In the crypto market, more than $17.27 billion in Bitcoin and Ethereum options agreements expire today. This mass expiration date can affect short-term pricing measures, particularly as both assets have been declining recently.

With Bitcoin options at $14.98 billion and Ethereum at $22.9 billion, traders are enduring potential volatility.

Expiration of high stake script options: what traders should see today

Today’s expired options show a significant increase since last week. According to Deribit data, Bitcoin options will have an expiration date of 139,390 contracts compared to last week’s 33,972 contracts.

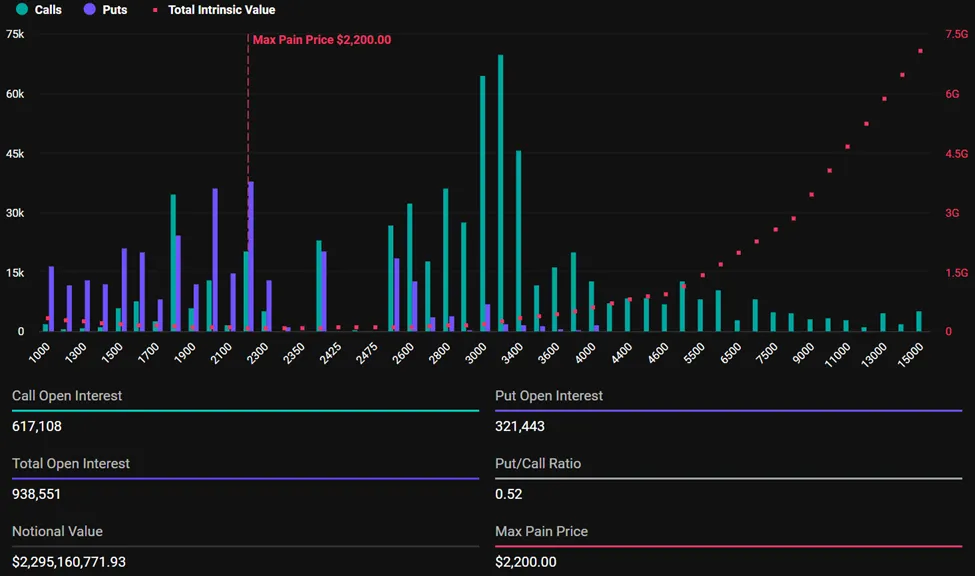

Similarly, Ethereum’s expiration option is a total of 938,551 contracts, up from the previous week’s 224,509 contracts.

Particularly, the big difference between today’s expired options and last week is because the June 27th contract is for that month.

For an expired Bitcoin option, the maximum pain is $102,000 and the put-to-call ratio is 0.75. This suggests that traders are purchasing more phone (purchase) options than put (sell) options.

Even if Pioneer’s ciphers reach new highs, it generally refers to bullish feelings.

The bullish outlook extends to Ethereum. Ethereum suggests market optimism with a maximum pain price of $2,200 and a put countermeasure ratio of 0.52.

The biggest problem is the key metrics of Crypto options trading that frequently guide market behavior.

This represents a price level where most options expire worthlessly. Furthermore, the put-call ratio of less than 1 between Bitcoin and Ethereum suggests optimism in the market, with more traders betting on price increases.

Please note that traders are experiencing flat or disruptive results despite market momentum.

The latest data shows that Bitcoin’s trading value fell 0.25% to $107,562. Similarly, Ethereum is trading at $2,449, down 1.02%.

The drop is no surprise. Based on the maximum pain theory, asset prices tend to be drawn to each maximum pain or strike price, as options close to their expiration date.

At the time of this writing, Bitcoin and Ethereum are well above their biggest pain levels. Traders and investors need to embellish volatility as options satisfaction often leads to short-term price fluctuations and causes market uncertainty.

“… The 110K major resistance has been noted as a critical level that may be difficult to violate. As Bitcoin’s volatility remains low, the focus on ETH options trading has shifted, and traders are hoping for potential negative side moves in July,” an analyst at Greeks.live wrote.

However, the market usually stabilizes immediately after the trader adapts to the new price environment. With today’s massive expiration dates, traders and investors can expect similar results, which could impact future crypto market trends.

Disclaimer

In compliance with Trust Project guidelines, Beincrypto is committed to reporting without bias and transparent. This news article is intended to provide accurate and timely information. However, we recommend that readers independently verify the facts and consult with experts before making decisions based on this content. Please note that our terms and conditions, privacy policy and disclaimer have been updated.