SEI, the native token of SEI networks, emerged as one of the top-performing crypto assets in June. Open source Cosmos-based Layer-1 blockchain is up over 100% per month.

This surge is being presented as an outlier this month despite a wider lull among altcoins.

SEI prices will double in June: What users need to know

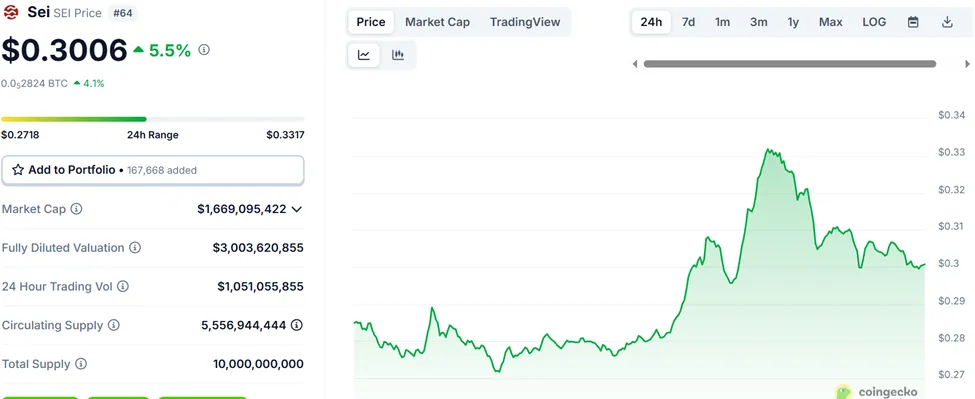

According to Beincrypto data, SEI token prices have skyrocketed by nearly 10% in the last 24 hours alone and over 90% in the past week. Tokens have increased by more than 100% last month. At the time of writing, the SEI was trading at $0.30425.

The move was catalyzed by a surge in bullish development, particularly notable, by the selection of SEIs for US government-supported Stablecoin pilots, a growing institutional attention from the Circle and Exchange-Traded Fund (ETF) outlook, and a surge in ecosystem adoption.

Wyoming Stablecoin Pilot Selection Increases Reliability

The clearest trigger for SEI’s explosive breakout was Status of Official selection of SEI in Wyoming A network of blockchain-based Stablecoin pilots. As part of the initiative, SEI was ranked ahead of more established networks such as Ethereum, Avalanche, SUI, and Ripple.

The announcement enhances SEI’s reputation and demonstrates strong public sector trust in its technical capabilities and regulatory stance. This well-known support sparked community and investor optimism, especially as more and more America began researching digital dollar infrastructure.

Facility Fuel: Circle Holdings and SEI ETF Filing

The SEI institutional narrative has also gained great momentum. In its submission of the IPO, the USDC Stablecoin Issuer Circle revealed that the SEI is the largest crypto token on the balance sheet.

This revelation redefines investors’ perceptions of the strategic importance and long-term potential of SEI.

In addition to momentum, asset manager Canary Capital filed ETFs based on the SEI. If approved, the fund marks a historic step in expanding institutional access to the SEI ecosystem.

“It’s exciting to see great progress in the institutional adoption of SEI,” commented in a post.

This ETF narrative and circle support raised expectations for a more structured capital inflow and reduced volatility. In particular, these are important criteria for institutional investors in risk aversion.

Ecosystem growth and whale influx support price action

Beyond the headlines, true recruitment indicators support SEI’s bullish momentum. Beincrypto reported a network that has recently hit 600,000 active wallets, even if the token corrects 30% of the month.

SEI has recently claimed second position among all EVM compatible chains by user count prior to Arbitrum, Optimism, Polygon and BNB chains.

A member of the SEI community, Philip also highlights the growing advantage of SEI, owning nearly 30% of the overall market share of the web3 gaming market. User traction outperforms networks such as Ronin and BNB.

The SEI locked total (TVL) has also risen sharply, and is now at an all-time high of $1 billion.

According to data from Defilama, SEI has $56,028 million in TVL at the time of this writing, with new Defi protocols Takara Lend and Yaka Finance growing them.

World Liberty Financial buys $1 million worth of SEI

In addition to the purchase pressure, Blockchain Thrus Look-on Chine reported that Trump-related global Liberty Financial has purchased $6 million SEI tokens, currently worth $1.8 million, for $1 million.

This led the Trump family’s debt officer to earn an 80% unrealized profit.

The trade appears to amplify the fear of traders (FOMO), with Coingecko’s data showing daily trading volumes exceeding $1 billion.

With on-chain metrics, institutional integrity and convergence of government partnerships, SEI’s parabolic June performance could begin a long-term trend.

However, this depends on maintaining the momentum of the network and dodging rivals in fast-paced Layer-1 (L1) races.

Disclaimer

In compliance with Trust Project guidelines, Beincrypto is committed to reporting without bias and transparent. This news article is intended to provide accurate and timely information. However, we recommend that readers independently verify the facts and consult with experts before making decisions based on this content. Please note that our terms and conditions, privacy policy and disclaimer have been updated.