Since peaking on May 12th at an in-day price of $0.0000176, Shiba Inu (SHIB), a major meme coin, has witnessed a 33% decline.

Due to the lack of performance of the coin, on-chain data reveals that a significant portion of SHIB holders are currently at net unrealized losses, indicating a market capitulation state. What does this mean for investors?

Shiv currently bleeding as 87% of address “from money”

According to Glassnode, Shib’s net unrealized profit/loss (NUPL) metrics show that the meme coin is firmly in the surrender zone.

The NUPL metric measures the difference between unrealized total profit and unrealized losses for all holders compared to the market capitalization of an asset. It provides insight into whether the market is on average in profit or loss status.

For each GlassNode, if the asset’s NUPL is negative, market participants are surrendering. This occurs when the total unrealized losses in the market exceed unrealized profits, suggesting that most holders are underwater. It reflects the period of losses that investors either sell panic or suffer.

Intotheblock’s Global In/of the Money confirms this bearish sentiment. At the time of pressing, the metric indicates that over 87.34% of all SHIB holders are currently “out of money.”

An address is considered “out of money” if the current market price of an asset it holds is lower than the average cost of acquiring the token at that address. This means that the holder will suffer a loss if it sells the assets at market price.

Shiv surrenders, is the price closer than it looks?

Historically, negative NUPL measurements indicate late stages of the bearish cycle. Usually, it advances the bottom of the price and ultimately rebounds at the price of the asset. This happens for two reasons.

First, when many holders sit at loss, they often have no desire to sell. Instead, they choose to wait for the recovery to break. This behavior helps reduce sales pressure and stabilize the price of the asset over time. As volatility decreases and prices begin to consolidate, they create conditions that can encourage fresh shiv purchases and increase prices.

The period of surrender also tends to wash away the “weak hands” while the “diamond hands” (more confident, long-term investors) pave the way for the market to enter. These more resilient buyers will bring capital to accumulate during market pain and support bullish price reversal.

Will Shiv regain highlands above $0.000012?

At press time, SHIB trades for $0.00001180. If sales pressure fades and fresh shopping takes resumes, it could potentially push meme coins past immediate resistance at $0.0000198. Violation of this price barrier could drive Shiv to $0.00001362.

However, if bear pressure increases and the decline continues, the price of Shiv could drop to $0.00001105.

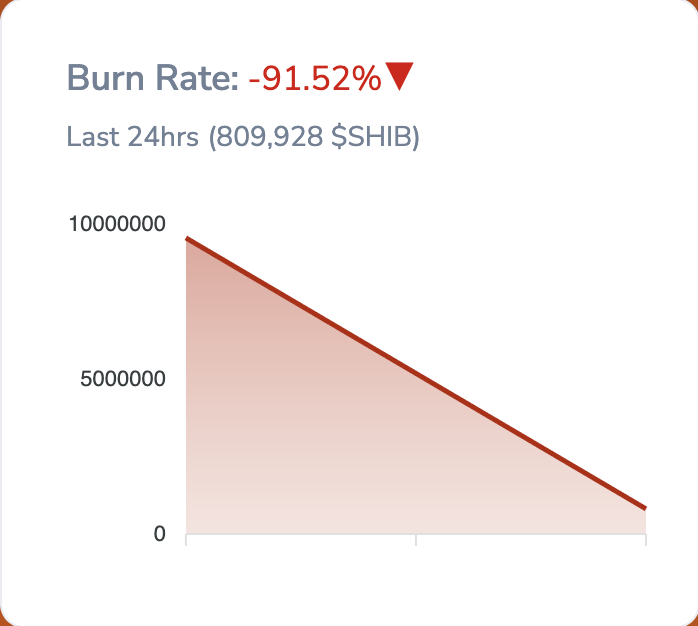

In addition to the short-term bearish outlook, Shiv’s burn rates will decrease. On past days, this was down 92%. Few tokens are excluded from distribution make it difficult to meet when Shiv prices do not have new demand.

If burn activity does not recover quickly, it could delay Shiv’s attempts to regain higher price levels.

Disclaimer

In line with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. Although Beincrypto is committed to accurate and unbiased reporting, market conditions are subject to change without notice. Always carry out your research and consult with an expert before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.