Hedera’s native token HBAR has risen 5% over the past week, along with increased investor demand and a wider increase in Altcoin activity.

However, despite the short-term gatherings, technical indicators now suggest that momentum is losing steam, indicating potential pullbacks in the coming days.

Hbar’s short-term rally was threatened by weakening bull pressure

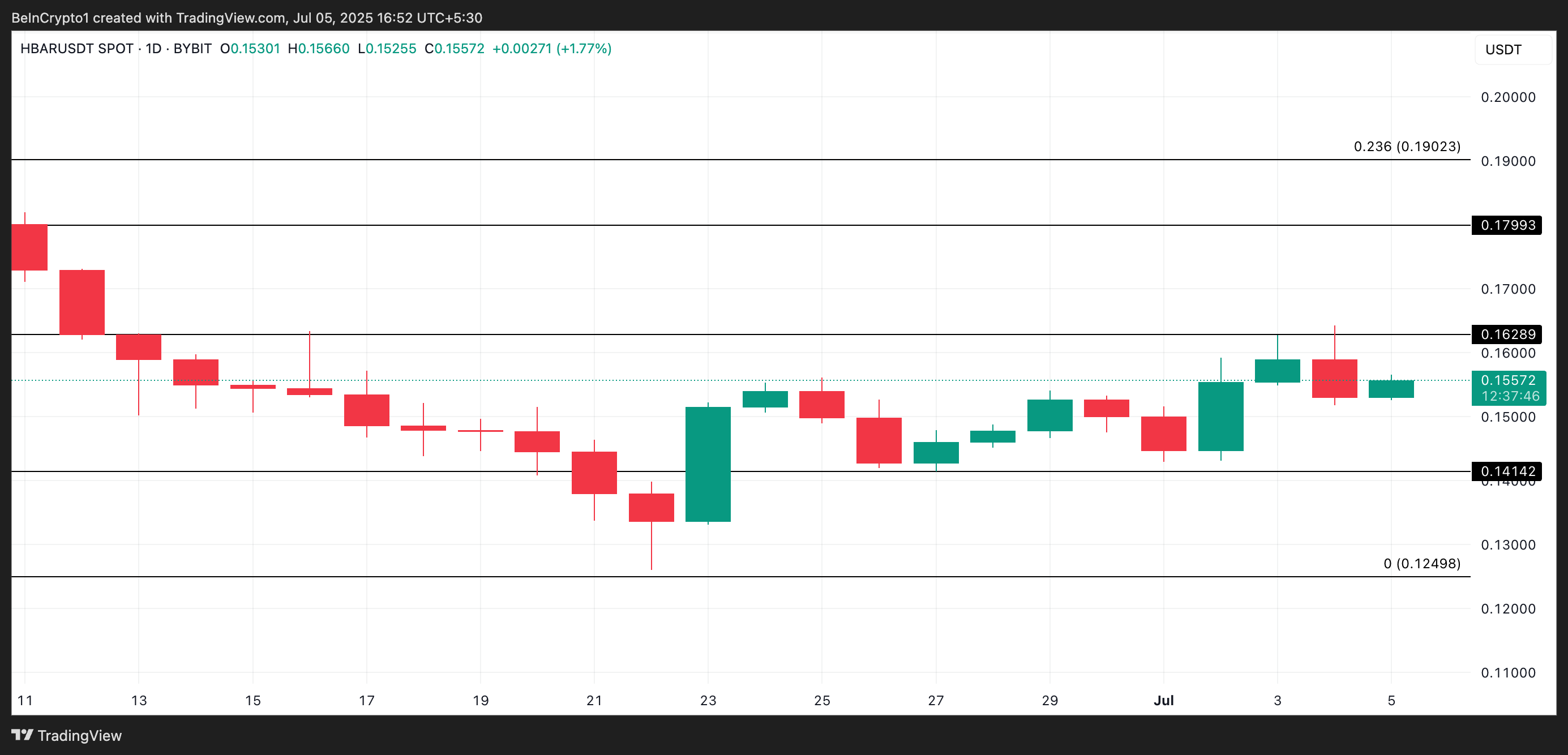

The HBAR/USD one-day chart rating shows that Altcoin is currently testing the current Altcoin, testing breaks below the 20-day index moving average (EMA). HBAR currently trades hands for $0.155, trading above this key moving average, forming dynamic support at $0.153.

The 20-day EMA measures the average price of an asset over the last 20 days, giving weight to recent price changes. If the asset’s price is poised to below the 20-day EMA, it indicates a weakening of short-term momentum.

The ultimate decline in HBAR is below this important moving average, making sure sales pressures outweigh purchasing activity. If strong purchasing rights do not arise, the asset can enter the corrective phase or even begin a new downtrend.

