PI, the native token of the PI network, has plunged in prices at 22% over the past week, extending the downtrend at a seven-day low of $0.61 at press.

The double-digit decline reflects a growing bearish sentiment around the token, consistent with a wider contraction in the crypto market.

As the bearish trend deepens, the outlook for PIs deteriorates

Global cryptocurrency market capitalization has fallen by more than 5% in the past seven days to exceed $170 billion. The widespread pullback has shaken investors’ trust and caused fresh PI selloffs over the past few days.

The enhanced sell-side pressure is evident in the Pi’s Bbtrend indicator. This continues to print Red Histogram Bars, a clear signal that attaches red light momentum. At the time of writing, the indicator is at -4.52.

BBTREND measures the intensity and orientation of the trend based on the expansion and contraction of the Bollinger band. A positive bbtrend value usually indicates a strong uptrend, whereas a negative value indicates an increase in bearish momentum.

The PI’s persistent negative Bbtrend suggests that its prices will be consistently closed near the bottom of the Bollinger band. This trend indicates sustained sales activity and suggests the possibility of sustained prices.

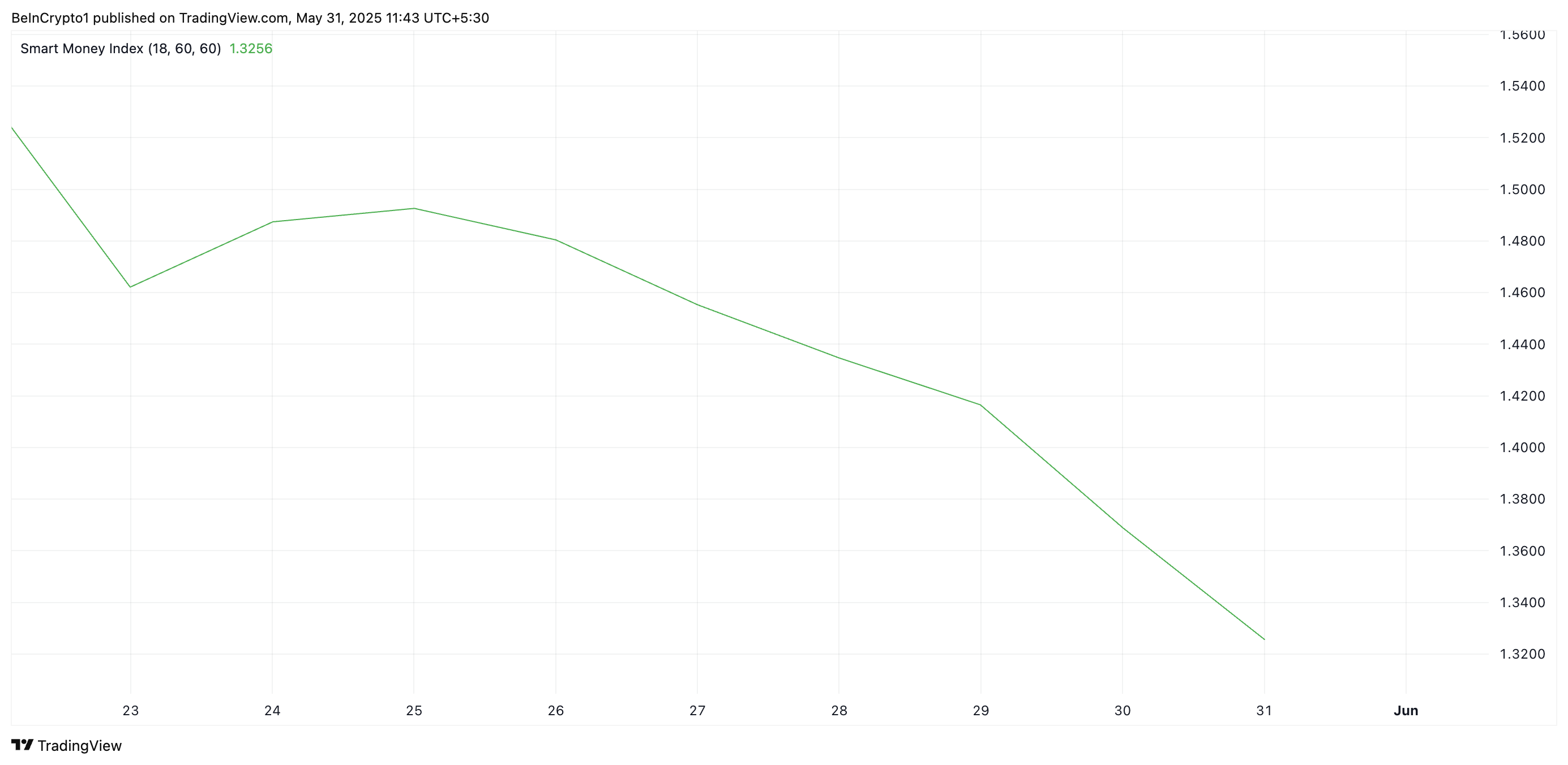

Additionally, Pi’s Smart Money Index (SMI) has declined over the past few days, indicating the withdrawal of “smart money” or institutional-grade investors. This is often seen as a key indicator of deeper price drops, as it suggests a decline in reliability from these key investors.

Asset SMI tracks the activity of institutional investors by analyzing market behavior during the first and last hours of a transaction. As it rises, these investors are increasing their purchasing activity, indicating the possibility of extended gatherings.

Conversely, like PI, if it drops, it weakens the institutional demand for assets, indicating further downsides.

Does PI Teeter close to major support – Will Will Bulls hold the line at $0.55?

PI climbing activities suggest that tokens may be vulnerable to further losses in the short term. If sell-off continues, Altcoin risks below the critical support formed at $0.55.

If the Bulls are unable to defend this support floor, the PI can revisit a history minimum of $0.40.

However, a surge in new demand for tokens could prevent this from happening. With the PI Network Token purchase pressure spike, it could push the price to $0.86.

Disclaimer

In line with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. Although Beincrypto is committed to accurate and unbiased reporting, market conditions are subject to change without notice. Always carry out your research and consult with an expert before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.