PI has appeared as today’s top market gainer, with prices rising nearly 50%. This jump continues with almost 150% weekly meetings, extending momentum for another day.

PI tokens are currently trading above $1, a level not seen since March. Technical indicators suggest that this upward momentum could be maintained, suggesting the possibility of further profits in the coming days.

PI Network Bull controls

The PI’s Directional Movement Index (DMI) is evaluated by using a negative directional index (+Di; blue).—DI;Orange). At the time of the press, it stands at the highest ever 60.96.

This shows a clear domination of bullish momentum, as +di has surpassed -DI well. If the asset +di exceeds its-DI in this way, it suggests that market participants are overwhelmingly supportive of purchasing over sales pressure.

This confirms that the current price surge for PI is supported by a significant demand for Altcoin.

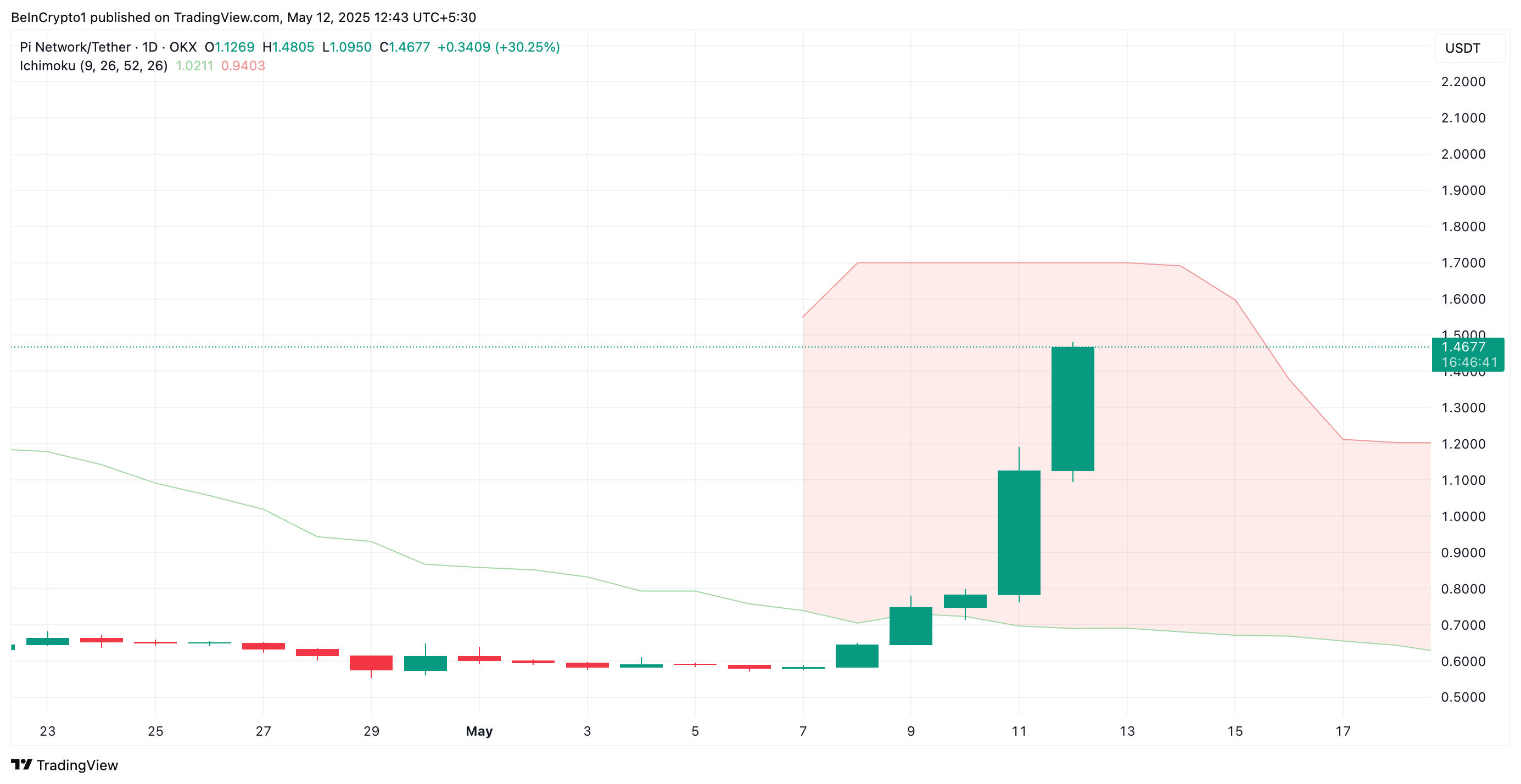

Furthermore, the double-digit profit on Pi is heading towards its price, while the main span A of Cloud Cloud, heading towards the main span B of the same indicator.