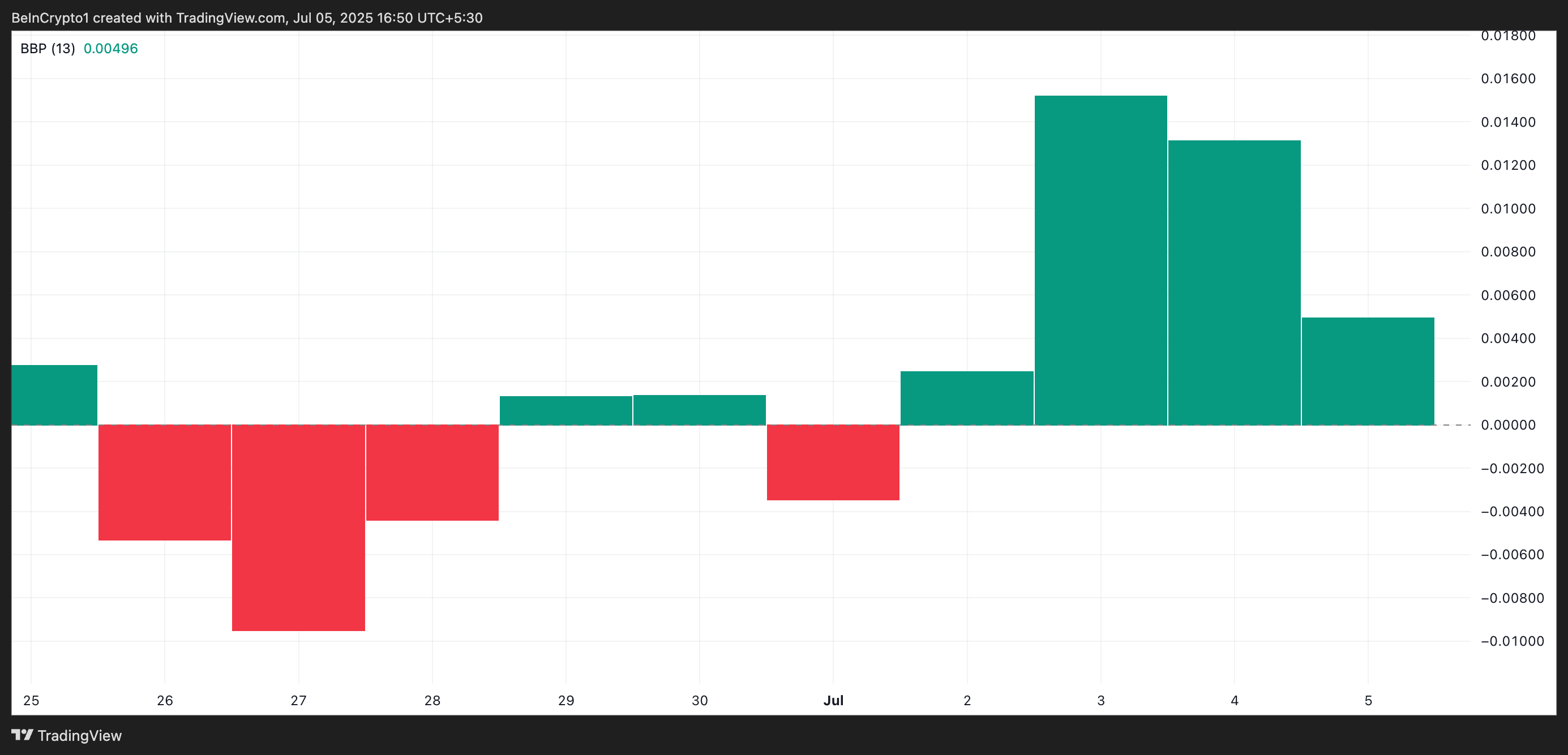

Additionally, measurements from Altcoin’s Elder-Ray index indicator support this bearish outlook. In the last three trading sessions, the green bars that make up the indicator have been reduced in size. This contraction reflects a declined bullish belief, reinforcing the risk of short-term reversals.

The indicator measures the strength of bulls and bears in the market. Printing a green histogram bar shows a strong buyer advantage and an upward momentum increase.

However, if these bars contract this way, they will show a dip in the token accumulation. This is the case with HBAR.

Benefits under the weak profits of Hbar

These trends suggest that HBAR may struggle to maintain profits unless fresh purchasing momentum has returned. In the meantime, I saw a retrace. For Selloffs Spike, the HBAR price could drop to $0.141.

If bear pressure is increased at this support level, the token price could plummet to $0.124.

Conversely, a revival of new demand for HBAR could negate this bearish outlook. If new buyers enter the market, they can drive the value of Altcoin over $0.162.

Disclaimer

In line with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. Although Beincrypto is committed to accurate and unbiased reporting, market conditions are subject to change without notice. Always carry out your research and consult with an expert before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.