Bitcoin (BTC) has strengthened its confidence in its prediction that it will soon set a new all-time high (ATH) with an increase of over $100,000.

Based on data on the chain, accumulation trends and market sentiment, there are some persuasive reasons to believe that Bitcoin could reach a new peak. In this article, we will analyze five important reasons to support that prediction.

5 Reasons to Drive Bitcoin towards a New ATH in May

The first reason is the accumulation of whales during May. GlassNode data shows that wallets of all sizes are actively accumulating BTC. GlassNode’s “Trend Accumulation Scores by Cohort” chart shows this trend.

In early April, accumulation was mainly limited to large whale wallets holding over 10,000 BTC. However, by May, the accumulation trend had spread to small wallets holding 100-1,000 BTC. Meanwhile, wallets below 100 BTC also showed an increase in accumulation activity reflected in the faded red color on the chart throughout May.

Additionally, Santiment reports that over the past 30 days, whale wallets have accumulated an additional 83,105 BTC. This accumulation helped to flip the spot volume delta into positive territory, giving it a bitcoin momentum and pushing it higher.

“The aggressive accumulation from these big wallets may be a matter of time until the coveted permanent high levels of Bitcoin are compromised, especially after US and China’s tariffs have been suspended,” Santiment predicted.

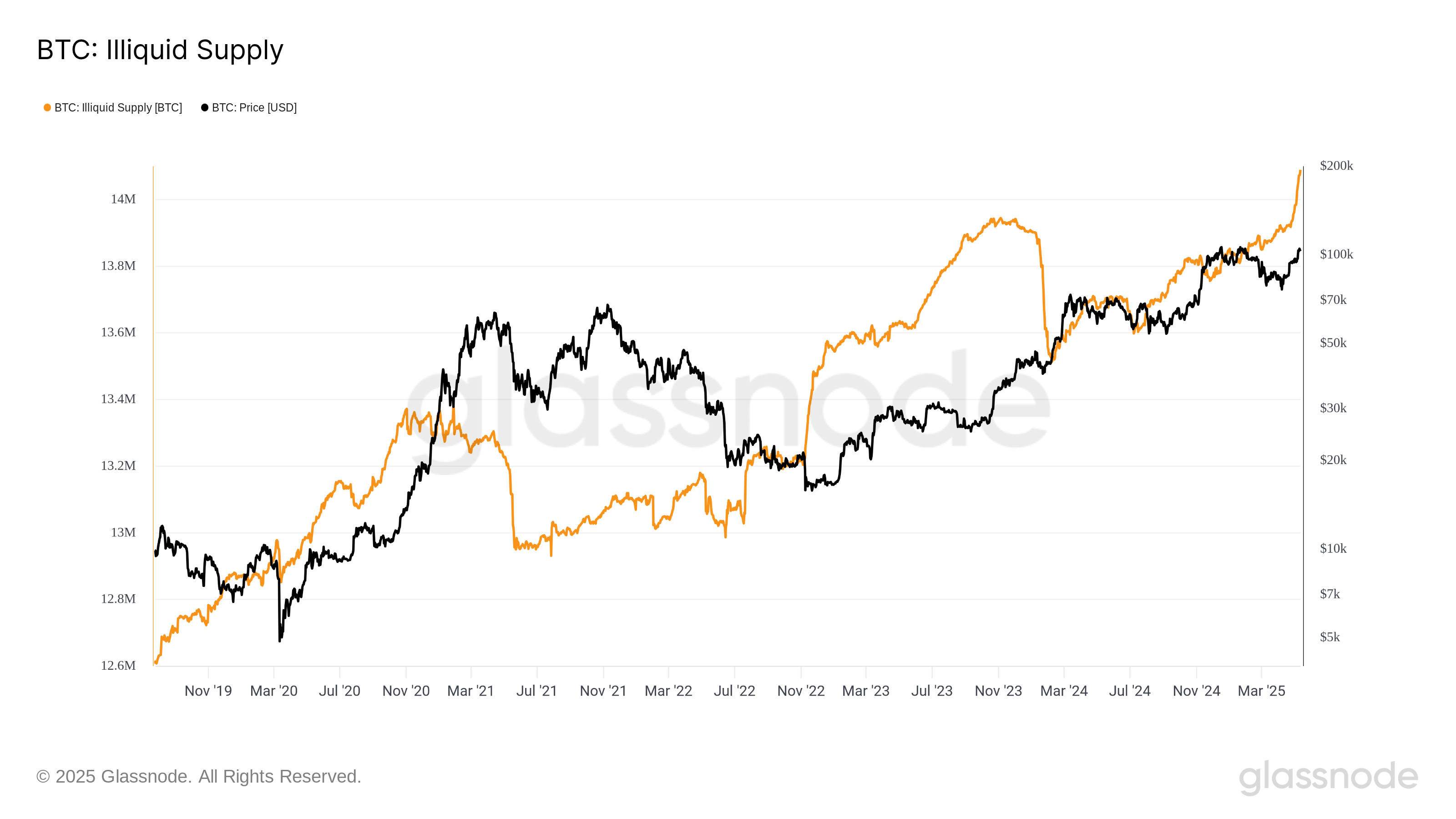

The second reason is that the non-current supply of Bitcoin has reached a record 14 million btc, which is worth more than $1.4 billion.

The illiquid increase in supply shows that long-term investors (Hoddlers) hold Bitcoin firmly. They are not planning to sell in the short term. As a result, this reduces circular supply and can lead to Bitcoin prices more easily as demand rises.

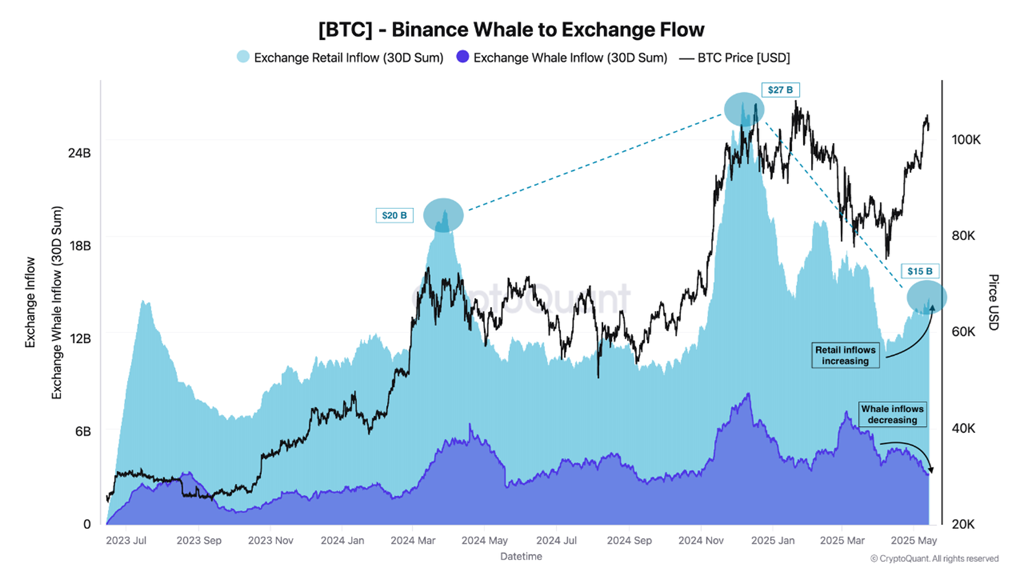

The third reason comes from small investors. While a new wave of retail investors has yet to emerge completely, Cryptoquant reports that it has begun to recover after Binance, the world’s largest crypto exchange, has declined in retail trading volume.

Additionally, Cryptoquant analyst Carmelo Alemán also observed that retail volumes have not yet surged, but show positive signs.

“In the coming months, we can expect to see growth in metrics such as active addresses, UTXO counts, and new addresses and transfer volumes, reflecting the sustained expansion of the crypto ecosystem,” Aleman predicted.

The fourth reason analysts are looking closely is the correlation between Bitcoin price and global M2 money supply.

