The PI Network (PI) has declined nearly 6% over the past seven days, indicating mixed signals across key technical indicators. The DMI suggests possible changes in bearish momentum and trends, while the CMF shows light, yet still shows positive purchasing pressure.

At the same time, the EMA line refers to integration, with PI trading exceeding the key support level of $0.601. Whether the price collapses or rebounds from here will likely depend on whether it retains critical support or allows it to pass nearby resistance levels.

PI Network DMI Signals Fade Bearish Momentum

The PI network’s Directional Motion Index (DMI) indicates that its mean directional index (ADX) has dropped to 34 from 44.59 just a day ago.

This decline follows a sharp rise from 16.89 three days ago, suggesting a recent but currently weak trend. ADX measures the strength of a trend regardless of direction.

Measurements below 20 indicate a weak or range trend, while values above 25 indicate a strong trend. With ADX still over 30, the PI may be in the trend phase, but the momentum appears to be cooled.

Looking at the directional indicators, +DI rose from just 4 to 20.89 two days ago, indicating enhanced pressure.

Meanwhile, the -DI peaked at 70.57 three days ago and then dropped significantly to 32.68, indicating that the bearish momentum is declining.

This crossover of directional strength can suggest a potential change in emotions. -If +DI continues to rise while DI is decreasing, the PI price may begin to recover or enter a more neutral stage after a severe sales period.

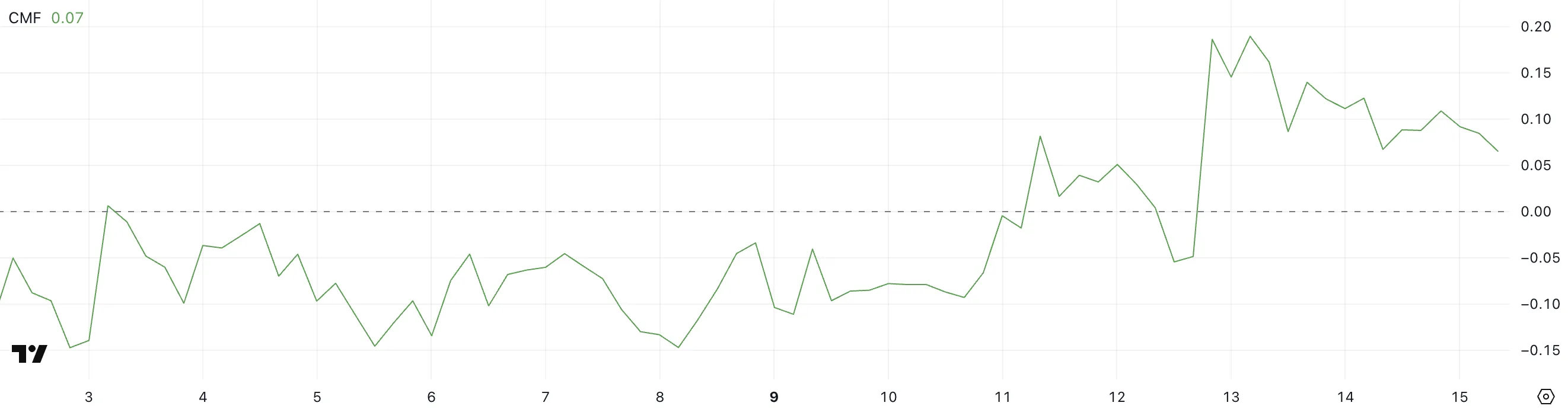

PI CMF shows light purchase pressure after recent spikes

The PI Network’s Chaikin Money Flow (CMF) is currently 0.07, down from 0.19 two days ago, but is higher than -0.05 three days ago.

CMF indicators use price and volume data to measure the flow of money in and out of assets over time. Values above 0 indicate purchase pressure, while values below 0 indicate sales pressure.

Measurements above 0.10 – 0.10 or less are usually considered stronger signals of accumulation or distribution.

The current CMF level of Pi at 0.07 suggests mild but positive purchasing pressure.

It’s not strong enough to confirm a positive accumulation, but not as intense as it was two days ago, indicating that capital is still flowing into the assets.

If the CMF continues to exceed zero, it may support price stabilization or progressive recovery. However, returning to below zero could indicate weaker demand and potentially negative risks.

Breakout or breakdown? PI trades close to important levels

The PI network’s EMA line now suggests a period of integration following a recovery from the sharp decline caused by the Israeli-Iran conflict escalation.

Price Action hoveres just above the key support of $0.601. If this level is broken, the PI price could drop to $0.542, and could be an additional $0.40 if bearish momentum is built.

This structure reflects uncertainty and there is no clear bullish or bearish control at this time.

The advantage is that if the PI can break through the resistance levels at $0.647 and $0.658, it could trigger a new uptrend.

A successful breakout over these zones could result in doors being opened for a move towards $0.796.

The EMA setup supports a neutral stance for now, waiting for a critical move in either direction.

Disclaimer

In line with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. Although Beincrypto is committed to accurate and unbiased reporting, market conditions are subject to change without notice. Always carry out your research and consult with an expert before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.