Solana continues to gain momentum in 2025, with blockchain having posted applications revenues for the second consecutive quarter.

The latest network health report from the Solana Foundation, released on June 20, highlights blockchain’s accelerated economic performance. The report says improved protocol efficiency, developer engagement, and validator incentives support this growth.

Solana quietly becomes the top sales blockchain thanks to meme coins

The report showed that Solana app revenue reached its highest point in January 2025, generating more than $806 million in a month.

This was followed by $376 million in February, boosting the network’s total app revenue beyond that quarterly mark.

The key factor behind this surge is that blockchain networks have become the hub for memecoin trading. Meme Coin LaunchPad platforms like Pump.Fun have emerged as the dominant force within ecosystems.

Beyond that, the launch of virus political tokens such as Trump and Melania meme coins has helped to promote user activity and fees across the network.

The report says that not only did these tokens trend socially, they also drove real fees and contributed significantly to the network’s GDP-style app revenue metrics.

With this in mind, fees from decentralized exchanges and other chain services are core indicators of Solana’s economic activity.

This growing revenue encourages developers to stay in Solana. It also allows networks to reinvest in critical infrastructure, allowing ecosystems to evolve with user needs.

Solana surpasses 7,000% Ethereum at TPS

The report also highlighted the domination of blockchain in developer appeal.

In 2024, it was the top blockchain for new developers, retaining over 3,200 active contributors each month, imposing a year-over-year growth in developer engagement.

Solana’s stability has played an important role in driving this trend. The network maintains 100% uptime for over 16 months. This includes a record-breaking daily trading volume period, reaching $39 billion in January 2025.

Meanwhile, major technical enhancements in the network reduced average relay time to less than 400 ms. This is a big leap from the past few years.

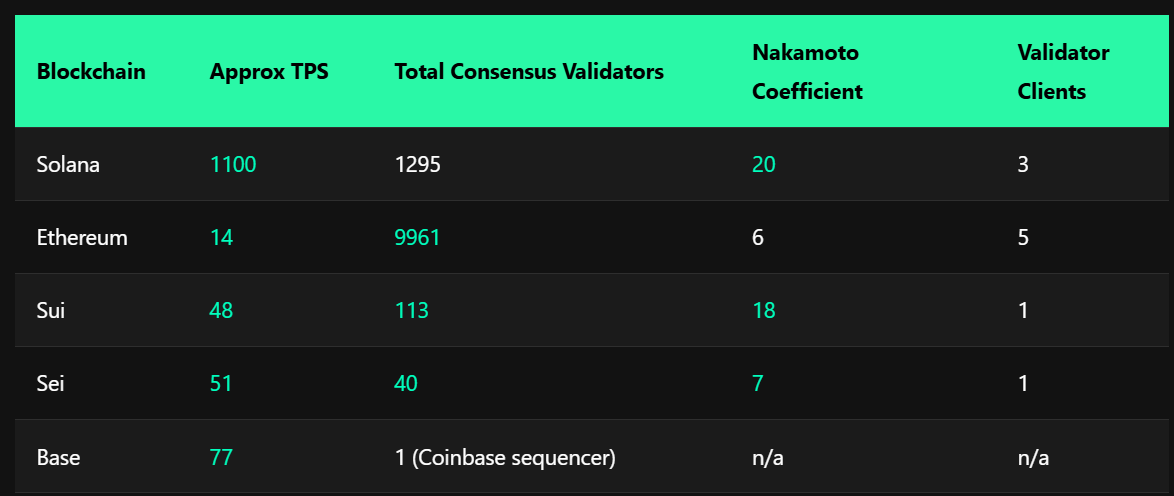

Transaction throughput remains an outstanding metric, with Solana handling around 1,100 transactions per second. This is above the average of Ethereum’s 14 TPS.

Validator’s compensation recorded a true economic value (Rev) of $56.9 million on January 19th.

Currently, the average quarterly REV is at $800 million, but the broken even staking threshold has dropped from 50,000 SOL in 2022 to just 16,000 SOL this year.

Overall, Solana’s steady profits in performance, developer retention and revenue generation refer to an increasing network. Together, these improvements suggest that it has evolved into one of the most sustainable ecosystems in the industry.

Disclaimer

In compliance with Trust Project guidelines, Beincrypto is committed to reporting without bias and transparent. This news article is intended to provide accurate and timely information. However, we recommend that readers independently verify the facts and consult with experts before making decisions based on this content. Please note that our terms and conditions, privacy policy and disclaimer have been updated.