After several weeks of drifting near local lows, PI prices show signs of life. On July 10th, the token rebounded from $0.465 to $0.51. This is the encouraging move to mark the first notable advantage since late June.

While still tracking previous highs, bounce comes with strong on-chain and technical confirmation that demand is creeping up.

Accumulation Line reveals stable buyer interest

The accumulation/distribution line tracks the relationship between price and volume and finds the pressure to buy or sell, has started to rise again. This happened exactly on July 9th.

If the A/D line exceeds the July 8 low (marked on the horizon), despite the next day’s DIP, the price could have a positive effect.

This suggests that despite the overall stagnation, smart money may be quietly stacking Pi coins.

Feelings continue to rise, but PI prices are delayed

Looking at historical trends, Pi Coin’s emotional score (Red Line) tends to move with PI prices and lockstep. As we saw at the explosive rally in May, when both lines surged together. This reflects real-time crowd reactions, not predictive signals.

Now, sentiment is being picked up again and continues hovering in the positive zone at the top. It’s not as euphoric as it was in mid-May, but it’s far above neutral, suggesting that traders still feel optimistic about the PI outlook.

What stands out this time is the cutting. Prices are not continuing at comparable strength. The Pi jumped briefly from $0.465 to $0.51 on July 10th, but it’s still approaching key resistance. If emotions remain stable like in past meetings, the price response may be delayed.

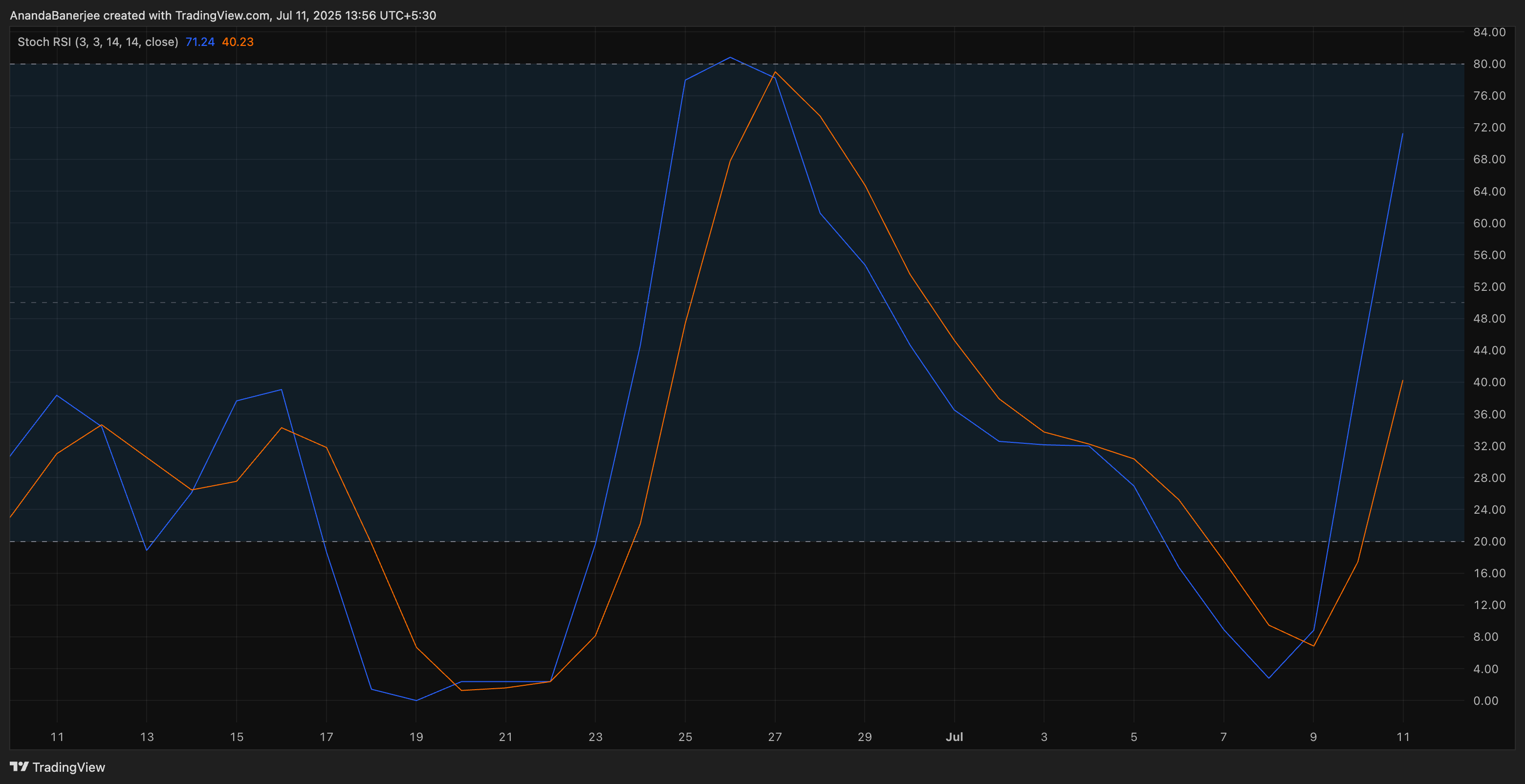

Probability RSI Crossover adds momentum signal

Momentum confirmation came from the probabilistic RSI, a momentum oscillator that compares the asset’s RSI with a range of highs over time. Recent crossovers with blue lines moving over the orange line indicate accumulation of bullish momentum. This type of crossover often appears at the turnaround or at the start of fresh legs.

The probabilistic RSI shows how strong or weak the recent price transfer of assets is, but the blue line is close to 72 and the red line is close to 40. In the context, RSI (Relative Strength Index) tracks the existence of excess or sales of tokens, while stochastic RSI is a step deeper by measuring how quickly the RSI itself is changing.

PI price pushes against the resistance zone

Price-wise, the PI price is $0.5026, and he is cheating on important resistance. Derived from the 0.618 Fibonacci Retracement Zone, this level has historically served as both a cap and a trigger. If the Bulls manage to push it neatly, the next leg could see a zone of $0.54-$0.56. However, if the price is rejected again here, you could get a pullback to $0.4578.

Currently, all three indicators that draw pressure, emotion and momentum are facing upwards. As long as the PI price exceeds $0.50 (the psychological support zone), the trend will remain the same. However, if you can’t stay above that level, the door will be able to return to a base of $0.45 to $0.40.

Pi Coin’s first bounce in weeks causes bullish divergence: price rally ahead? It first appeared in Beincrypto.