The PI coin appears to be collapsing. However, the hidden differences between PI prices and momentum suggest that this is not the case.

As exchange inflows rise and traders stack up on shorts, a quiet inversion pattern is formed.

The replacement base note remains high

Pi Coin’s exchange reserves have skyrocketed over the past two months, with the recent spikes showing a major inflow into trading platforms. This usually indicates that the holder is preparing for sale rather than holding.

The latest table shows exchange net inflows that surpass major CEX outflows. It is the bull’s warning flag.

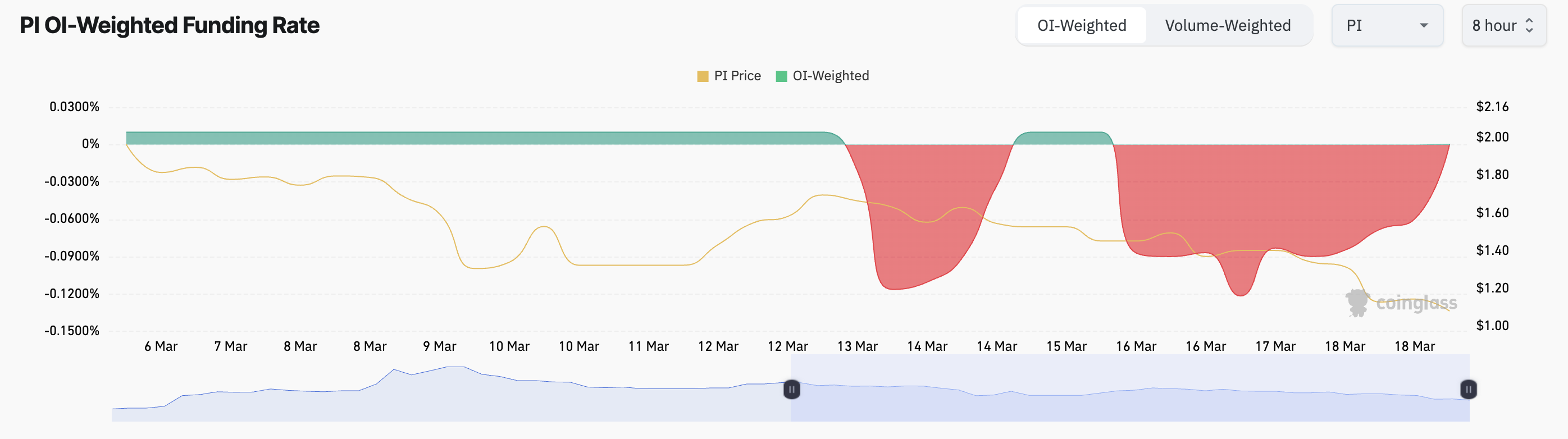

Funding rates stay deep in negative territory

The financing rate for PI permanent contracts remains firmly negative. In other words, traders who hold a long position are paid by those who shorten their PI.

Funding rates reflect the cost of holding long and short positions in a permanent future. Negative readings indicate that traders pay to maintain their bearish exposure, almost short.

