Over the past week, prominent entities such as Circle and Ripple Labs have taken steps to secure US banking licences. This is a positive development for crypto companies seeking institutional adoption, but also raises concerns among enthusiasts who prioritize the purist vision of cryptocurrency.

Representatives of the XBTO and Kronos study suggest that two seemingly contradictory ideas can coexist. They argue that institutional adoption, while undoubtedly deviating from Satoshi’s core principles of decentralization and inheritance, also means that the crypto industry is mature and taking a new form.

Regulatory approval competition is heated

The wave of institutional adoption continues as several well-known companies seek to secure US banking licences.

Circle unleashed this chain reaction after the Stablecoin issuer applied to establish a national trust bank last Monday. This license allows Circle to act as a custodian in its own USDC preparation and, if approved, can provide digital asset management services to institutional clients.

This move follows the circle’s successful initial public offering (IPO). It is consistent with their long-term goal of deeper integration into the traditional financial system, especially in light of new US stable regulations.

Two days later, Ripple Labs likewise called for the National Trust Bank Charter, which aims to raise the recently launched Stablecoin, RLUSD, primarily under federal regulations. With approval, Ripple can act as a federal regulated bank and remove the requirements for individual state remittance licensing.

There have also been reports that other major players, such as Fidelity Digital Assets and Bitgo, intend to pursue banking licensing.

Cryptocratists celebrated these developments, spurred primarily by the passage of Senate acts of genius, but Bitcoin traditionalists met the news with skepticism.

Can Satoshi’s vision coexist with regulations?

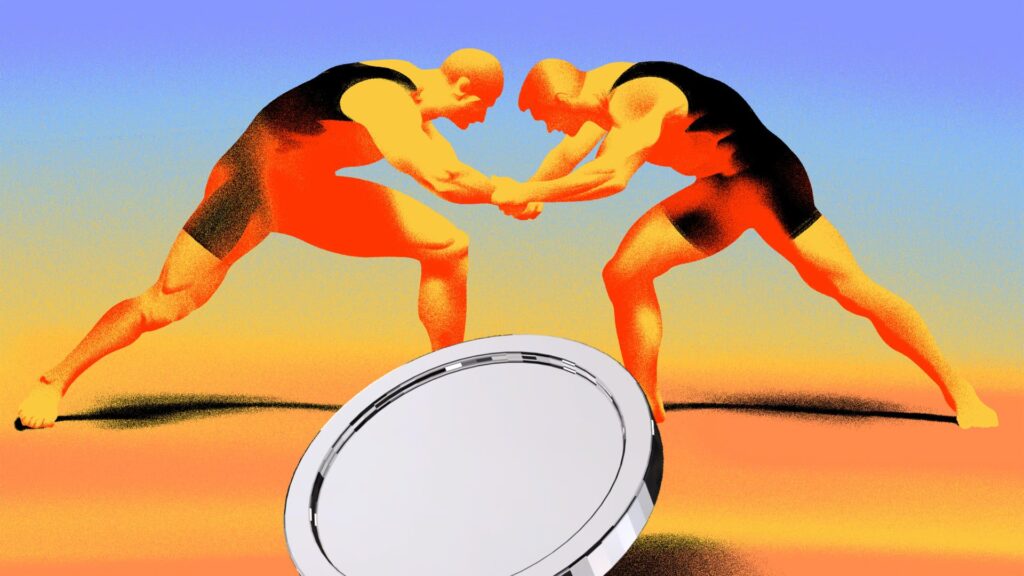

The willingness by crypto companies to protect banking underscores tensions in the core industry: unauthorized decentralization and regulatory integration.

Satoshi’s spirit defends decentralization, censorship resistance and intervention accepted and defended by early adopters. Therefore, when crypto companies are seeking consistency with systems that are intended to avoid, it naturally raises concerns about their fidelity to those fundamental principles.

This move may contradict Nakamoto’s original vision of a peer-to-peer system bypassing banks, but reality is more complicated. It represents a natural evolution as the crypto industry matures, moving from its ideological foundation to actual infrastructure and integration.

“The early spirit of Crypto was to challenge facilities, but we are now witnessing convergence designed to achieve meaningful scale and adoption that ultimately serves everyone. Institutional adoption requires clarity and trust in regulations.

Bank licensing is essential to achieving widespread adoption of crypto.

Banking License: Benefits Beyond Centralization

Crypto companies must comply with regulatory safeguards to appeal to institutional clients. This shift moves them further from pure decentralization, but approaches a model that offers enhanced end-user protection.

“Bank licenses bring clarity, compliance and reliability, but also costs and constraints. They shift crypto companies from code-first to regulatory responses, trading pure decentralization for public trust.”

Instead of viewing this as a concession, it would be better to view it as a computational step towards a wider integration.

“Bank licenses open the door to wider adoption and deeper integration, and innovations cannot replace traditional funding at blockchain bridges,” Huang added.

However, this development does not rule out the need for decentralization. Instead, they create demand for two types of systems.

A multifaceted cryptographic ecosystem

The cryptographic ecosystem is vast. Among many other use cases are Bitcoin, altcoin, stubcoin, memecoin, and real-world assets. This diversity has inherently attracted attention from a wide range of individuals.

Bitcoin, for example, is unchanging. The degree of institutional interest cannot manipulate or alter its immutable, unauthorized nature. For this reason, traditional financial individuals may feel attracted to something more stable.

Unlike Bitcoin, stubcoin is fixed in traditional currency and is not subject to the same volatility. Now, at least in the US, businesses can issue their own stubcoins.

“Bitcoin embodies decentralization and monetary sovereignty. Steady-state coins like USDC provide transaction utilities. These are digital representations of existing currencies, not exchanges.

They are not inconsistent as they serve different purposes. As a result, they can coexist, allowing both decentralized and centralized reality to exist simultaneously. Such a setup will benefit the ecosystem in the long run.

Pragmatists and purists: essential balance?

In an environment where pragmatists and purists coexist, they can act as mutual checks and balances.

If Crypto favors traditional sectors over decentralization, purists can help to curb the industry. Conversely, pragmatists can intervene when purists become too rigid and refuse to mediate at the expense of adoption.

“The division of maximalism and pragmatism shapes the future. Maximists protect pure decentralization, while pragmatists seek and expand partnerships and documents. Both paths coexist, conflict, and drive how regulations and cryptography evolve,” Huang told Beincrypto.

This trend can lead to greater market segmentation, which benefits any industry.

“We see separate layers emerge: regulated stubcoins and tokenized assets operating within traditional frameworks provide clarity for different user types, along with unauthorized protocols that maintain their decentralized nature.

The convergence of crypto and traditional finance is an inevitable necessary development. Instead of viewing this evolution as a betrayal, it is better understood as an important step in the industry reaching substantial scale and providing strong and safe services.

Such services can coexist with and ultimately be strengthened with the crypto ecosystem. Going forward, the market will become subtle and there will be unauthorized innovations and regulated financial infrastructures that are thriving to serve a global user base with diverse needs.

Disclaimer

Following Trust Project guidelines, this feature article presents the opinions and perspectives of industry experts or individuals. Although Beincrypto is dedicated to transparent reporting, the views expressed in this article do not necessarily reflect the views of Beincrypto or its staff. Readers should independently verify the information and consult with experts before making decisions based on this content. Please note that our terms and conditions, privacy policy and disclaimer have been updated.