Since taking office in January, President Trump has announced the waves after the tariff wave. “It’s called negotiation,” he said recently.

In April, administrative officials vowed to sign trade deals with up to 90 countries in 90 days. The ambitious target came after Trump announced it and then rewind some of the sudden tariffs, meaning that import taxes would cost more than the wholesale price of the good itself.

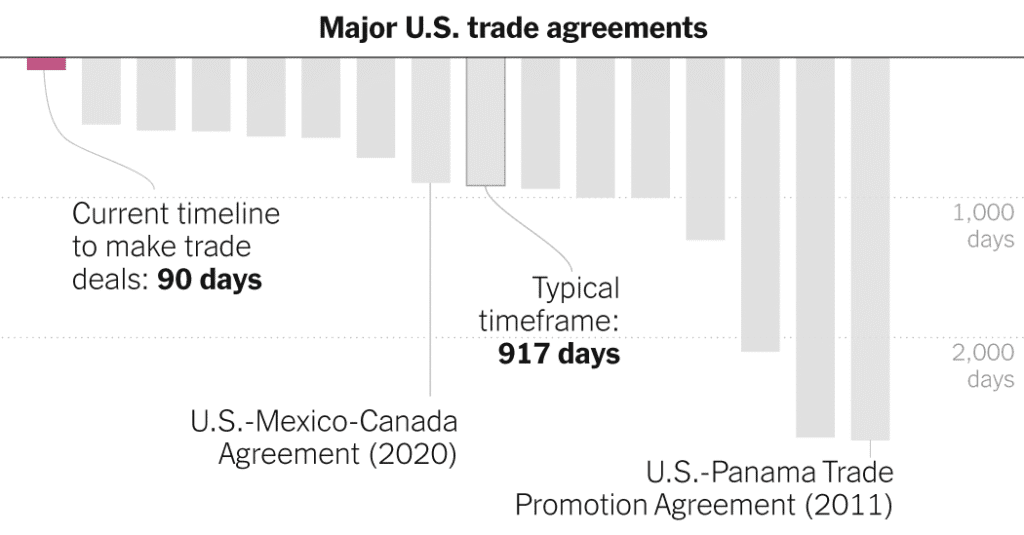

However, the 90-day target is usually one-tenth of the time it takes to reach a trade deal, according to a New York Times analysis of a major agreement with the US currently in effect. Analysis shows that from the first lecture it takes 917 days, or about two and a half years, to sign a trade deal to the president’s desk.

About 60 days after the current process, Trump has announced only one transaction so far. It is an agreement with the UK, not one of America’s biggest trading partners.

He also suggests that negotiations with China were rocks. “I like President XI of China, always and always, but he’s very difficult and very difficult to make a deal!!” Trump wrote on Wednesday about the true society. Last month, China and the US agreed to temporarily cut tariffs on each other’s imports with good intentions gestures to continue consultations.

Some of what the president can achieve is summarised in what you can call a deal.

Wendy Cutler, vice president of the Asian Association’s Institute of Policy Studies and a former US trade negotiator, said the agreement with the UK is not a transactional framework. The ones officially released by the two countries were more similar to “what you were trying to negotiate against your actual commitment,” she said.

During his first term, Trump secured two major trade agreements signed in January 2020. The first was the US-Mexico-Canada Agreement, a reworking of the North American Free Trade Treaty, which transformed the economies of three countries since the 1990s.

According to trade analysts, the USMCA is a comprehensive, legally binding agreement that arises from a long, formal process.

Such transactions are to cover all aspects of trade between each country and are negotiated under specific guidelines for parliamentary consultations. Termination of the transaction involves both negotiation and ratification of changes or creation of laws in each partner country. The transaction is signed by a trade negotiator before the president signs a law that will enable it to the United States.

Trump’s other major agreement in his first term came with China in the current reverberation of the trade war. The agreement, unlike previous deals, came after Trump threatened tariffs on certain Chinese imports. This “first tariffs, talk later” approach, Inu Manak, a trade policy fellow at the Council of Foreign Relations, said it is part of the same playbook that the administration is currently using.

The result was a non-binding agreement between the two countries known as “Phase 1.” This does not require approval from Congress and could be terminated by either party at any time. Still, it took almost a year and nine months to complete. China ultimately fell far short of the commitment it made to buy American goods under the agreement.

A comparison of the two first-term Trump deals shows the drawn, sometimes winding paths each took to complete. Fragile transs (including those made for 90 days) were formed, but only to collapse later, rounds of tariffs injected uncertainty into the diplomatic relations between the countries.

The Times analysis determined the length of the contracts for each major contract, dating back to 1985, from the start of negotiations to the date they signed, to the date the president signed. The median time it took to reach the president’s signature was over 900 days. (Another analysis published by the Institute for International Economics in 2016 found that the median transaction took more than 570 days, using the date of signature by a representative of the country as the completed moment.)

About a month before the administration’s voluntary deadline, Trump’s ability to forge deals suddenly plunged into doubt. Last week, the US Trade Court held that it had surpassed his authority in imposing the April tariffs.

For now, the duties remain intact after a temporary stay from the federal court of appeals. However, in asserting that claim, the federal government initially said the ruling could hinder negotiations with other countries and undermine the president’s leverage.

In a statement Wednesday, White House spokesman Kush Desai said trade negotiators are working to ensure “custom-made trade deals in lightning strikes that levelle American industry and workers’ arenas.”

However, in other recent official statements, White House officials have significantly reduced their trading ambitions.

In April, Treasury Secretary Scott Bescent hedges the number of contracts he could reach, suggesting that the US would talk to somewhere between the 50 countries. Last month, he said the US was negotiating with 17 “very important business relationships” that do not include China.

“When the administration first began, I think they thought they could actually make these binding and enforceable transactions within 90 days, and then they quickly realized they would bite more than they could bite,” Cutler said.

The administration has told negotiating partners to submit an offer of trade concessions that they willing to make by Wednesday to attack trade transactions in the coming weeks. The deadline was previously reported by Reuters.

The current approach to transaction production may be strategic, Manac said. One of the benefits of not making a comprehensive deal like the USMCA is that the administration can declare small “wins” on a much faster timeline, she said.

“That means trade agreements are not just what they were before,” she added. “And you can’t really guarantee that whatever the US promises, it will actually be endorsed in the long term.”

The data and graphics are based on New York Times’ information analysis from Congressional Research Services, US Trade Representatives, the organization of the American state’s foreign trade information systems and Public White House Communications.