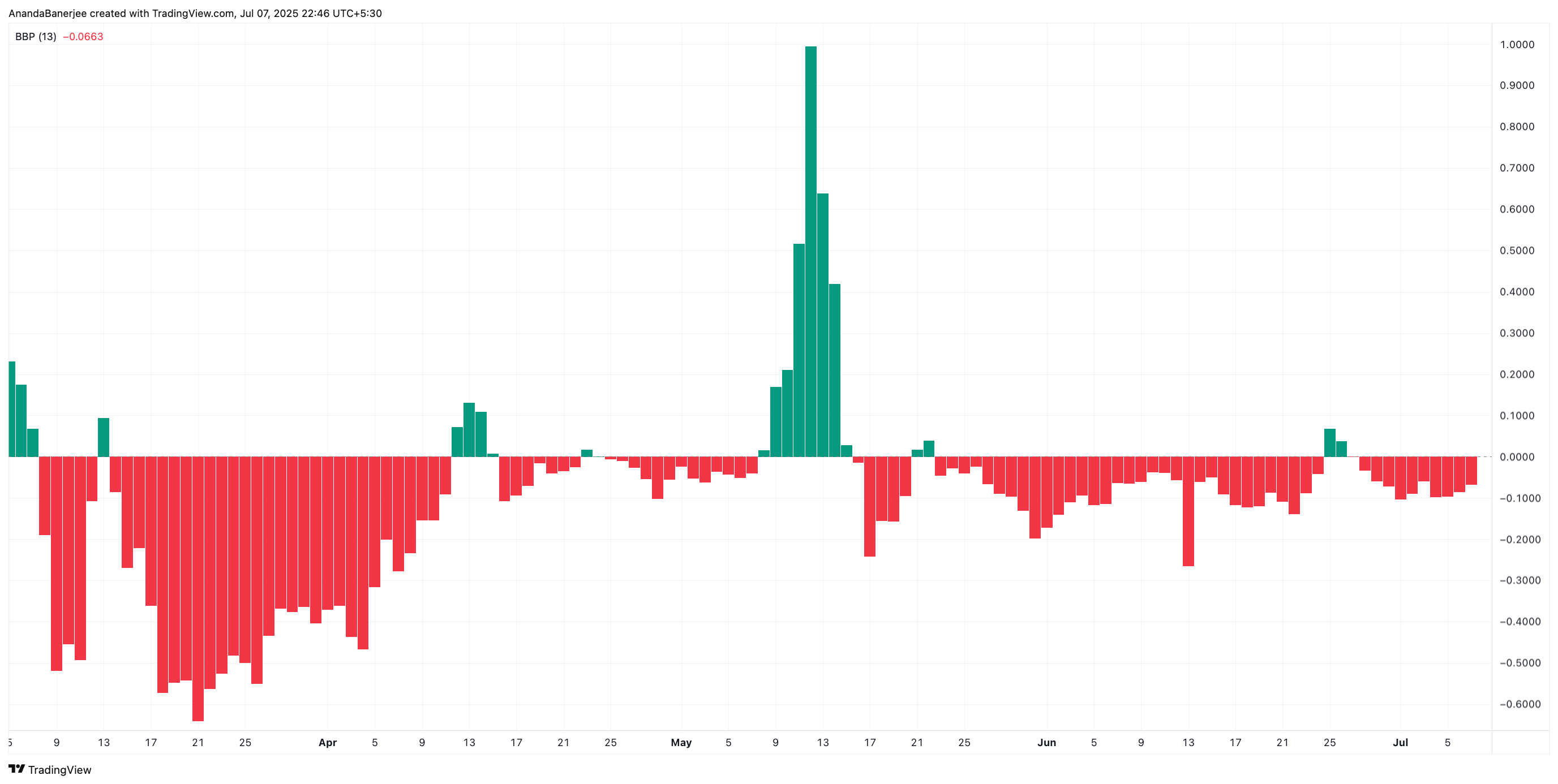

Weak bull, but there is no surrender yet

The Elder Ray Index draws confusing pictures. The bull remains largely muted, and the bare power still shows a consistent red bar. However, these bars don’t have fresh spikes. This could lead to optimism.

The Elderley Index is used to measure buyer and seller strength by comparing price actions to exponential moving averages. With Pi, the bull is struggling to maintain momentum.

Still, the lack of new bear surges suggests a standoff, not a breakdown yet.

