Bittensor (TAO) has grown by 6.5% over the past seven days, and despite adjusting 6.6% over the past three days, its market capitalization is just under $4 billion. Recent pullbacks weaken important technical indicators, showing signs of degradation in both momentum and trend intensity.

TAO managed to retain its main support level and remained above $440, but bearish signals are beginning to appear on multiple charts. Whether the Bulls are able to regain control or whether Tao can fall below $400 could define the next major move.

As bearish momentum overtakes the bull, the tendency in both sections becomes weaker.

TAO’s DMI (Direction Movement Index) chart shows a sharp decline in ADX (Mean Direction Index) from 47 to 23.16 over the past three days, indicating a weakening trend.

ADX measures trend strength on a scale from 0 to 100, regardless of direction. Values above 25 usually show a strong trend, while measurements below 20 suggest weak or ranged markets.

TAO’s current ADX is just above 23, suggesting that recent trends may have lost strength and are approaching the transition phase. Nevertheless, according to Coingecko data, Bittensor is the largest artificial intelligence coin on the market, surpassing nearby players such as ICPs, renderings.

Meanwhile, +DI (positive directional indicator) fell from 23.87 to 17.41, indicating a drop in bullish pressure. At the same time, the -DI (negative direction indicator) rose from 17.86 to 23.15, indicating that the bearish momentum is gaining control.

This crossover (where -DI exceeds +DI) indicates that the seller has overtaken the buyer and ADX is still over 20.

If this divergence continues, Tao’s price could face even more negative side pressure in the short term, unless the bull changes momentum and re-enters.

Tao recovers, but there is no clear strength

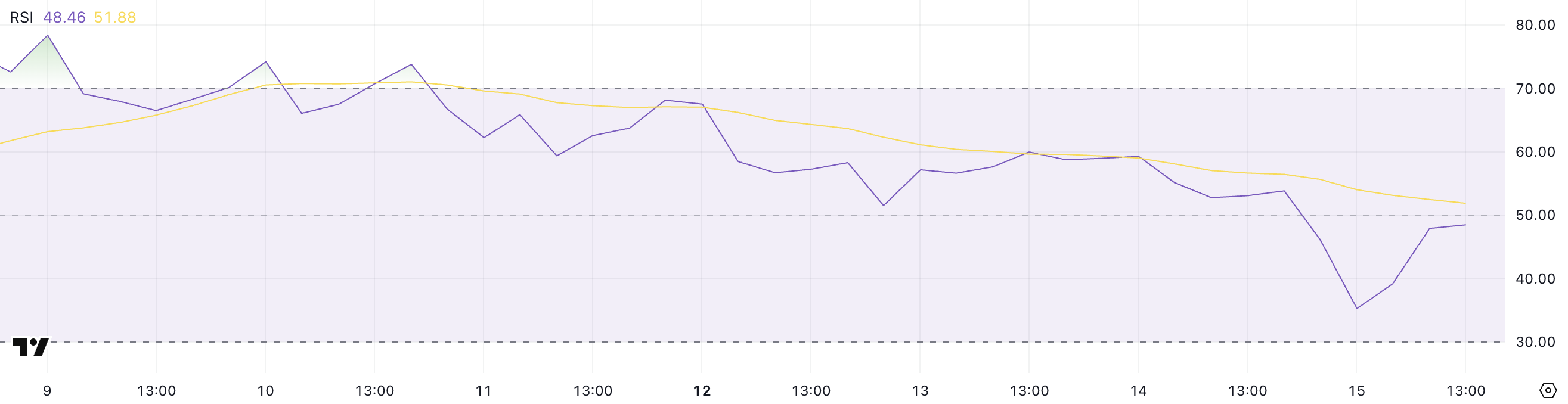

TAO’s relative strength index (RSI) is now 48.46 after experiencing a sharp daytime DIP of 35.25, from 53.82 yesterday to 35.25 just hours ago.

RSI is a momentum indicator that measures the speed and magnitude of recent price movements from 0 to 100. Typically, values suggest conditions above 70 and possible pullbacks.

Measurements between 30 and 70 are considered neutral, and the 50 mark often serves as a balance point for bullish and bearish momentum.

TAO’s current RSI of 48.46 is located slightly below its midpoint, indicating a mild bearish bias after a short period of strong sales pressure.

A recovery from a low low of 35.25 indicates that buyers have returned, but the inability to exceed 50 suggests that bullish momentum remains weak. This level may reflect integration or indecisiveness in the markets where Tao may trade sideways, unless new catalysts appear.

If the RSI stabilizes or increases the 50 again, it could show new strength, but another drop to the 30 adds to the negative risk.

Tao retains support but faces important tests for recovery of momentum

Tao recently tested key support around $417.6, bouncing beyond $440 and showing resilience after a short dip. Its EMA line still reflects a bullish structure, with the short-term moving average lying on top of the long-term structure.

However, the narrow gap between them suggests that momentum is weakening. If sales pressure returns, trends can change, threatening Bitenser’s leadership as the biggest AI coin.

Once Bittensor regains its strength, it can aim to retest the $492.79 resistance area, which fully recovers from recent losses.

On the downside, if they fail to hold support levels of $434 and $417.6, Tao is at risk of entering a sharper downtrend.

The break below these zones reduced the price to $380, pushing TAO to under $400 for the first time in about a week.

Disclaimer

In line with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. Although Beincrypto is committed to accurate and unbiased reporting, market conditions are subject to change without notice. Always carry out your research and consult with an expert before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.