Ethereum (ETH) has experienced its largest day gathering since 2021, rising 31% in just 24 hours. Surges helped bring ETH closer to a critical resistance level of $2,500 following the successful implementation of the Pectra upgrade.

However, despite impressive returns, there is a challenge as investors’ actions can hinder further price movements.

Ethereum Pectra upgrades are live

The Pectra upgrade has had a major impact on market sentiment over Ethereum, with the exchange having recorded a net inflow of $15.6 billion since its launch. On May 8 alone, $12 billion worth of ETH was sold, marking the highest daily sales in over five months.

This suggests that investors are keen to secure profits after price surges and could continue to move upwards with ETH’s outlook. This profit-making action could limit the upward momentum of ETH.

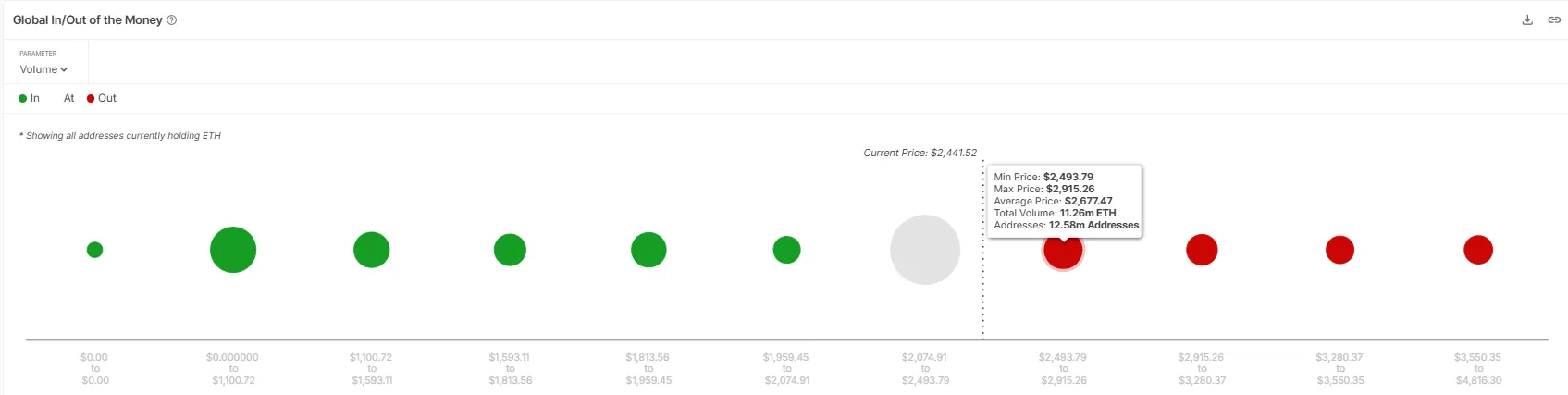

Ethereum’s macro momentum shows both strength and potential headwinds. The IOMAP (outside of money on price) analysis reveals that 11.56 million ETHs have been purchased in the range of $2,493 to $2,915. This range is very important as ETH must continue its upward trend and violate $2,500 to lock in recent profits.

However, within this range, there is a great deal of sales pressure on this range, where ETH worth $27.8 billion is sitting. This can reduce Ethereum’s ability to sustain sustainable growth as the risk of large-scale sales at higher prices increases.

ETH prices will be two months higher

Ethereum prices currently trade at $2,366, up 31% in the last 24 hours after Pectra upgrade. This price rise has brought ETH to two months high, approaching resistance levels of $2,513. Breaking this barrier marks a key milestone for Ethereum, but whether or not they can maintain this move in the face of investors’ sales remains a challenge.

The challenge of over $2,500 is lies in the ongoing sales pressure from investors who have already taken advantage of recent profits, and those who can sell if prices continue to rise. So Ethereum could struggle to maintain its upward trajectory, possibly under the $2,344 support. In this scenario, ETH could test the $2,141 level and erase some of its recent profits.

However, if the broader market remains bullish and ETH exceeds $103,000 in Bitcoin gains, Ethereum could break past $2,513 and secure it as a support floor. This creates an opportunity to rise further towards $2,654, negating the current bearish outlook and indicating that Ethereum can continue its recovery towards new price highs.

Disclaimer

In line with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. Although Beincrypto is committed to accurate and unbiased reporting, market conditions are subject to change without notice. Always carry out your research and consult with an expert before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.