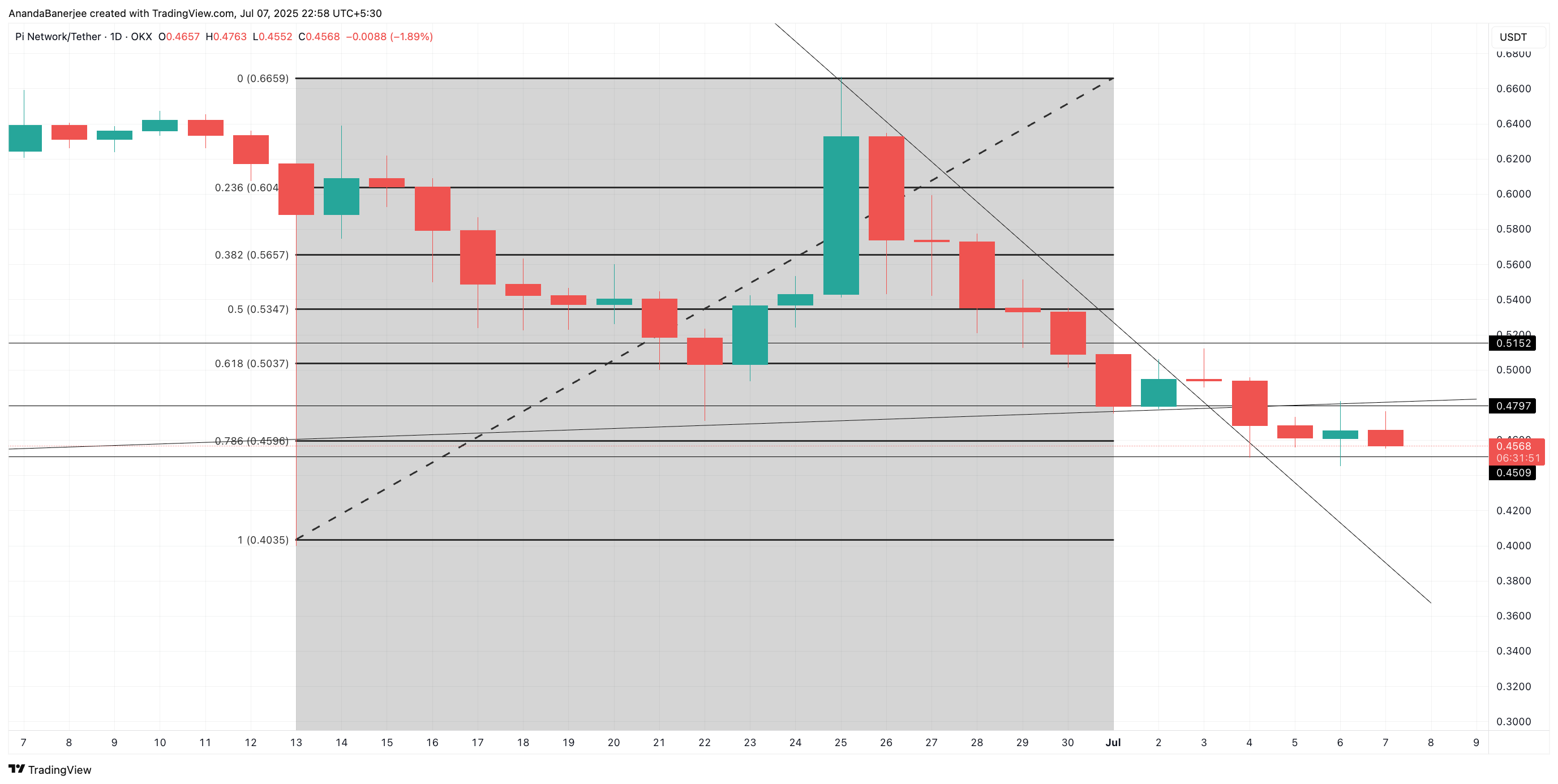

The hidden bull’s emancipation gives the bull slim hope

One of the optimism comes from the relative strength index (RSI). The PI price has been consistently getting a lower low, while the RSI is printing a higher, lower low. This often indicates that bearish pressure is weakening, even if the price has not yet responded.

The relative strength index tracks momentum. Prices fall, but as RSI rises, hidden bullish divergence occurs, often a sign of future reversals.

If this divergence occurs, the key resistance zone is at $0.4797 and $0.5152. A confirmed breakout above these levels could open a pass headed for $0.60. The Fibonacci indicator, drawn from the most notable low swing to the last notable high swing, gives an additional resistance level of $0.5037, $0.5347, and $0.5657.

Mapping potential support and resistance levels based on Fibonacci indicators drawn from major price fluctuations, proportional retracement zones.

However, if the PI price falls below the $0.4035 support zone, the entire bullish paper could collapse and drag the PI into a deeper correction.

Disclaimer

In line with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. Although Beincrypto is committed to accurate and unbiased reporting, market conditions are subject to change without notice. Always carry out your research and consult with an expert before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.