This indicator tracks the momentum of asset market trends and identifies potential support/resistance levels. A break above the main span A suggests that PI has overcome significant resistance.

If it breaks beyond the main span B and maintains its position, there could be more upward trends, and market interest is growing.

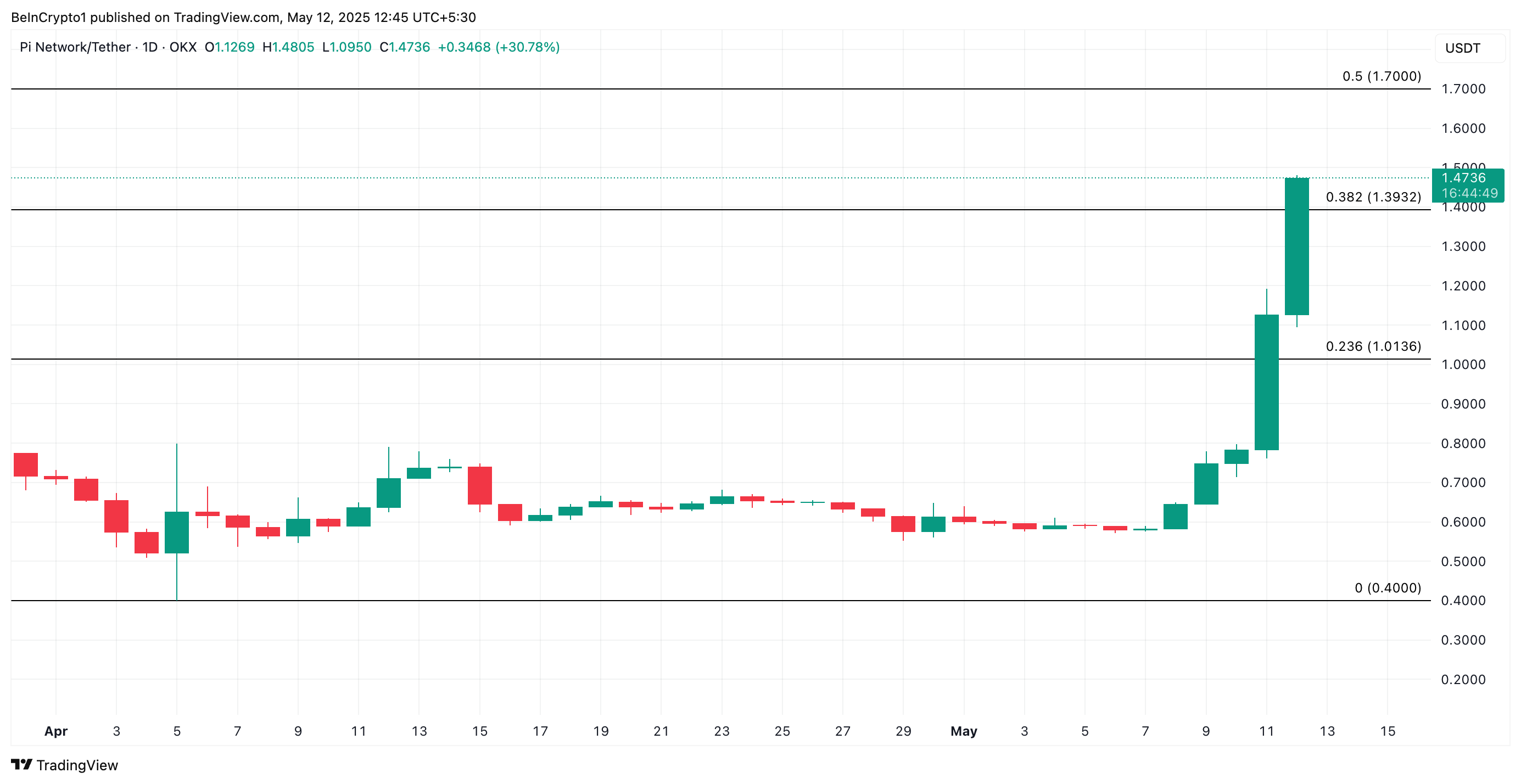

PI sets new support to $1.39: Can the Bulls push it into $1.70?

The PI trades at $1.47 at press and rests at $1.39 on the newly formed support floor. As purchasing pressure increases, this level can boost and promote the price of the Pi to $1.70.

However, this bullish outlook is ineffective when you make a profit. In that case, the PI’s value could fall below the $1.39 support and fall to $1.01.

If the Bulls are unable to defend this level, the PI token could extend the decline to less than a dollar, returning to an all-time low of $0.40.

Disclaimer

In line with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. Although Beincrypto is committed to accurate and unbiased reporting, market conditions are subject to change without notice. Always carry out your research and consult with an expert before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.