Colin, a Crypto expert, says M2’s growth, a measure of money supply from central banks such as the Fed, ECB and BOJ, is accurately predicting Bitcoin growth from $76,000 to $105,000, according to Crypto.

“Is Bitcoin going well at global M2 by the end of May. Over $120,000?” Colin said.

This correlation is not new. Historically, Bitcoin has a tendency to gain and rise sharply as global liquidity improves. Given current macroeconomic conditions, expanding money supply could potentially continue to fuel Bitcoin’s growth.

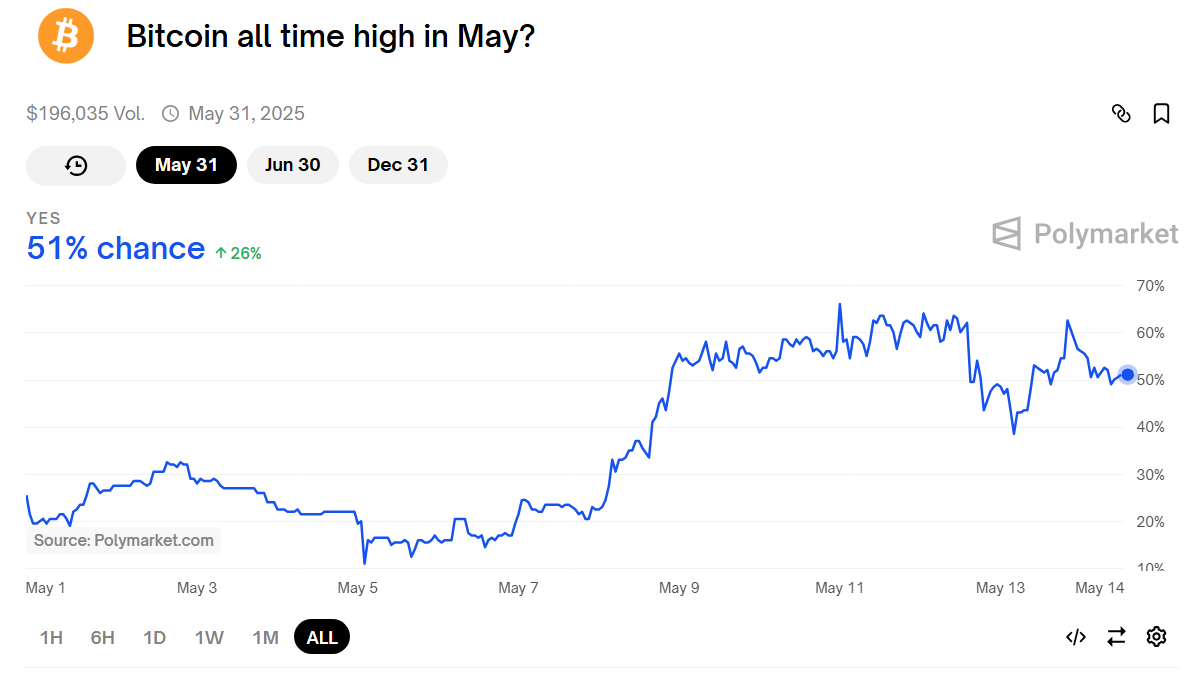

Finally, poly in the forecast market generally indicates that the likelihood that Bitcoin will reach a new ATH in May has increased from 11% to 60%, indicating that it is currently at 51%. Polymarket allows users to bet on future events. This change reflects growing community optimism.

As confidence grows in the potential for Bitcoin to go upward, it can cause the FOMO (fear of missed) effect. This may attract more investors and increase the price even higher.

In fact, Bitcoin has already hit new Ass in countries such as Türkiye and Argentina. Experts like billionaire Tim Draper predict that Bitcoin will reach $250,000 by the end of 2025. Additionally, standard chartered forecast Bitcoin could reach $120,000 in the second quarter.

Disclaimer

In compliance with Trust Project guidelines, Beincrypto is committed to reporting without bias and transparent. This news article is intended to provide accurate and timely information. However, we recommend that readers independently verify the facts and consult with experts before making decisions based on this content. Please note that our terms and conditions, privacy policy and disclaimer have been updated.