HBAR plunged briefly yesterday to a five-month high of $0.30 driven by a wider rally in the crypto market.

However, the meeting is short-lived. Despite overall bullish sentiment in today’s market, HBAR reversed courses and fell nearly 5% in the last 24 hours as profitable activity intensifies.

hbar buckles under pressure to earn profit

HBAR is bucking the broader market growth to record a 5% price drop over the past 24 hours. Dip suggests that the trader riding the rally is on the $0.30 ride. It suggests that there is currently a downward pressure on token prices.

According to Coinglas, HBAR’s open interest has risen 8% over the past 24 hours, reaching $497 million, even if the token price has gone down. This is usually considered a red flag, as it indicates that more futures jobs are open and bets on further declines.

About Token TA and Market Updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s daily crypto newsletter.

Open profit refers to the total number of unresolved futures contracts that have not yet been resolved. When it rises and prices drop, it means that new money is entering the market to bet on assets rather than supporting them.

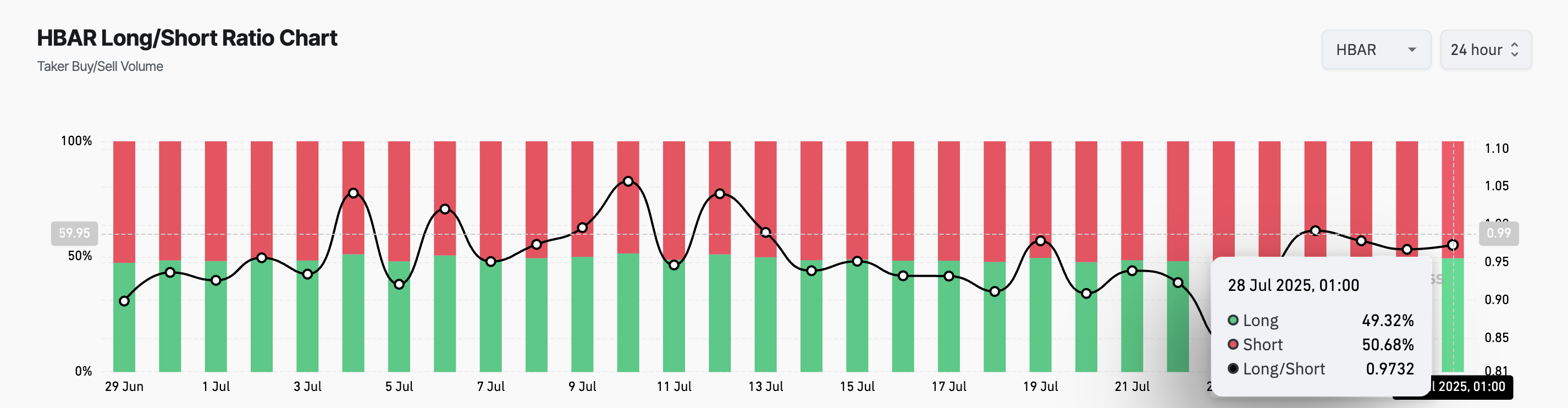

This pattern is generally interpreted as a bear signal. Especially when the long/short ratio comes with an increase in open profit. This is the case with HBAR, which adds to the bearish pressure that Altcoin faces. At the time of writing, the ratio is 0.97.

A long/short metric measures the percentage of the bullish (long) position of an asset in the futures market (short) position. If the ratio is 1 or higher, there is a position longer than a shorter position. This suggests bullish sentiment, with most traders expecting the value of their assets to rise.

On the other hand, as in the case of HBAR, one lower ratio means that more traders are betting on a price drop rather than on a price rise. This reflects growing skepticism about Altcoin’s short-term price outlook as more traders try to lock in profits.

HBAR at the intersection: $0.26 breakdown or $0.30 breakout next?

Unless new demand enters the market to provide support, HBAR prices could continue to face lower pressures driven by both spot sales and bear derivative positioning. If this continues, Altcoin could drop to $0.26.

Meanwhile, when you buy a climb, HBAR defeats resistance for $0.29, collects a cycle peak of $0.30, and tries to climb further.

Disclaimer

In line with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. Although Beincrypto is committed to accurate and unbiased reporting, market conditions are subject to change without notice. Always conduct your own research and consult with an expert before making a financial decision. Please note that our terms and conditions, privacy policy and disclaimer have been updated.