Hedera slipped 1% in the last 24 hours, diverging slightly from the bullish momentum of the wider market. This minor dip comes after several days of price consolidation.

The indicators on the chain suggest that bullish sentiment may be returning to the HBAR market. By reducing sales pressure, AltCoin could successfully chart courses above the $0.20 price mark in the short term.

Hedera Traders bet upwards

HBAR’s liquidation heat map shows a large concentration of liquidity in the $0.203 price region. Traders use clearing heat maps to identify areas where many leveraged locations are likely to be cleared when prices reach a certain threshold.

Such zones often act as a magnet for price action as they tend to move towards these areas to cause liquidation and allow the market to open up fresh positions.

Therefore, in the case of HBAR, a significant liquidity concentration in the $0.203 price region shows a strong interest in purchasing or closing short positions around that level from traders. This sets a potential price increase stage in the short term.

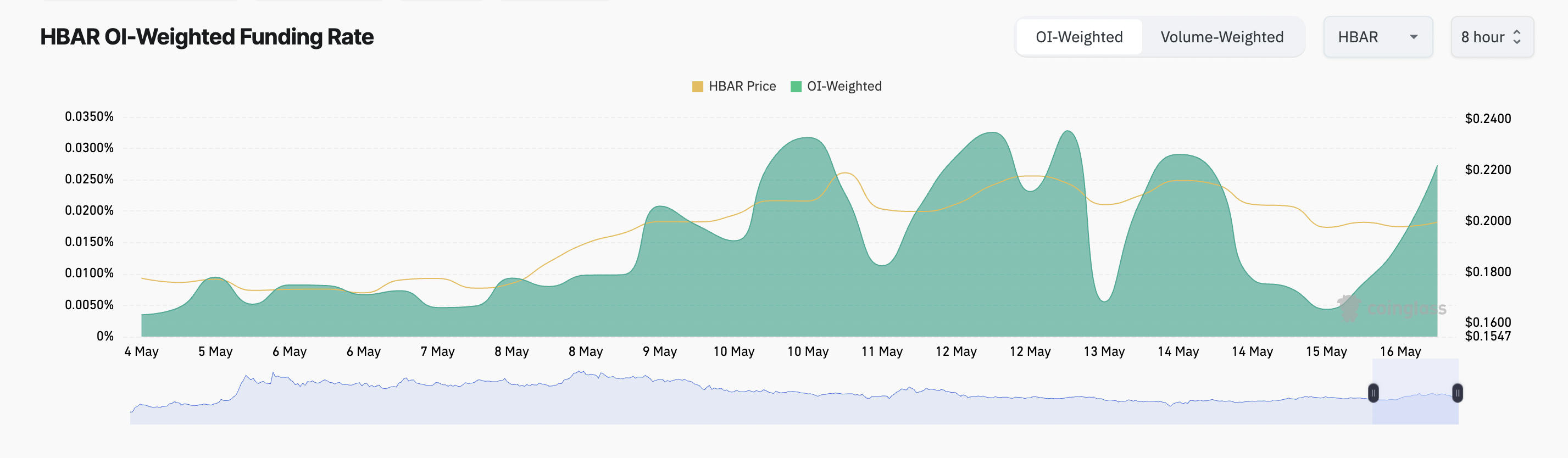

Furthermore, HBAR’s funding rate remains positive due to poor price performance. At the time of press, it was 0.027%, reflecting ongoing demand for long positions.

Funding rates are periodic payments exchanged between traders who hold long and short positions in a permanent future. It is designed to bring the contract price closer to the spot price of the underlying asset.

If that value is this positive, the long trader pays the person who has a short position. This is a bullish signal that expects prices to rise.

Hbar Eyes is $0.23 as purchasing pressure builds up

On the daily charts, a slight increase in HBAR’s Chaikin Money Flow (CMF) today confirms a return to purchasing pressure. At press time, the CMF is at 0.06.

This indicator measures the flow of money in and out of assets. A positive CMF value indicates that purchases outweigh the sales volume and signal investor accumulation.

For HBAR, this trend reinforces the idea that demand for tokens is growing despite recent price consolidation. If this continues, the token price could rise to $0.23.

However, if sales pressure gains momentum, the HBAR price could fall below $0.19.

Disclaimer

In line with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. Although Beincrypto is committed to accurate and unbiased reporting, market conditions are subject to change without notice. Always carry out your research and consult with an expert before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.