Bitcoin’s recent rally attracted investors’ attention at a price close to $105,000. Major cryptocurrencies have gained momentum throughout the past month, backed by strong institutional interests and new market optimism.

However, conflicting market conditions could prevent Bitcoin from reaching its all-time high.

Bitcoin holders accumulate large amounts

Investor activities were overwhelmingly bullish. Over 30,072 BTC has been purchased over $3.13 billion in the past week alone. This surge in purchasing activity has led to the net exchange positions reaching their lowest level in four months.

The metric shows that more coins are being drawn out of exchange than sediment, a classic sign of accumulation.

The fear of missing out on profits is urging Bitcoin holders to accumulate at a rapid pace. As Bitcoin emerges near record highs, it appears that long-term investors are adding their positions and betting on a new breakout.

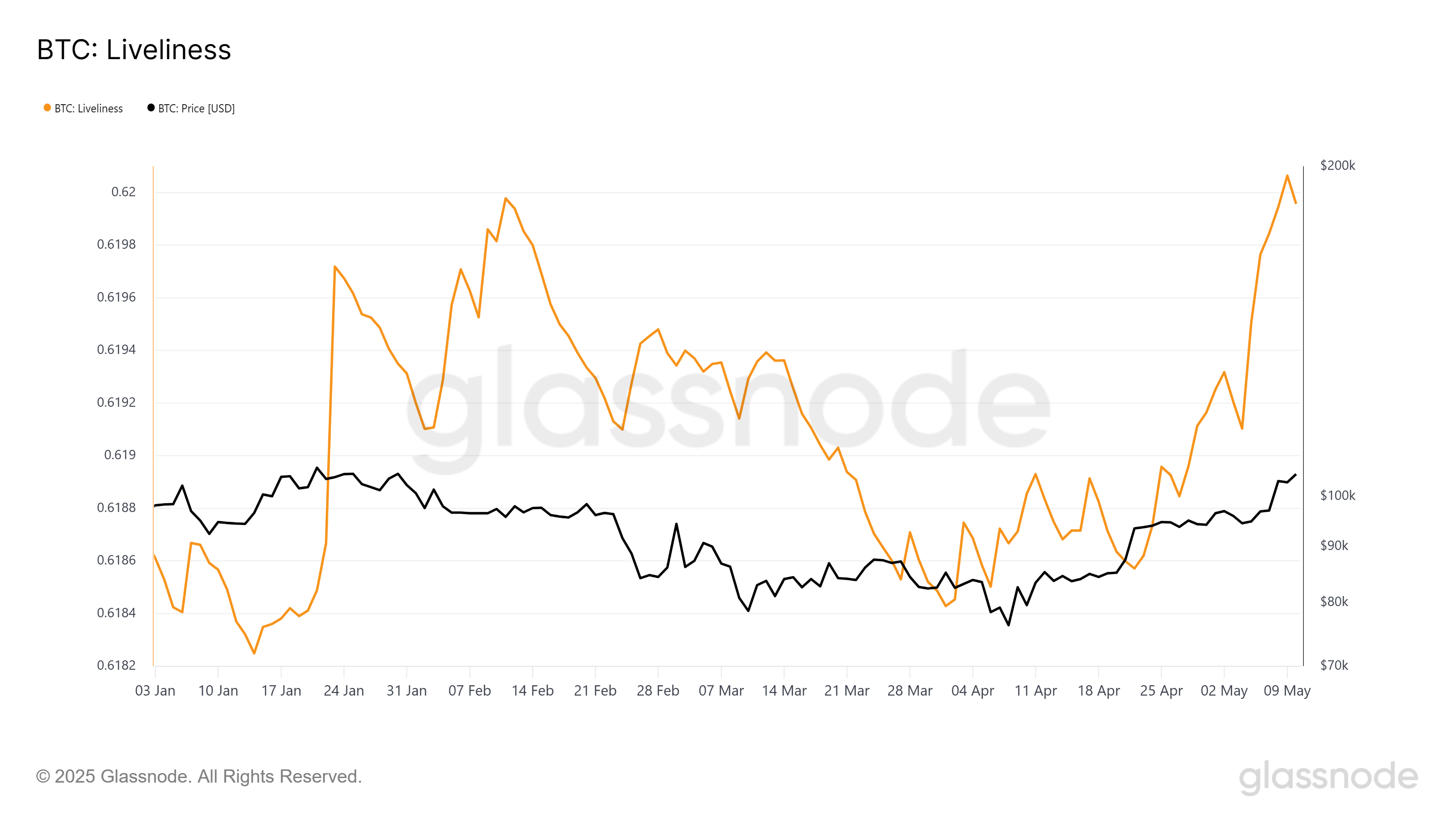

While accumulation remains strong, macro trends present complex pictures. The Liveliness Indicator, a key-on-chain metric, has seen notable spikes since its launch in May. It currently sits at a few weeks’ high, suggesting that long-term holders (LTH) are beginning to liquidate.

An increase in vibrancy usually means that dormant coins are re-active, often indicating that early adopters are benefiting. This action could create new sales pressure on the market.

If Bitcoin lths keeps offloading its holdings, it can undermine the bullish emotions driven by fresh accumulation.

BTC price aims for a new ATH

Bitcoin is currently trading at $104,231 just under a significant psychological resistance of $105,000. However, technical data shows that the actual resistance is $106,265. This price level has served as a ceiling since December 2024, preventing Bitcoin from gaining even more traction.

Despite its all-time high of $109,588, the $106,265 mark is an immediate hurdle for Bitcoin. Market dynamics acknowledge that this level is particularly difficult to violate – including sales from LTHS and conflicting investor sentiment.

If Bitcoin fails to overcome this resistance, a price adjustment back to $100,000 remains a strong possibility.

Conversely, if BTC can turn it over by defeating $106,265 on the support floor, it could rekindle bullish momentum. Such a move would pave the way for Bitcoin to regain $109,588 and form a potentially new all-time high.

Above this level, the bearish outlook will be disabled and the driving stage can be set to $110,000.

Disclaimer

In line with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. Although Beincrypto is committed to accurate and unbiased reporting, market conditions are subject to change without notice. Always carry out your research and consult with an expert before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.