Hashflow (HFT) is a distributed exchange (DEX) using requests for cited (RFQ) mechanisms, which recorded a sharp surge in trading volume and impressive price performance at the beginning of July.

The wider Altcoin market is still struggling to recover, but what has helped HFTs to resist the trend?

Hashflow (HFT) leads Dex Tokens by over 100%

According to Beincrypto data, HFT prices have risen by more than 100% in the last two days. Currently, HFT is trading for around $0.135. This is the highest price ever since February 2025.

On June 30th, HFT recorded a daily increase of over 80%. The day marked the strongest day’s performance since its peak in 2023.

Additionally, CoinMarketCap data shows HFT’s 24-hour spot trading volume exceeds US$500 million. This is the best daily volume of the year, 25 times the average of the last day.

This price surge has led to HFT performing the best among Dex Tokens, and the Dex sector has become the best performing crypto segment over the past week.

Data suggests investors are back in HFT after losing 95% of their value in nearly three years.

What drives the price rally for HFT?

In June, Binance announced support for HFT deposits on the Solana network, along with other integrations with platforms such as Jupiter and Titan.

“Hashflow is growing rapidly in the Solana ecosystem. Binance currently supports Solana’s HFT, so too are us. We’ve already integrated with Jupiter, Kamino and Titan.

These developments may have sparked positive investors’ sentiment and facilitated the price rallies for HFT.

However, this gathering can face several challenges. First, the project’s token unlock schedule continues daily and continues until the end of 2028. Currently, only 36.5% of the total supply of HFT is in circulation, but each month, 15.8 million Hft is unlocked, equal to 1.58% of the total supply.

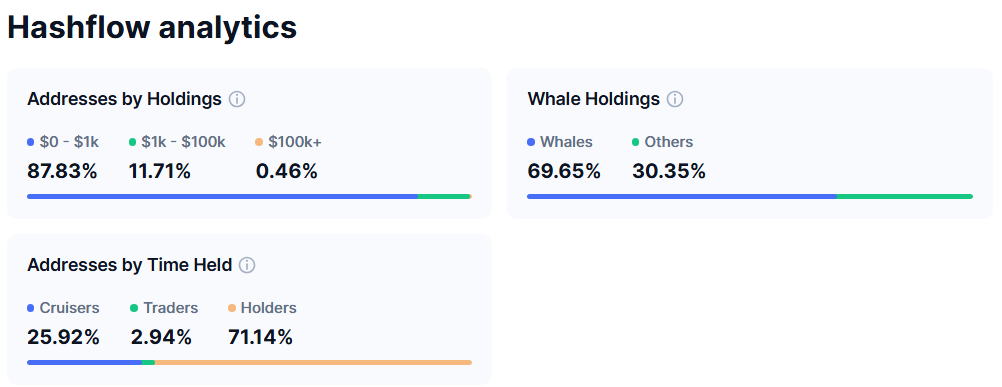

Furthermore, CoinMarketCap data shows that almost 70% of the supply of HFT is held by whales.

Over 71% of holders have maintained their tokens for more than a year, but many have withstanded a price drop of more than 90% in nearly three years. These long-term holders may be sold if prices recover.

HFT prices have skyrocketed, but Hashflow’s TVL showed no major breakouts. It remains modest at just $618,000, with daily Dex trading volumes of around $7.6 million.

Together, these data points emphasize that the real challenge of hashflow is not just to keep this price momentum, but to keep it up.

Disclaimer

In compliance with Trust Project guidelines, Beincrypto is committed to reporting without bias and transparent. This news article is intended to provide accurate and timely information. However, we recommend that readers independently verify the facts and consult with experts before making decisions based on this content. Please note that our terms and conditions, privacy policy and disclaimer have been updated.