Hbar price rally may be losing steam. Despite a strong profit of 58.77% per month, HBAR erases all weekly profits, falling by more than 8% over the past 24 hours.

This may seem like a standard cooldown, but a closer look at past price actions, short-term chart signals, and key support zones suggests that deeper pain may be stored.

Historic drawdowns suggest familiar profit-taking zones

Why do you see the drawdown now? This is because Hedera has historically entered the zone where profit bookings begin. In March 2025, when the HBAR was repeated to $0.26, the drawdown from the all-time high was around 53.74%. It followed a 47% crash, bringing the token down to $0.14 in just a month.

Fast forward to July 22nd, drawing down at 52%, with HBAR trading at nearly $0.27. Since then, the revision has already begun. A sign that traders may be profiting again in this 50-60% drawdown zone.

Even if this works like March, with a light touch (course of the Altcoin season story), a 40% drop from $0.27 to $0.16 will bring the HBAR price to $0.16. Interestingly, this is alongside the main level of support. More on this from a previous analysis!

In short, the historic drawdown zone is usually where traders are hitting the brakes. And the pattern appears to be repeated.

Ath Drawdown measures how much token prices have fallen from their all-time highs. This helps traders identify the common zones where they lock their profits.

A 4-hour chart death cross could accelerate HBAR prices

Zooming to the 4-hour chart reveals another bearish warning. The 20-cycle EMA (exponential moving average) or red line is trapped in the 50th EMA (orange line), a classic bearish crossover known as the “Death Cross.” It’s not triggered yet, but the setup is almost complete.

Here we use a 4-hour chart. This is because we often pick up trend shifts before the daily time frame progresses. This early signal suggests that momentum is changing in favour of bears.

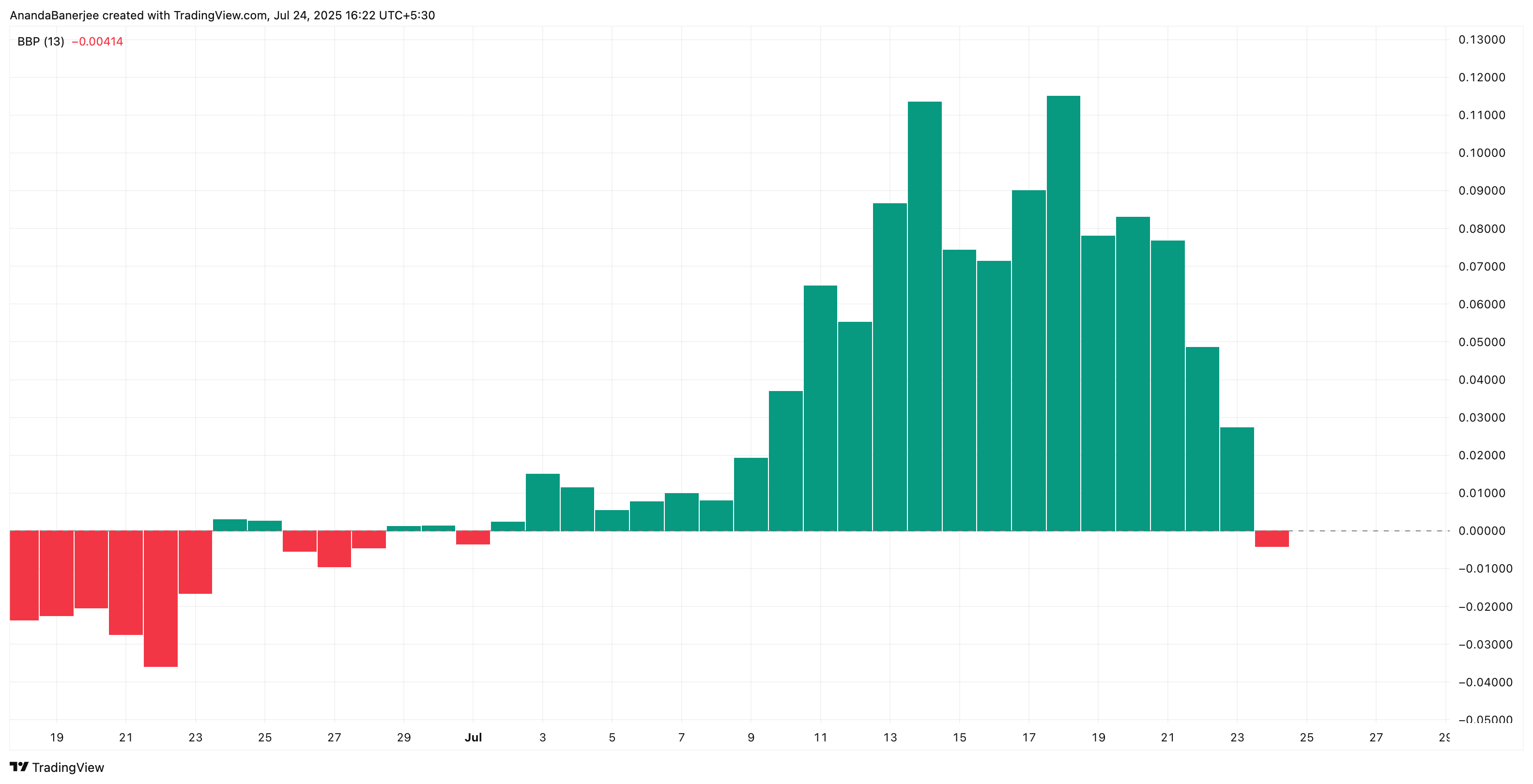

Supporting this view is the Bullbear Power Index, which has been negatively inverted. Sellers have acquired a position. A signal that if the Bulls do not intervene, the drop can be accelerated. If a crossover is confirmed, if Kumars is led by controlling, especially if history is already set on the stage, we hope that momentum-driven sales will lower prices.

The power of a bullbear measures the strength of a buyer and seller. If it changes to negative (red), it means that the bear has control.

About Token TA and Market Updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s daily crypto newsletter.

Important HBAR price support is $0.21

The HBAR price is currently trading at around $0.23, exceeding the 0.382 Fibonacci retracement level. This line has been withdrawn from a recent low of $0.12 to $0.29.

If you think $0.23 is more likely, then the next support is at $0.212 (FIB 0.5 level). Beyond that, $0.19 and $0.16 are important levels to watch. The latter is down 40% from its recent peak.

However, if HBAR can regain support of $0.25 (now turning resistance), and no death crossover occurs, the bearish hypothesis could be invalidated.

Disclaimer

In line with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. Although Beincrypto is committed to accurate and unbiased reporting, market conditions are subject to change without notice. Always carry out your research and consult with an expert before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.