Fartcoin has dropped by more than 8% in the last 24 hours, putting its $1 billion market capitalization at risk. After a strong rally earlier this month, momentum has been crucially growing a beard beyond multiple technical indicators.

Bbtrend becomes rapidly negative, ADX shows the intensity of its tendency to decline, and potential death crosses show the loom on the EMA chart. Unless pressure comes back soon, Fartcoin could face deeper losses in the future.

Fartcoin’s momentum reversal as bbtrend becomes deeply negative

Fartcoin’s Bbtrend has been sharply turned over into bearish territory currently sitting at -6.22 after becoming negative two days ago. This marks a sharp turnaround from the most recent 27 high just five days ago, indicating a major change in momentum.

BBTREND, or Bollinger Band Trend, measures the strength of the direction of price action by analyzing how much the price is moving compared to Bollinger bands.

Positive values indicate a strong bullish trend with increasing volatility, while negative values indicate bearish momentum and contract price action.

When the Fartcoin’s Bbtrend is firmly below zero, the indicator refers to an increase in downside pressure.

A read of -6.22 means that the asset is trading near the bottom edge of the volatility envelope and is increasing in strength.

This usually reflects a loss of profits for buyers, and can predict continuous price weakness unless feelings are reversed immediately.

When ADX drops below the key threshold, Fartcoin loses steam

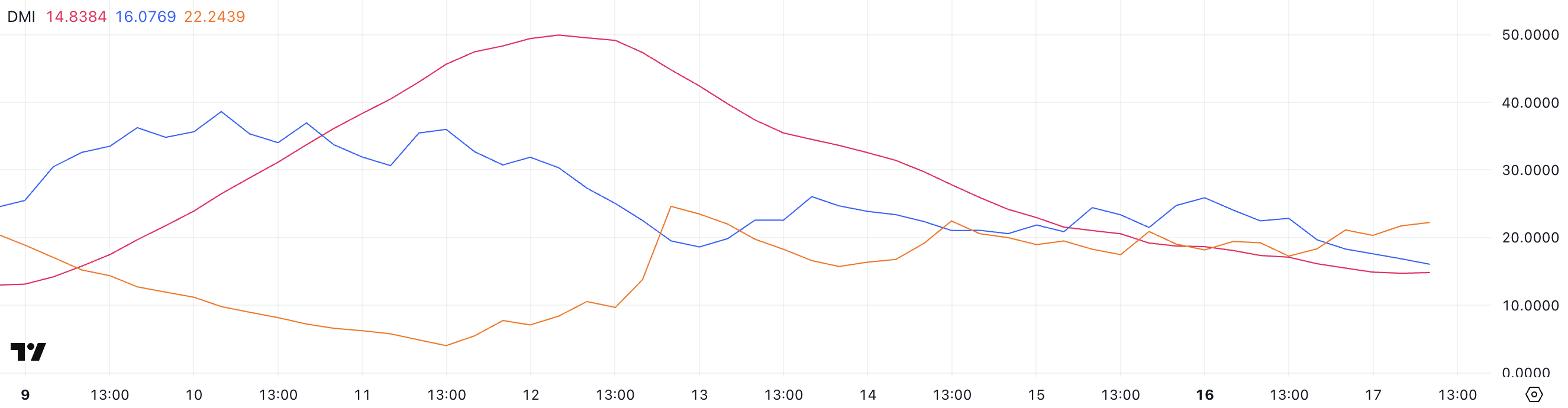

Fartcoin’s Direction Motion Index (DMI) shows clear indication that the mean directional index (ADX) has dropped to 14.83 from 27.82 just three days ago, reducing the trend intensity.

ADX measures the intensity of a trend regardless of direction. Values above 25 usually suggest a strong trend.

Because ADX is under 15 years old, Fartcoin appears to be in the low volatility stage. There, directional convictions may decline and price action may become less disrupted.

Directional indicators, on the other hand, draw short-term pictures of memecoin bearish. Track bull pressure +DI drops sharply from 25.89 to 16, indicating fading purchase rights.

At the same time, -DI rose from 17.27 to 22.24, suggesting an increase in sales force.

This growing gap between Bearish and bullish strength, coupled with the decline in ADX, points to a market controlled by sellers, but we are still not very certain.

Fartcoin could face more downsides if trend strength begins to rebuild with a bearish advantage.

fartcoin slips 22% in 6 days as death is woven into the chart

Fartcoin was one of the best performing meme coins earlier this month, attracting 64% from June 5th to June 11th. However, momentum has shifted sharply, with tokens down 22% over the past six days.

Lately pullbacks have put technical pressure on prices, and chart indicators suggest a potential trend reversal. Fartcoin’s EMA line is now approaching the formation of the cross of death.

If Death Cross is confirmed, Meme Coin will slide to test support at $1.06 and $1.00, and could drop by $0.86 if bearish momentum accelerates.

On the back, if the Bulls regain control and the trend goes up, Fartcoin can retry the resistance for $1.20. A clean breakout that level could pave the way for $1.53.

Disclaimer

In line with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. Although Beincrypto is committed to accurate and unbiased reporting, market conditions are subject to change without notice. Always carry out your research and consult with an expert before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.