Solana has dropped sharply over the past week, flowing 15% amid the wider market pullbacks that have hit most major altcoins. Layer-1 coins are trading at $153.53 from last week’s highs from nearly $180.

The revision reflects weaknesses across the crypto market, but on-chain metrics suggest that this slump may be nearing its end.

Long-term Solana holders show confidence as the market cools down

Solana’s vibrancy has declined significantly recently, indicating that long-term holders (LTHS) view recent price drops as a strategic purchase opportunity. According to GlassNode, it is currently the lowest in the last 14 days.

Vibration measures the coin days ratio of assets destroyed by total coin days accumulated to track LTHS activity. Climbing suggests that more dormant coins are being moved or sold, indicating an increase in profit acquisition by long-term holders.

Meanwhile, when dormant wallets begin to accumulate, liveliness decreases. This trend indicates that Sol’s LTHS is removing the exchange, a bullish sign of accumulation.

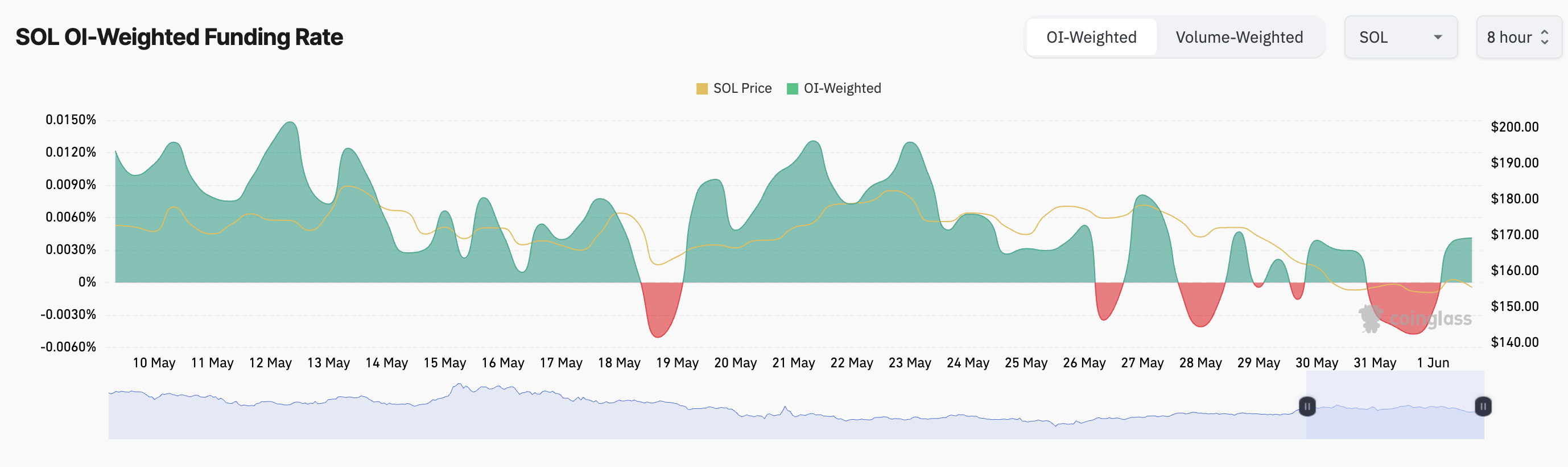

Furthermore, the coin’s funding rate has been positively reversed, currently at 0.0041%. This shows the preference for long positions among Sol Futures Traders.

Funding rates are recurring fees paid between long-term and short-term traders in permanent futures contracts to maintain contract prices at the spot price. In the case of positives, long traders pay shorts, indicating that bullish sentiment dominates, and more traders expect prices to rise.

If support is retained, Sol could surge to $195

Solana’s prices could recover towards the $171.88 mark if its LTHS continues to double if coin accumulation and broader market conditions are stable. If that price range solidifies as a support floor, it could drive the sol towards an additional $195.55 level.

However, when the bearish momentum grows, sellers can push Sol down to $142.59.

Disclaimer

In line with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. Although Beincrypto is committed to accurate and unbiased reporting, market conditions are subject to change without notice. Always carry out your research and consult with an expert before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.