Technology Reporter

Getty Images

Getty ImagesNatwest says it fixed an issue that prevented customers from using the bank’s mobile app and that it could not access their accounts.

The customer reported issues such as inability to create purchases or payment staff.

Natwest previously said that web-based online banking services are still functioning properly, but some customers have previously said they are disputing this, and apologised to customers, saying they “apologise for the inconvenience.”

“We solved the problem that caused this and our customers are now able to log in and pay as normal,” the spokesperson said.

0910 GMT Stopped Site Down Detector begins to report issues.

BBC/NatWest

BBC/NatWestCustomers then went to social media to complain about the impact IT failure had on them.

One person said, “You have to shop before you go shopping,” while another said, “I’m waiting to go shopping,” but they couldn’t send money to do so.

Customers were encouraged to access their accounts in other ways, such as online banking, if possible.

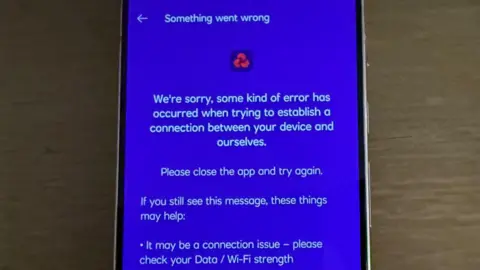

However, some people have also reported issues to Natwest’s online services, but others share the error message they receive when they attempted to pay.

Others have expressed dissatisfaction with the bank’s response, with some saying that the time frame to resolve the issue was “disgrace,” while others call it “very bad service.”

“What I’m not getting is for banks to close the load on branches ‘to save money’ and force people to resort to apps and online banking…but they’re clearly not investing in a system that works well,” said one angry customer.

Repeated issues

This is the latest in a long line of bank shutdowns.

In May, many major banks revealed that 1.2 million people had been affected in the UK in 2024.

According to a report in March, nine major banks and the building society spent about 803 hours (equivalent to 33 days), the equivalent of the first high-tech termination since 2023.

Inconvenient for customers, suspensions also cost banks.

The Commons Finance Committee has found that Barclays could face a £12.5 million compensation payment from 2023 onwards than a suspension.

During the same period, Natwest paid £348,000, HSBC paid £232,697, and Lloyds paid £160,000.

Other banks paid small amounts.