The adoption of corporate Bitcoin continues to spread as more companies pursue the Ministry of Finance’s accumulation strategy. Companies can benefit from recapitalization, diversification and inflation hedge if executed properly.

However, not all Bitcoin acquisition strategies are created equally. If the sole purpose of a company is to retain BTC without sufficient resources or size, it could risk a complete collapse during the extended bare market period. The chain reaction could further amplify downward pressures that could prove catastrophic.

Various approaches to corporate Bitcoin Holdings

Institutions’ adoption of Bitcoin is on the rise worldwide, with Bitcoin’s Treasury data showing that their holdings have doubled since 2024.

Interestingly, this volume increase also represents the extent to which the reasons for doing so.

Some companies, especially Strategy (formerly MicroStrategy), have deliberately pursued such playbooks to become Bitcoin financial holding companies. The move worked well with a strategy that supplies 53% of total corporate holdings with over 580,000 BTC.

Other companies, such as GameStop and Publicsquare, have taken a different approach, prioritizing exposure over aggressive accumulation. This scenario is perfect for businesses that just want to add BTC to their balance sheets while continuing to focus on their core business.

Such initiatives have far less risk than companies whose core businesses own only Bitcoin.

However, the growing trend of companies adding Bitcoin to their financial reserves, just to concentrate on holding Bitcoin, will have a major impact on the business and the future of Bitcoin.

How do Bitcoin-focused companies attract investors?

Building a successful Bitcoin Treasury holding company is not just about actively purchasing Bitcoin. When the sole purpose of a business is Bitcoin retention, it is only evaluated based on the bitcoin it holds.

To ensure that investors buy stocks rather than directly retain Bitcoin, these companies need to surpass Bitcoin itself and reach a premium called multiple in net asset value (MNAV).

In other words, they must convince the market that their stocks are worth more than their total holdings of Bitcoin.

The strategy implements this by convincing investors, for example, that by purchasing MSTR stocks, it is not just a certain amount of Bitcoin. Instead, they invest in strategies that executives work aggressively to increase the amount of Bitcoin caused by each share.

If investors believe that micro strategies can consistently grow Bitcoin per share, they pay a premium for that dual ability.

However, that is only part of the equation. If investors win that promise, a strategy must be provided by raising capital to buy more Bitcoin.

MNAV Premium: How it is built and how it breaks

A company can only offer MNAV Premium if it increases the total amount of Bitcoin it holds. The strategy does this by issuing convertible obligations that allow you to borrow funds at low interest rates.

It also leverages market (ATM) equity offerings by selling new stocks when the stock trades at its underlying Bitcoin value and premium. With this move, the strategy will acquire more Bitcoin per dollar raised than existing stocks, increasing Bitcoin per share for current owners.

This self-enhancement cycle allows premiums to raise more capital, fund more bitcoin and strengthen the narrative, but it goes beyond the direct bitcoin holding of strategy to maintain stock valuations.

However, such processes involve several risks. For many companies, this model is directly unsustainable. Even pioneers like Strategy endured the heightened stress when Bitcoin prices fell.

Nevertheless, over 60 companies have already adopted a Bitcoin accumulation playbook in the first half of 2025. As that number increases, new finance companies face more keenly the associated risks.

Aggressive BTC accumulation is at risk for small players

Unlike strategy, most companies don’t have the scale, established reputation, or the “leader status” of leaders like Michael Saylor. These characteristics are important to attract and maintain the trust of investors needed for premiums.

They also generally do not have the same creditworthiness or market power. Knowing this, small players are more likely to experience higher interest rates on their debts and face more restrictive contracts, making their debts more expensive and difficult to manage.

If their debts are secured by Bitcoin in the bear market, a price drop could immediately cause a margin call. During periods of long downward pressure, refinancing obligations for refinancing can be extremely difficult and expensive for businesses that are already under burden.

Worse, if these companies shift their core operations to focus solely on Bitcoin acquisition, there is no alternative business cushion that generates stable, separate cash flows. They will become entirely dependent on capital raises and Bitcoin prices.

If several companies make such moves at the same time, the outcomes to the larger market could dramatically move south.

Is the adoption of corporate Bitcoin at risk of a “death spiral”?

