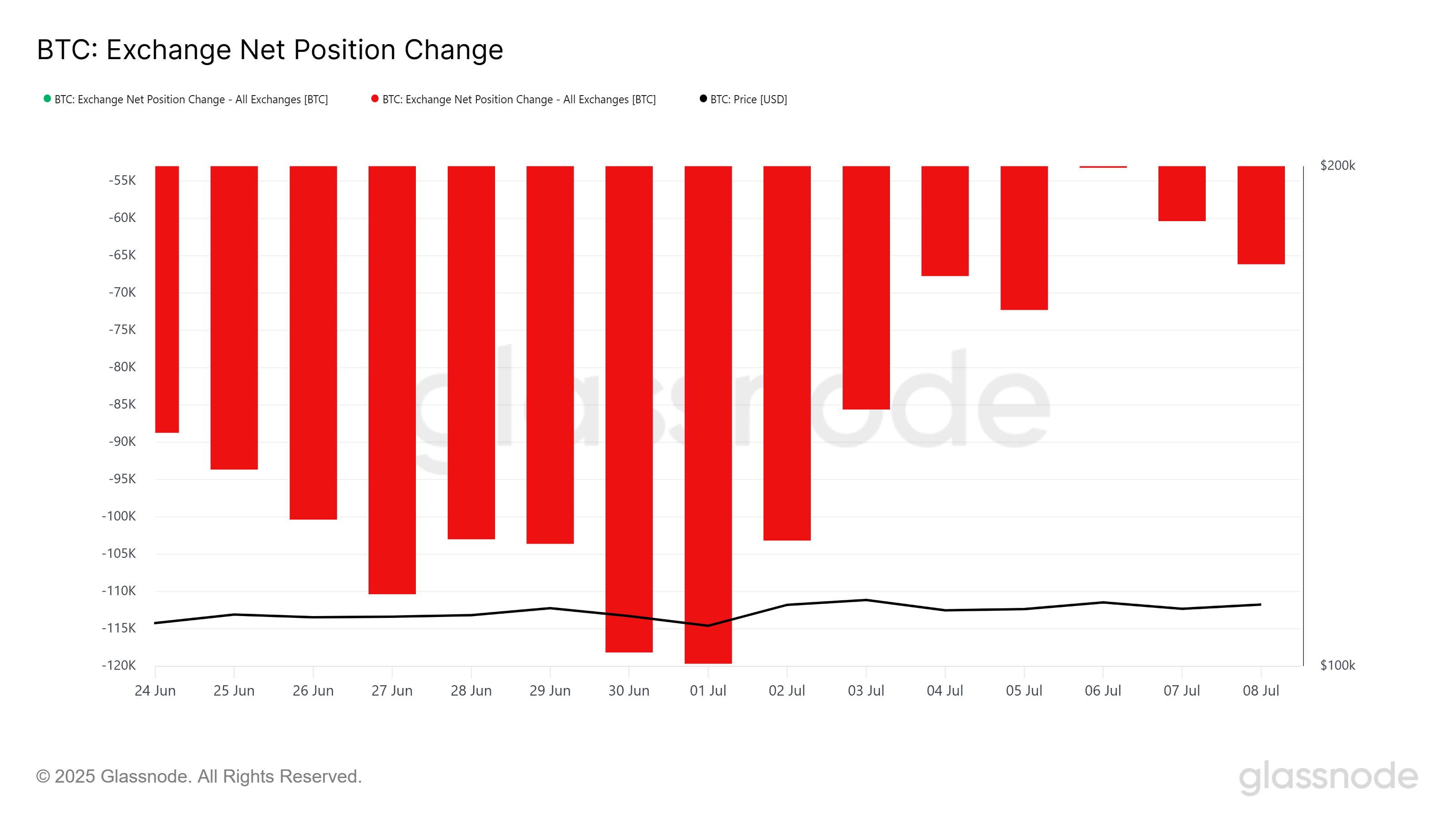

This also appears to be a change in the net position of exchanges that tend to affect the momentum of the macros behind Bitcoin. Since the beginning of July, more than 52,048 BTC, worth around $5.7 billion, has been sold to the exchange.

This sales pressure will lower the regular price, but that effect was offset by the whales that hold strong Bitcoin positions. The net effect of these actions allowed Bitcoin to remain on an upward trajectory, and bullish emotions were restored.

BTC prices form new highs

Bitcoin prices have recently formed a new ATH, nearly reaching $112,000. This marked the first ATH in over a month and revitalized investor trust. The latest price movement shows that bullish trends are alive, with many expecting ongoing profits as Bitcoin builds support at a higher level.

At the time of writing, Bitcoin is trading for $111,183 with the aim of securing $110,000 as a critical support floor. If BTC can maintain this level and maintain upward momentum, there may be another shot of setting up a new ATH in violation of $112,000. This could be a catalyst for more price increases, and strong demand is expected to drive the market forward.

However, even whales may not be able to compete with sales pressure once investors start selling large amounts. If Bitcoin falls below $110,000, you could end up at under $108,000. A sustained drop beyond this level would negate the current bullish paper.

Disclaimer

In line with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. Although Beincrypto is committed to accurate and unbiased reporting, market conditions are subject to change without notice. Always carry out your research and consult with an expert before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.