Onyxcoin (XCN) has faced challenges over the past month, with prices primarily stagnating. The lack of bullish movement could be the result of the opposing forces that activate cryptocurrency (investment actions and market conditions).

However, there is some positive news surrounding the upcoming OIP-56 proposal, which will bring users to a petrol-free vote. This could serve as a trigger for XCN price increases.

onyxcoin is overrated

OnyxCoin’s NVT (network value to transaction) ratio is currently 5 months high, indicating a rapid increase in network ratings compared to transaction activity. This spike indicates a potential overestimation of XCN as the actual transaction activity in the network does not correspond to the evaluation.

This contradiction can create a sense of value that has historically been indicative of price correction. As the NVT ratio indicates a disconnect between price and real-world usage, Onyxcoin could experience an increase in sales pressure if investors start to recognize an overvaluation.

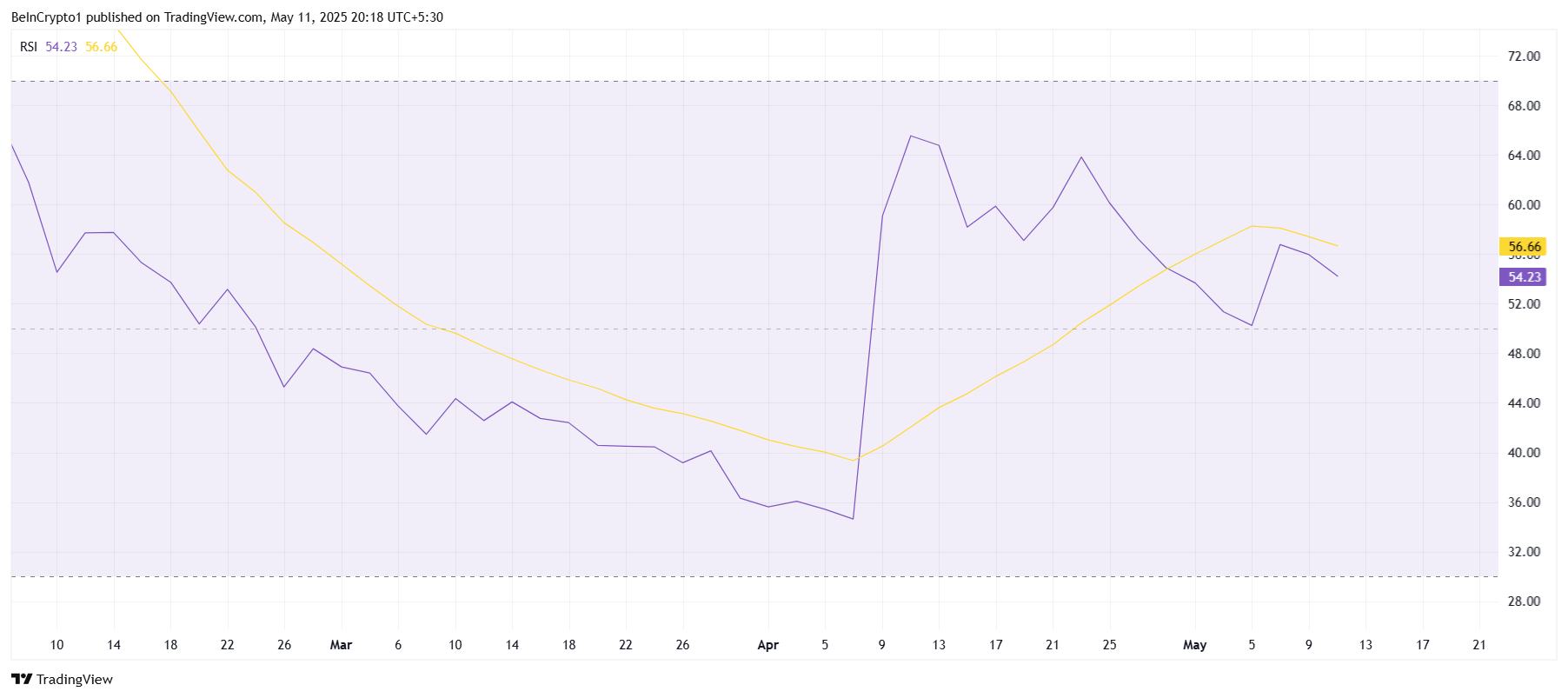

Despite signs of overestimation, Onyxcoin is not facing any significant bearish momentum, as shown by its relative strength index (RSI). Currently, the RSI sits on the neutral 50.0 mark, not preferred in the market, but XCN still shows that it is in the positive price range.

The RSI position suggests that Onyxcoin will remain relatively stable or even experience upward momentum. Prices may recover if the broader market situation improves, or if OIP-56 succeeds in providing additional utilities to the network.

XCN Prices are aiming to recover

Onyxcoin prices currently trade at $0.0180 and are integrated between $0.0214 and $0.0165. The bullish lack of momentum over the past few weeks has prevented prices from exceeding $0.0214, reflecting the market’s hesitation.

Given the mixed signals from both market sentiment and technical indicators, Onyxcoin prices could continue to consolidate within this range for the time being.

This integration phase could continue unless a critical catalyst pushes prices in one direction. If the market situation gets worse, Onyxcoin could fall below the $0.0165 level and possibly drop to $0.0150.

This could further validate concerns about cryptocurrency overvaluation and indicate a deeper correction in prices.

However, if Onyxcoin’s price starts to match investor behavior and bullish momentum, it could break beyond the $0.0214 resistance. This will result in a potential rise of $0.0237, and ultimately $0.0300.

Successful violations at these levels have negated the current bearish outlook and indicate a stronger upward trend for Onyxcoin in the near future.

Disclaimer

In line with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. Although Beincrypto is committed to accurate and unbiased reporting, market conditions are subject to change without notice. Always carry out your research and consult with an expert before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.