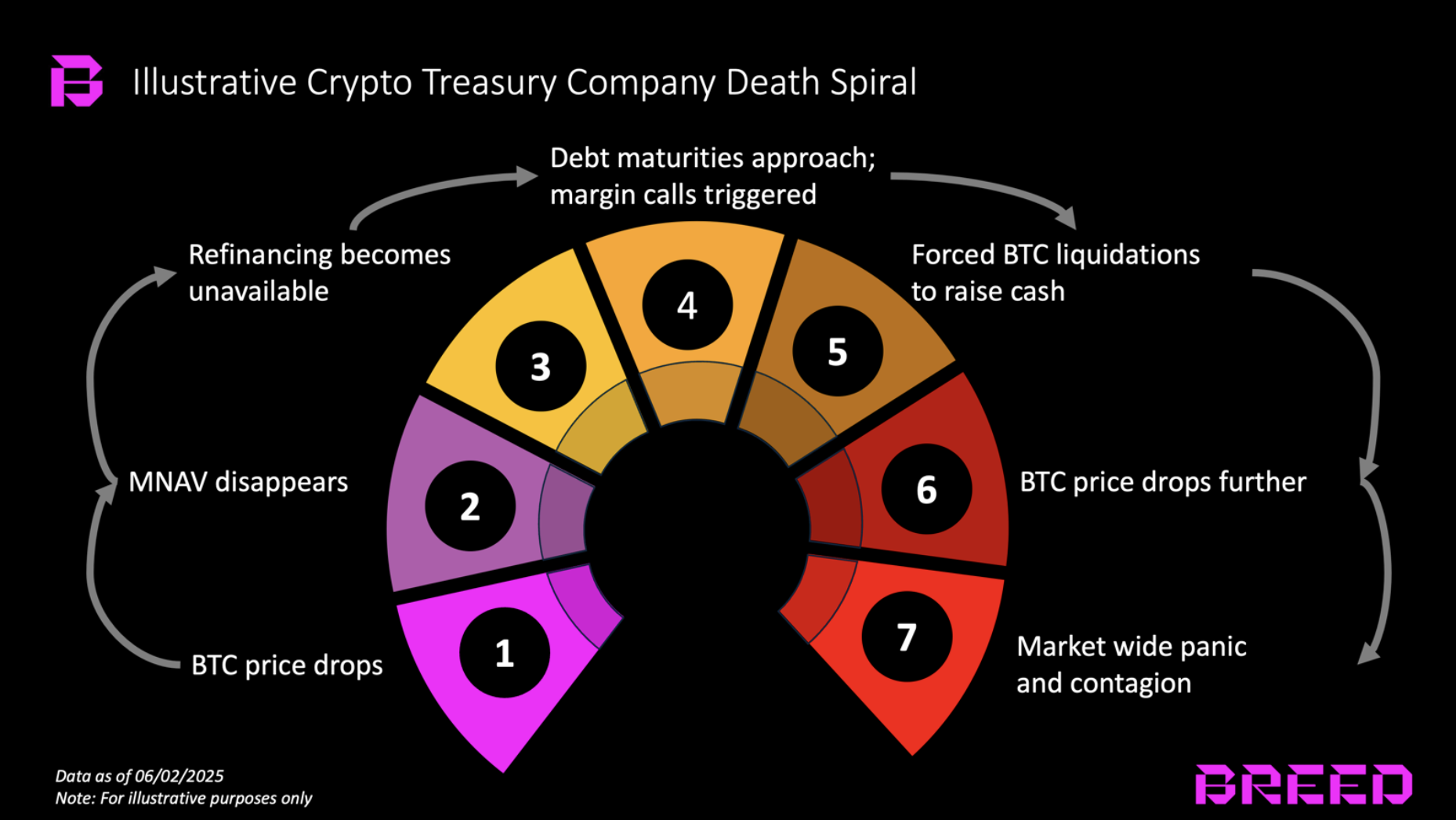

If many small businesses are pursuing a Bitcoin accumulation strategy, the market impact during a recession can be severe. If Bitcoin prices fall, these companies could run out of options and be forced to hold them.

This widespread distressed sales inject huge supply into the market, greatly amplifying downward pressure. As seen in the 2022 Code Winter, such events can cause a “reflexive death spiral.”

Forced sales by one distressed company can further reduce the price of Bitcoin, causing forced liquidation of other companies to similar positions. Such a negative feedback loop can drive a market decline.

Second, highly publicized failures can undermine the trust of a wider range of investors. This “risk-off” sentiment can lead to widespread sales across other cryptocurrencies due to market correlation and general flights to safety.

Such a move will inevitably put regulators on high alert and will surprise investors who may have considered investing in Bitcoin at some point.

Beyond Strategy: Risk of becoming “all-in” with Bitcoin

Bitcoin’s strategic position as a financial holding company is unique as it was the first mover. Only a handful of companies match Saylor’s resources, market impact and competitive advantage.

The risks associated with such playbooks vary and, if grown, can be harmful to the larger market. As more public companies move to add bitcoin to their balance sheets, they need to make a careful decision whether to get exposure or all-in.

If you choose the latter, you will need to carefully and thoroughly measure the results. Bitcoin is the highest ever today, but the bear market never completely escapes the problem.

Disclaimer

Following Trust Project guidelines, this feature article presents the opinions and perspectives of industry experts or individuals. Although Beincrypto is dedicated to transparent reporting, the views expressed in this article do not necessarily reflect the views of Beincrypto or its staff. Readers should independently verify the information and consult with experts before making decisions based on this content. Please note that our terms and conditions, privacy policy and disclaimer have been updated.