The US Dollar Index (DXY) plunged to 97.2 on Thursday, marking its lowest mark since 2022. This reinforces the market’s expectations for major changes in capital flow to Bitcoin (BTC) and crypto.

This dollar’s expanded weakness arises as investors digest the uncertainty of the macroeconomic and some analysts call generational rotations to digital assets.

Analysts bet on the cryptography as dxy collapse hunts for growth

According to Barchart, the dollar lost more than 10% of its value in 2025. This marks the worst first half of almost 40 years.

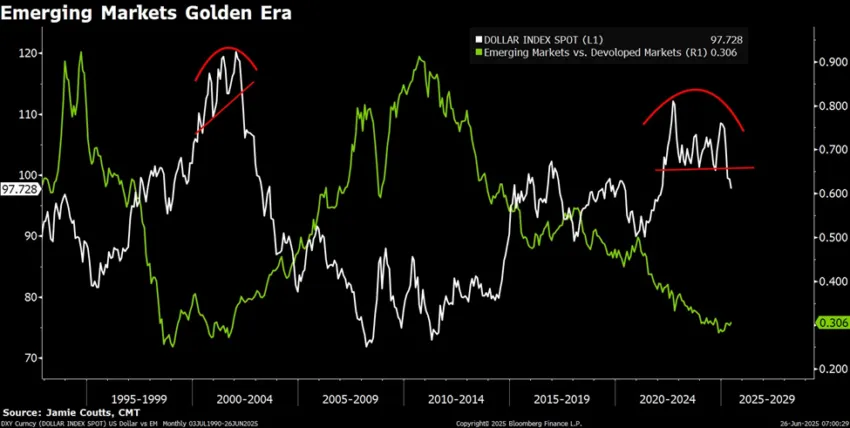

Fast depreciation encourages comparisons with past market cycles. Jamie Coutts, lead Crypto analyst at Real Vision, draws out some of the most popular historical parallels.

“From 2002 to 2008, the last major dollar depreciation ignited a fire under EM (emerging market) stocks and commodities. EM went three times better than DM (developed markets) as it chased a young economy chasing capital.

Coutts argues that today’s crypto markets resemble emerging markets 20 years ago, attracting influx from investors seeking higher returns amidst structural changes.

With Fiat currency weakening globally, digital assets are increasingly seen as the next frontier for growth.

In the same tone, Crypto analysts like Mister Crypto point out the dollar’s decline and plattize Bitcoin’s domination as a signal that could bring the Altcoin season closer.

Chainbull reflects this view and notes that the weakness of the dollar and the rise in Bitcoin domination are pivotal changes.

However, while capital may spin into crypto, Bitcoin is the main beneficiary compared to altcoins. Beincrypto reported that Bitcoin’s dominance recently achieved a new annual high, leading some to believe that their enthusiasm for altcoins is premature.

However, it can change rapidly as traders increasingly expect dollar-driven rotations to smaller cap tokens.

The broader crypto market tends to respond to the strength of the dollar. Typically, weaker DXY reduces borrowing costs, increases liquidity and encourages risk taking. This is the ideal condition for digital assets to outperform.

If the current trend holds, capital could flood Crypto, just like emerging markets in the early 2000s.

When macro power, historical analogues, and real-time on-chain signals lined up, the stage may be set to a major crypto rally.

“Capacity is moving to places where energy is present. Fiat is declining,” added Coutts.

Whether this means a sustained rise in altcoin or the latest strength of Bitcoin, a dollar decline could reshape investors’ risks and crypto could bring profits.

Disclaimer

In compliance with Trust Project guidelines, Beincrypto is committed to reporting without bias and transparent. This news article is intended to provide accurate and timely information. However, we recommend that readers independently verify the facts and consult with experts before making decisions based on this content. Please note that our terms and conditions, privacy policy and disclaimer have been updated.