Some experienced investors suggest that it may be time for Altcoin traders to change their mindset rather than wait for market conditions to improve. Half of 2025 has already passed, and there is no guarantee that the second half will be easier.

Meanwhile, the Altcoins purchase and holding approach failed as Bitcoin domination (BTC.D) has risen for the second year in a row.

Why move from shopping and retention to disciplined trading?

Faced with widespread losses among Altcoin traders, X’s well-known investor, Stockmoney Lizards shared a simple strategy designed for people with limited experience. It is named the “Low-IQ Altcoin Strategy” and consists of four main steps.

Choose reputable Altcoins: Focus on coins that have proven resilient across multiple market cycles, such as Sol, ADA, and ETH. These coins are usually stronger foundations and lower risk than new, smaller projects. Carefully allocate capital: divide trading capital into five equal parts to spread risk to different purchase points. Define a clear entry point: Enter your location when your daily RSI is below 30 (oversell signal). It continues to be added with every 10% price drop since the last purchase. Set strict exit points: Once the profit reaches 30-50%, end the entire position. The Altcoin market is extremely unstable and remains vulnerable to sudden movements by whales, so it is awaiting hesitation and even higher profits.

Stockmoney Lizards aims to help traders avoid losing everything, like most Altcoin investors. Recommendations include reinvesting half of your profits into stubcoin and reinvesting the other half into Bitcoin for long-term accumulation.

“You won’t get rich anytime soon, but you won’t lose everything like 99% of Altcoin traders. This boring strategy is exactly how I survived my early trading days,” says Stockmoney Lizards.

Michaël Van De Poppe, CIO of MnFund and founder of MnFund, also highlighted the common mistakes. Many investors only buy and buy if prices are already rising sharply, causing the risk of loss.

The disciplined approach proposed by Stockmoney’s lizards helps to reduce and reduce the FOMO mindset described by Michaël Van De Poppe.

However, maintaining discipline is challenging as many traders still want fast and big profits.

“It’s not a strategy that most people at Crypto believe, but it’s necessary. I want that Lambo yesterday,” commented another investor at X.

Will the Altcoin season arrive at H2 2025?

A recent Beincrypto report has identified signs that the Altcoin winter could last. An analysis of Altcoin Market Capital (Total2) on the six-month chart shows that Total2 has completed four consecutive green candles, and now appears to be in the topology of a red candle.

Previous cycles suggest that four green six-month candles usually end with two red candles, suggesting that the second half of 2025 could remain challenging for altcoins.

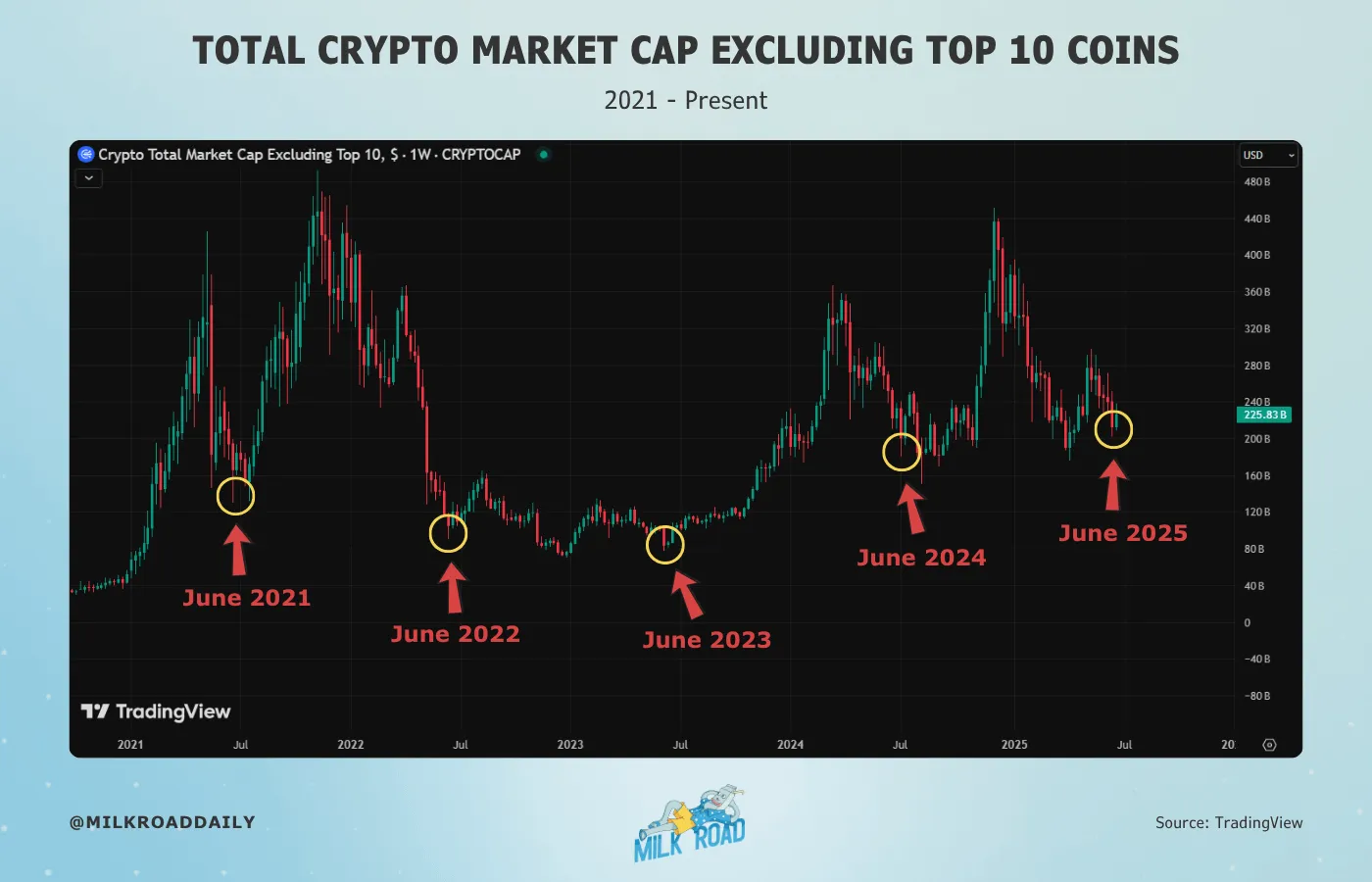

However, investor Milk Road observed a more optimistic historical pattern. Every June, it is at the bottom of Altcoins’ market capitalization, excluding the top 10 forms.

“Every June since 2021 marks a significant turning point in the Altcoin market. June 2025 could follow the same script,” observed Milk Road.

This perspective is supported by other investors hoping that Altcoin’s market capitalization will reach a new high in the second half of 2025.

Conflict signals from different data models add uncertainty to predictions for H2 2025. At the same time, Bitcoin Domination (BTC.D), which normally requires you to refuse to show the Altcoin season, has been above 65% and above 65% since February 2021.

Altcoin investors remain divided. Some people try to adjust their expectations and strategies after previous losses, while others wait for important returns to justify their long-standing retention.

Disclaimer

In compliance with Trust Project guidelines, Beincrypto is committed to reporting without bias and transparent. This news article is intended to provide accurate and timely information. However, we recommend that readers independently verify the facts and consult with experts before making decisions based on this content. Please note that our terms and conditions, privacy policy and disclaimer have been updated.