Key indicators for predicting the Altcoin season – we were able to show negative trends in June, including Bitcoin dominance (BTC.D) and the AltCoin season index. With these developments, the prospects for Altcoin Rally are increasingly unlikely.

As political tensions grow between the US and Iran, investors appear to be restructuring their Altcoin portfolios to reduce risk.

Bitcoin domination reaches its highest level since 2021

At the time of writing, Bitcoin Dominance (BTC.D), which measures Bitcoin’s market capitalization as a percentage of the total market, reached a new high in 2025. He is currently earning his highest points since February 2021.

TradingView data shows that BTC.D has risen for the seventh consecutive quarter without a single quarter revision. This trend reflects strong long-term trust in Bitcoin from both retail and institutional investors.

Crypto analyst Rekt Capital made a bold prediction that Bitcoin control could rise to 71% in the near future.

If that happens, it could trigger a sudden fix in the Altcoin market. A similar scenario took place in February 2025. This is when Bitcoin’s advantage peaked, leading to a sharp decline in many major altcoins.

“Bitcoin’s dominance is currently only 5.5% off 71%. Altcoin won’t be at zero. Instead, it could respond in a similar way in February 2025,” predicted Rekt Capital.

In February 2025, Altcoin’s market capitalization (total of 2) fell from $1.4 trillion to $1 trillion. If Rekt Capital’s forecasts are true, Altcoin’s market capitalization could fall below $700 billion.

Coinbureau co-founder Nic also suggested that BTC.D could rise to 70%. This is Rekt Capital’s prediction. RealVision founder and CEO Raoul Pal shared the same prospects. He believes Altcoins will bleed more than Bitcoin while fixing.

The rising tensions between the US and Iran are characterized by air strikes and threats of massive military deployment from President Trump, causing unexpected market volatility.

The crypto industry leaders remain optimistic, but their sentiment doesn’t extend to altcoins.

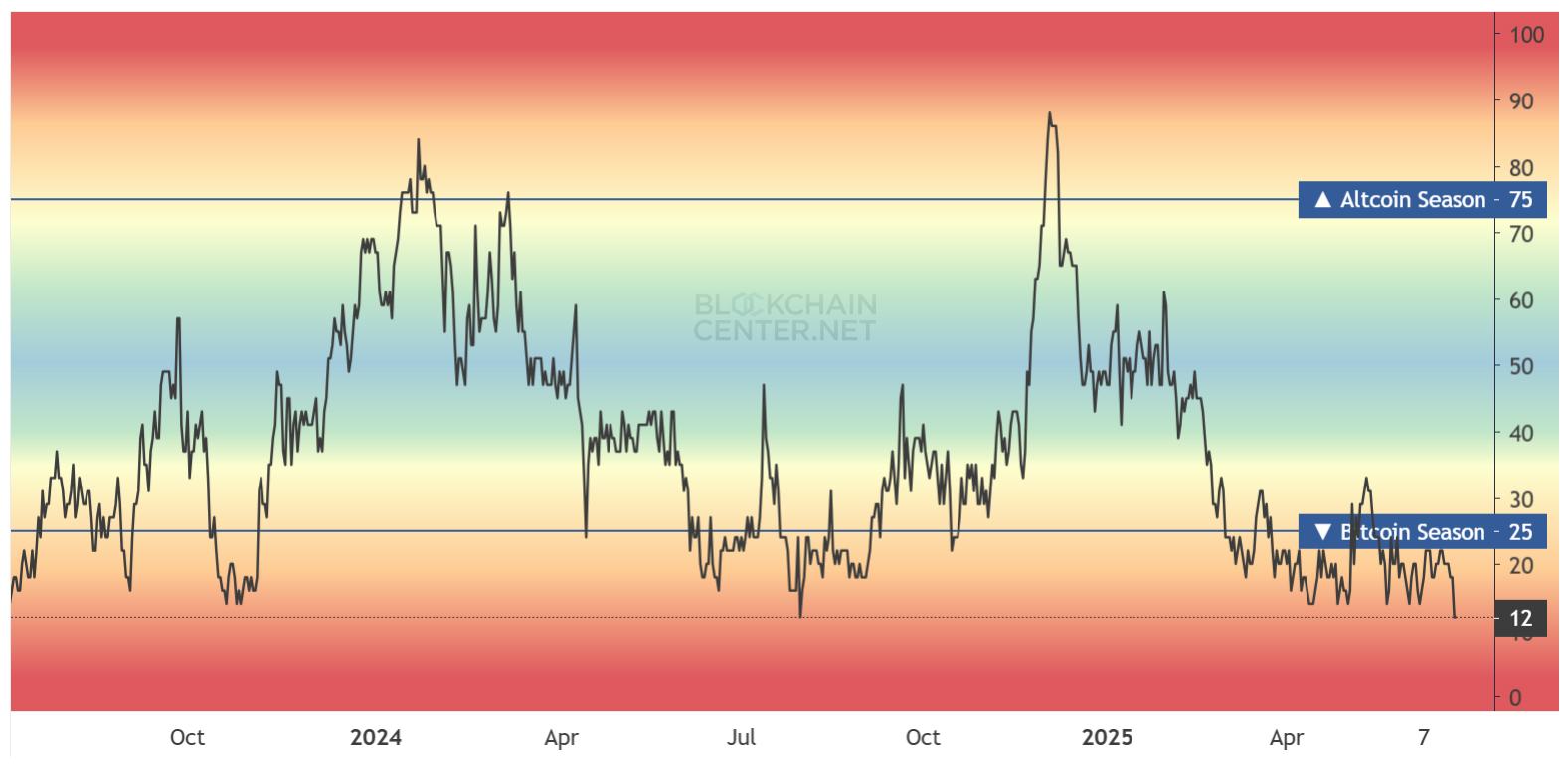

Altcoin Season Index hits rock bottom

As of June 23, the index for the Altcoin season had dropped to 12 points. This is the lowest level in two years. This index tracks whether Altcoins has surpassed Bitcoin over the past 90 days. A score above 75 usually indicates the Altcoin season. The current reading is far from that threshold.

“Now, it’s the farthest thing I’ve ever been out of the Altcoin season in almost a year. That’s if you believe in the ‘Altcoin Season Index’,” says Nic.

However, well-known cryptography analyst Michael Van de Poppe pointed to an interesting pattern. In recent years, the Altcoin Season Index has tended to bottom out in June or July.

This suggests seasonal trends. Investors tend to shift capital to Bitcoin at the beginning of the summer, potentially returning to Altcoins in July or August.

Analyst 0xnobler also believes that the Altcoin season will normally start in the summer. This is in line with previous predictions that Bitcoin control could increase to 71% before it gets revised.

Therefore, these analysts say that despite the surprises from the ongoing geopolitical conflict, patience is key for Altcoin investors.

However, a recent report from Beincrypto highlighted some reasons why Altcoin’s winter lasts longer. And even if the Altcoin season occurs, it may not benefit all projects currently on the market.

Disclaimer

In compliance with Trust Project guidelines, Beincrypto is committed to reporting without bias and transparent. This news article is intended to provide accurate and timely information. However, we recommend that readers independently verify the facts and consult with experts before making decisions based on this content. Please note that our terms and conditions, privacy policy and disclaimer have been updated.